United States Joint Spacer Systems Market Size, Share, and COVID-19 Impact Analysis, By Procedure Type (Knee, Hip, and Shoulder), By End-user (Hospitals and Ambulatory Surgical Centers), and United States Joint Spacer Systems Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Joint Spacer Systems Market Forecasts to 2035

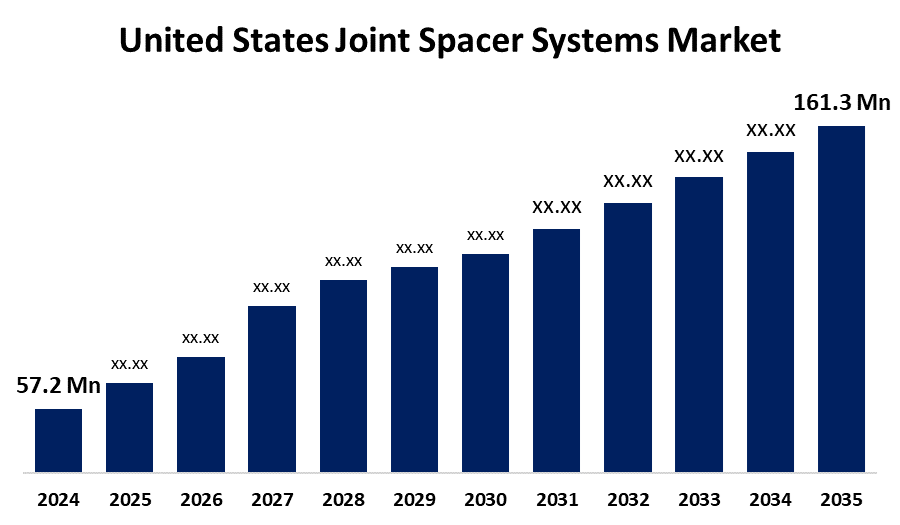

- The United States Joint Spacer Systems Market Size Was Estimated at USD 57.2 Million 2024

- The United States Joint Spacer Systems Market Size is Expected to Grow at a CAGR of around 9.88% from 2025 to 2035

- The United States Joint Spacer Systems Market Size is Expected to Reach USD 161.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Joint Spacer Systems Market is anticipated to reach USD 161.3 Million by 2035, growing at a CAGR of 9.88% from 2025 to 2035. In the United States, market growth is being fueled by a rising incidence of prosthetic joint infections and an increasing number of orthopaedic implant procedures. Ongoing innovation and new product launches by key market players.

Market Overview

The joint spacer system market refers to includes either articulating or preformed spacers made from bone cement and infused with antibiotics. These spacers come in various sizes and are designed to temporarily preserve joint mobility, thereby improving patient function and overall satisfaction. Primarily used for managing infections that occur after joint replacement surgeries, these antibiotic-loaded spacers are temporary intra-articular devices. They provide continuous, localized antibiotic distribution while maintaining joint functionality. These devices are required in two-step modification surgery, which is a common method for treating prosthetic joint infection (PJI). The increasing demand for joint spacer products in the US is largely due to their ability to fight a wide range of normal bacteria and to reduce surgical site infections in high -risk patients for primary arthroplasty. In particular, these spaces perform a strong antibacterial activity against approximately 90% clinically relevant bacteria and significantly reduce the risk of surgical infection in individuals undergoing primary joint replacement.

In United States elderly demographic joint-related diseases such as osteoarthritis, rheumatoid arthritis, and rising incidence of prosthetic joint infections and an increasing number of orthopaedic implant procedures. are more prone to, there is an increasing demand for joint spacer systems to manage these conditions. Additionally, the increasing awareness and availability of advanced medical remedies has demanded surgical intervention to more individuals, leading to further accelerate market expansion over the forecast period.

Report Coverage

This research report categorizes the market for the US joint spacer system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States joint spacer system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States joint spacer system market.

United States Joint Spacer Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 57.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.88% |

| 2035 Value Projection: | USD 161.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Procedure Type, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | Tecres S.P.A., Osteo Remedies, LLC, Heraeus Group, Arthrex, Zimmer Biomet, Stryker, DePuy Synthes and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rise in aging population, old osteoarthritis and increasing incidence of other degenerative joint diseases, are prominent driver for joint replacement processes. Spacer design, development in materials and manufacturing processes, such as 3D printing and using biocompatible materials, are improving the efficacy and efficiency of the joint spacer system. In U.S. the incidence of knee osteoarthritis increases day by day causing pain and loss, further increase adoption of joint spacer. Two-revision surgery is becoming more prevalent, and the joint spacer system is important in management of prosthetic joint transitions and facilitating these procedures. Moreover, the adoption of technologically advanced orthopaedic implants is likely to be improved by the companies’ increased focus on developing advanced technologies for preformed joint spacers with a view to achieving better patient outcomes. In addition, government and private healthcare sectors spending more on healthcare infrastructure and advanced medical equipment.

Restraining Factors

Joint spacer is newly launched products compared to surgeon-made spacers, which are used in two-stage modification arthroplasty. In addition, surgeon-based spacers have better access across the US and have great benefits in terms of dynamics, pain, bone loss, success, or re-renovation rate, as unlike joint spacers. These benefits of surgeon-based spacers are expected to obstruct the adoption of joint spacer systems in the US market. In addition, there are many complications associated with the spacer system, which limit their adoption in joint replacement processes.

Market Segmentation

The United States joint spacer system market share is classified into by procedure type and end user.

- The knee segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States joint spacer system market is segmented by procedure type into knee, hip, and shoulder. Among these, the knee segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In U.S. total knee replacement processes due to increasing incidence of prosthetic joint infections. In addition, some causative segment growth factor is the availability of large number of bone spacer products for knee surgery and there is an increasing demand for pre -joint spacers to treat prosthetic knee infections. The effectiveness knee joint spacer system in providing temporary relief and maintaining joint functionality has made them a popular choice between the surgeons and patients.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States joint spacer system market is segmented by end-user into hospitals and ambulatory surgical centers. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The presence of technically advanced equipment in hospitals, along with an increase in hospital visits by patients undergoing two-step modification procedures for the treatment of prosthetic joint infection. Availability of advanced medical facilities and the presence of skilled healthcare professionals. The increasing number of joint replacement surgery performed in hospitals is an important factor to run the demand for joint spacer system in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States joint spacer system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tecres S.P.A.

- Osteo Remedies, LLC

- Heraeus Group

- Arthrex

- Zimmer Biomet

- Stryker

- DePuy Synthes

- Others

Recent Developments:

- In December 2021: Heraeus Group expanded its capabilities in the medical manufacturing sector by acquiring Norwood Medical, a leading provider of outsourced manufacturing solutions for advanced medical procedures. This strategic acquisition enhanced Heraeus' production of orthopaedics medical devices, including joint spacers, particularly for use in orthopaedics, minimally invasive treatments, and robotic-assisted surgeries.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States joint spacer system market based on the below-mentioned segments:

United States Joint Spacer System Market, By Procedure Type

- Knee

- Hip

- Shoulder

United States Joint Spacer System Market, By End-User

- Hospitals

- Ambulatory Surgical Centers

Need help to buy this report?