United States Laboratory Glassware Market Size, Share, and COVID-19 Impact Analysis, By Type (Flasks, Pipettes, Beakers, and Burettes), By End-User (Contract Research Organisation, Food & Beverage Industry, Pharmaceutical & Biotech Industry, and Research & Academic Institutes), and US Laboratory Glassware Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUSA Laboratory Glassware Market Insights Forecasts to 2035

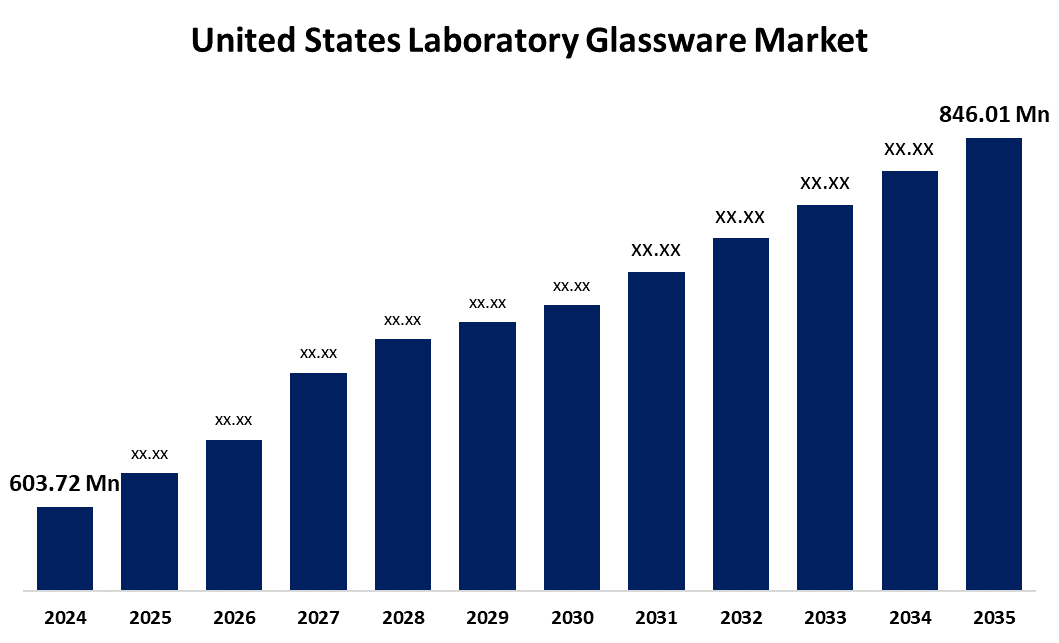

- The US Laboratory Glassware Market Size was Estimated at USD 603.72 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.11% from 2025 to 2035

- The USA Laboratory Glassware Market Size is Expected to reach USD 846.01 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Laboratory Glassware Market Size is Anticipated to Reach USD 846.01 Million by 2035, Growing at a CAGR of 3.11% from 2025 to 2035. The market growth is accelerated by the rising research and development activities, increasing biotechnology studies, and laboratory testing.

Market Overview

The production, shipping, and utilization of glass-based laboratory supplies for scientific studies, pharmaceuticals, biological sciences, and academic institutions are the areas of expertise for the US laboratory glassware market. A broad variety of glass equipment used in scientific labs for research and experimentation is known as laboratory glassware. Since it has its inert nature and excellent visibility, it is perfect for analytical, chemistry, and biology labs. Numerous industries, including the pharmaceutical, biotechnology, chemical, and environmental sciences sectors, heavily rely on laboratory glassware. Improvements in manufacturing processes have led to increased durability and resistance to thermal shock in borosilicate glass, which is renowned for its chemical inertness and thermal resistance. Its longevity and durability are being improved through the development of new formulations. Glassware used in laboratories is equipped with electronic components for data logging and real-time monitoring. Modern automated cleaning systems guarantee thorough and reliable cleaning, lowering the possibility of cross-contamination and extending the life of glassware. High-throughput screening and analysis are made possible by microfluidic technology, which manipulates tiny fluid volumes. These developments are intended for particular research uses, like lab-on-a-chip and single-cell analysis, and drive the market growth.

Report Coverage

This research report categorizes the market for the US laboratory glassware market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US laboratory glassware market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US laboratory glassware market.

United States Laboratory Glassware Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 603.72 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.11% |

| 2035 Value Projection: | USD 846.01 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By End-User, and COVID-19 Impact Analysis. |

| Companies covered:: | Thermo Fisher Scientific, Sartorius AG, Crystalgen, Bellco Glass, Mettler-Toledo International Inc, DWK Life Sciences, Corning Inc., Gerresheimer AG, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for lab glassware is expanding significantly as a result of increased emphasis on research and development across several industries. High-quality lab glassware is necessary as pharmaceutical and biotechnology companies invest in research and development to create new medications and treatments. Research efforts are also being increased by academic and research institutions in the USA, especially in emerging economies. The market has new prospects as a result of the growth of biotechnology and personalized medicine. The market is expanding as a result of technological developments in glassware materials, such as smart glassware with real-time data monitoring and borosilicate glass with improved chemical and thermal resistance.

Restraining Factors

Funding constraints, high prices, the switch to plasticware, and fragility are some of the issues facing the US laboratory glassware market.

Market Segmentation

The USA laboratory glassware market share is classified into type and end-user.

- The pipettes segment held the largest share of 24.66% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US laboratory glassware market is segmented by type into flasks, pipettes, beakers, and burettes. Among these, the pipettes segment held the largest share of 24.66% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the highly accurate, precise, easy-to-use, sterile, and efficient.

- The research & academic institutes segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US laboratory glassware market is segmented by end-user into contract research organisation, food & beverage industry, pharmaceutical & biotech industry, and research & academic institutes. Among these, the research & academic institutes segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is owing to the growing focus on research studies, an upsurge in chemical synthesis, rising interest of students in biotechnological sectors, and microbiological experiments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US laboratory glassware market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific

- Sartorius AG

- Crystalgen

- Bellco Glass

- Mettler-Toledo International Inc

- DWK Life Sciences

- Corning Inc.

- Gerresheimer AG

- Others

Recent Developments:

- In October 2023, SCHOTT introduced next-generation type I borosilicate glass tubing to meet the future needs of the pharma industry. The product supports three major trends: the rise of complex pharmaceuticals, sustainability, and digitalization. FIOLAX® Pro, a new glass tubing, is used by pharmaceutical converters to produce high-quality vials, ampoules, syringes, and cartridges for storing simple and complex drugs. The tubing has superior chemical quality, improved Extractables & Leachables profile, and is completely free of heavy metals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US laboratory glassware market based on the below-mentioned segments:

US Laboratory Glassware Market, By Type

- Flasks

- Pipettes

- Beakers

- Burettes

US Laboratory Glassware Market, By End-User

- Contract Research Organisation

- Food & Beverage Industry

- Pharmaceutical & Biotech Industry

- Research & Academic Institutes

Need help to buy this report?