United States Keratin Market Size, Share, and COVID-19 Impact Analysis, By Product (Hydrolyzed and Alpha-keratin), By Application (Personal Care & Cosmetics, Healthcare & Pharmaceuticals, and Food & Beverage), and United States Keratin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Keratin Market Insights Forecasts to 2035

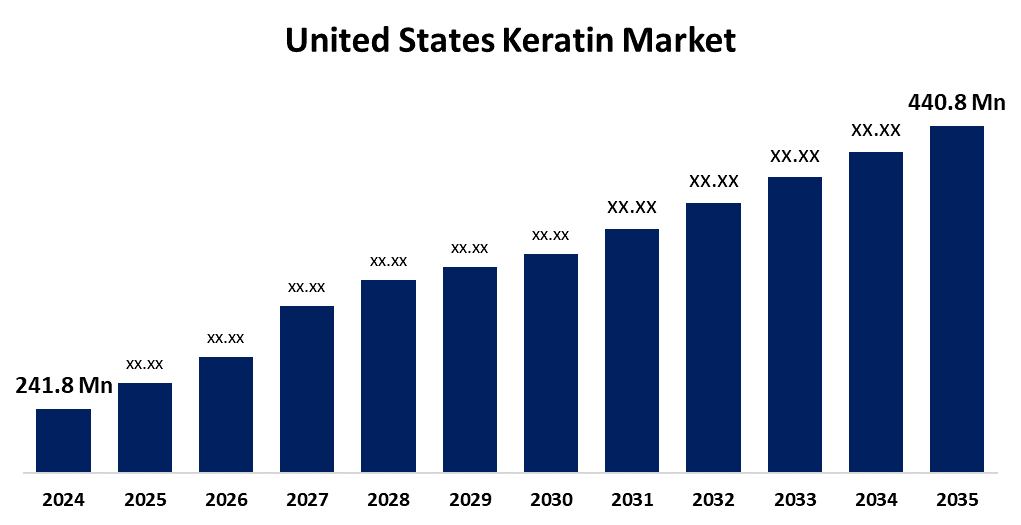

- The US Keratin Market Size Was Estimated at USD 241.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.61% from 2025 to 2035

- The US Keratin Market Size is Expected to Reach USD 440.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Keratin Market Size is anticipated to reach USD 440.8 Million by 2035, growing at a CAGR of 5.61% from 2025 to 2035. The expansion of the United States keratin market is propelled by the increasing consumption of keratin in the personal care and cosmetics industry.

Market Overview

The vertebrate epithelial cells contain a fibrous structural protein called keratin. It is essential to the body's formation of protective barriers and helps to maintain the resilience and shape of different tissues. Keratin is frequently used in skincare and hair care products, such as shampoos and conditioners, to minimise blemishes from heat and chemicals, eliminate dead skin cells, repair damage, and reduce oiliness. Keratin, which is insoluble in water, is found in horns, feathers, the epidermis, hair, wool, nails, and claws. Because keratin is a safe, multipurpose, and sustainable substitute for other acids found in cosmetics, its demand is growing in the personal care and cosmetics industries. The industry's demand for keratin will be further increased by its revitalising benefits on skin and hair. The growing consumer preference for bio-based products, primarily as a result of rising disposable incomes, is a major reason propelling the keratin industry's expansion. Higher keratin consumption is the outcome of manufacturers continuously improving their product lines to satisfy the expanding demands of end customers. To address the growing demand for keratin, governments in the US have increased their manufacturing investments due to the growing population, as well as the continuous urbanisation and industrialisation.

Report Coverage

This research report categorizes the market for the United States keratin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States keratin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States keratin market.

United States Keratin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 241.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.61% |

| 2035 Value Projection: | USD 440.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Active Concepts, LLC, MakingCosmetics Inc, Rejuvenol, OQAI Haircare, OGX Beauty, Johnson and Johnson, Inspired Beauty Brands, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States keratin market is boosted by the growing need for hair care items. The natural protein keratin is present in skin, hair, and nails. It lessens the likelihood of hair damage and breakage while strengthening and protecting hair. Consequently, customers have shown a strong interest in keratin-based hair care products, including shampoos, conditioners, and serums. These products aid in repairing damaged hair, minimising frizz, and enhancing the general health of hair. Growing knowledge of the benefits of keratin for hair care is expected to propel future growth in the keratin market.

Restraining Factors

The United States keratin market faces obstacles because its extraction and purification are a difficult and resource-intensive procedure that calls for specialised tools and drawn-out procedures. This results in increased production costs, which are subsequently transferred to customers in the form of higher keratin-based product pricing.

Market Segmentation

The United States Keratin Market share is classified into product and application.

- The hydrolyzed segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States keratin market is segmented by product into hydrolyzed and alpha-keratin. Among these, the hydrolyzed segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by a mixture of peptides and amino acids. Hydrolysed keratin is frequently found in skin, hair, nails, and other personal care products. It has several uses, such as having antistatic, nail conditioning, and humectant properties. Additionally, hydrolysed keratin promotes the health of biological tissues. Cosmetic and personal care companies include it in their products to enhance health, beauty, and well-being.

- The personal care & cosmetics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States keratin market is segmented into personal care & cosmetics, healthcare & pharmaceuticals, and food & beverage. Among these, the personal care & cosmetics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is propelled by conditioners, shampoos, and face moisturisers, which are just a few of the personal care products that are used on the market. Customers' changing lifestyles are reflected in the growing demand for keratin, which makes beauty procedures easier to manage in the face of hectic schedules.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States keratin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Active Concepts, LLC

- MakingCosmetics Inc

- Rejuvenol

- OQAI Haircare

- OGX Beauty

- Johnson and Johnson

- Inspired Beauty Brands

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- In March 2024, Kera Mane (LLC Brazilian Magic), a beauty brand specializing in hair care, announced the launch of its new keratin hair treatment kit, designed to offer a high-quality hair care experience from home. Based in Westminster, Maryland, the brand's latest product aimed to provide a safer, more accessible approach to hair treatment for individuals worldwide.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Keratin market based on the below-mentioned segments:

United States Keratin Market, By Product

- Hydrolyzed

- Alpha-keratin

United States Keratin Market, By Application

- Personal Care & Cosmetics

- Healthcare & Pharmaceuticals

- Food & Beveragec

Need help to buy this report?