United States Laboratory Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Molecular biology, Cytokine and chemokine testing, Carbohydrate analysis, Biochemistry, Environmental testing, Cell/tissue culture, and Others), By Application (Government, Education, Industrial, and Healthcare), and United States Laboratory Chemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Laboratory Chemicals Market Insights Forecasts to 2035

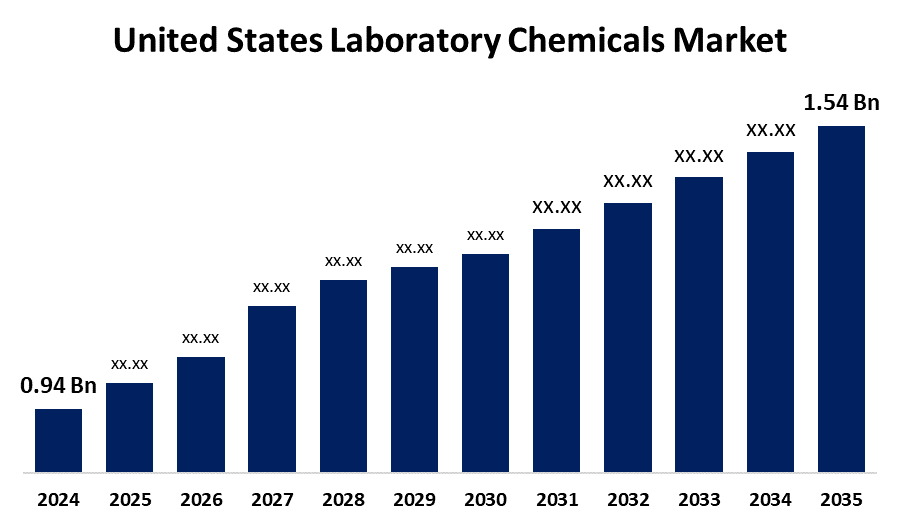

- The United States Laboratory Chemicals Market Size was Estimated at USD 0.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.59% from 2025 to 2035

- The United States Laboratory Chemicals Market Size is Expected to Reach USD 1.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the USA Laboratory Chemicals Market Size is anticipated to reach USD 1.54 Billion by 2035, Growing at a CAGR of 4.59% from 2025 to 2035. The United States laboratory chemicals market is growing due to increasing R&D activities in pharmaceuticals, biotechnology, and academic institutions. Rising demand for high-purity reagents, advancements in chemical synthesis, and government support for scientific research also drive growth. Additionally, expanding healthcare and environmental testing sectors contribute significantly to the rising consumption of laboratory chemicals nationwide.

Market Overview

The United States laboratory chemicals market encompasses a wide range of chemical substances used in research, development, and quality control across various industries, including pharmaceuticals, biotechnology, environmental testing, and academia. Key drivers of market growth include the increasing demand for advanced research and development activities, rising investments in biotechnology and pharmaceutical sectors, and the growing need for quality control and testing in manufacturing processes. Strengths of the market lie in the robust infrastructure of research institutions, a well-established regulatory framework, and a strong focus on innovation and technological advancements. Opportunities exist in the development of specialized chemicals for emerging fields such as nanotechnology, personalized medicine, and environmental testing. Government initiatives play a crucial role in supporting the market through funding for research and development, establishment of regulatory standards, and promotion of innovation through grants and partnerships.

Report Coverage

This research report categorizes the market for the United States laboratory chemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA laboratory chemicals market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. laboratory chemicals market.

United States Laboratory Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.94 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.59% |

| 2035 Value Projection: | USD 1.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Eastman Chemical Company, Honeywell International, Thermo Fisher Scientific, Corning Incorporated, Agilent Technologies, Ecolab Life Sciences, VWR Corporation, R and D Systems, Fisher Scientific, Eppendorf AG, Sigma-Aldrich, PerkinElmer, Avantor, SASOL, BASF, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing demand for advanced research in pharmaceuticals, biotechnology, and life sciences, with increasing government and private sector investments in R&D initiatives, boosts the need for high-purity reagents and specialized chemicals. The expanding healthcare industry, with a focus on drug development and diagnostic testing, further supports market growth. Additionally, rising academic research activities and collaborations with industrial laboratories contribute to the increased use of laboratory chemicals. Technological advancements in analytical techniques and laboratory automation enhance chemical application efficiency, driving further adoption. Environmental testing, forensic analysis, and food safety testing also fuel demand, as regulatory bodies enforce stricter quality and safety standards.

Restraining Factors

The stringent environmental regulations targeting hazardous substances like PFAS, which are costly to replace. Additionally, the lapse of the Chemical Facility Anti-Terrorism Standards program has compromised security measures at high-risk facilities. These factors increase operational costs and liability risks for manufacturers.

Market Segmentation

The United States laboratory chemicals market share is classified into type and application.

- The biochemistry segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States laboratory chemicals market is segmented by type into molecular biology, cytokine and chemokine testing, carbohydrate analysis, biochemistry, environmental testing, cell/tissue culture, and others. Among these, the biochemistry segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its vital role in studying biological processes and understanding biomolecules. This includes applications in protein analysis, enzyme assays, and nucleic acid research, which are essential for drug discovery, personalized medicine, and healthcare advancements.

- The industrial segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States laboratory chemicals market is segmented by application and government, education, industrial, and healthcare. Among these, the industrial segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its extensive use in pharmaceuticals, biotechnology, and manufacturing. High demand for R&D, quality control, and process development fuels consumption. Moreover, robust investment in innovation and compliance with regulatory standards further drives industrial usage, surpassing other segments like education, healthcare, and government in market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States laboratory chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eastman Chemical Company

- Honeywell International

- Thermo Fisher Scientific

- Corning Incorporated

- Agilent Technologies

- Ecolab Life Sciences

- VWR Corporation

- R and D Systems

- Fisher Scientific

- Eppendorf AG

- Sigma-Aldrich

- PerkinElmer

- Avantor

- SASOL

- BASF

- Others

Recent Developments:

- In May 2025, Ecolab Life Sciences opened a state-of-the-art Bioprocessing Applications Laboratory in King of Prussia, Pennsylvania, USA, to support biopharma purification processes. The lab offered advanced tools, lifecycle study capabilities, and real-time collaboration to accelerate drug development. This U.S. facility complemented their existing R&D center in the U.K., enhancing global support for pharmaceutical manufacturing efficiency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. laboratory chemicals market based on the below-mentioned segments:

United States Laboratory Chemicals Market, By Type

- Molecular biology

- Cytokine and chemokine testing

- Carbohydrate analysis

- Biochemistry

- Environmental testing

- Cell/tissue culture

- Others

United States Laboratory Chemicals Market, By Application

- Government

- Education

- Industrial

- Healthcare

Need help to buy this report?