United States IT Services Market Size, Share, and COVID-19 Impact Analysis, By Technology (AI & ML, Big Data Analytics, Threat Intelligence, and Others), By Approach (Proactive and Reactive), and United States IT Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States IT Services Market Insights Forecasts to 2035

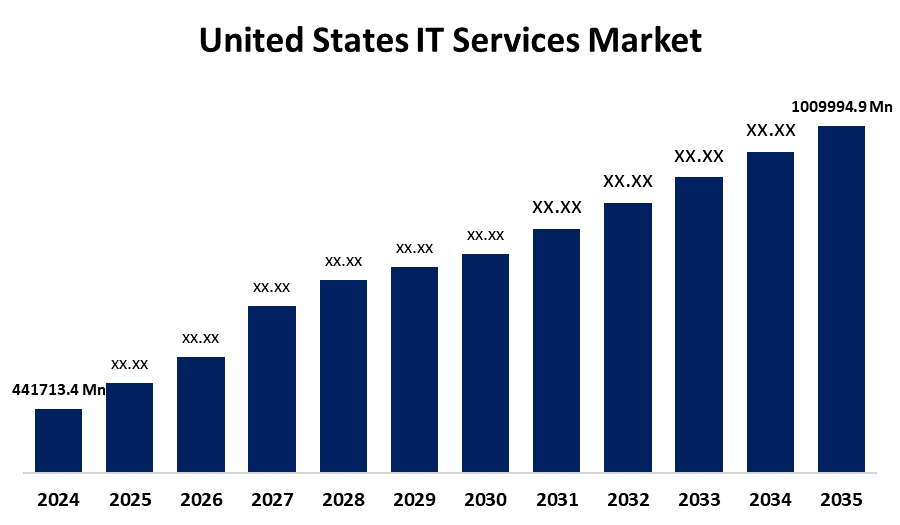

- The US IT Services Market Size Was Estimated at USD 441713.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.81% from 2025 to 2035

- The US IT Services Market Size is Expected to Reach USD 1009994.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States IT Services Market Size is anticipated to reach USD 1009994.9 Million by 2035, growing at a CAGR of 7.81% from 2025 to 2035. The expansion of the United States IT services market is propelled by a paradigm shift in the business landscape has been brought about by the widespread use of big data analytics, artificial intelligence, the Internet of Things (IoT), and machine learning (ML).

Market Overview

IT services are the application of business and technological know-how to the development, implementation, management, and enhancement of an organization's business procedures and information systems. Companies have sought new services to facilitate automation and enhance their supply chain. Cloud services and business intelligence are abundantly available in the United States. Digital technologies are being utilized much more widely for cost savings, operational intelligence, and overall efficiency. Customers' desires for mobility, customization, and personalisation have highlighted the need for new ideas with suppliers and service providers. In gaining a competitive advantage in the US market, managed services have been an asset. For example, managed services can help to navigate the financial industry’s active regulatory environment, offer emerging security implementation, utilize technological skills, and create a safe and scalable infrastructure. The manufacturing industry can utilize managed services to help minimize repetitive processes and track increasing data. The introduction of more digital business processes and data has triggered a larger focus on cybersecurity. IT service providers advertise a wide range of cybersecurity services such as threat monitoring and response, vulnerability assessments, security consulting, and managed security services. Their goal is to help their customers protect digital assets, achieve regulatory compliance, and lower the risk of cyber threats such as ransomware, insider threats, and data breaches.

Report Coverage

This research report categorizes the market for the United States IT services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States IT services market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States IT services market.

United States IT Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 441713.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.81% |

| 2035 Value Projection: | USD 1009994.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology and By Approach |

| Companies covered:: | Juniper Networks Inc, Avaya, Cisco Systems Inc, DXC Technology Company, Hewlett-Packard Enterprise Co, Fortinet Inc, Broadcom Inc, Microsoft Corp, International Business Machines Corp, Oracle Corp, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States IT services market is boosted by the increasing adoption of emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and big data analytics creates opportunities for data security and privacy. In order to help protect private data, mitigate user access, reduce algorithmic bias, data breaches, and breaches of privacy, these technologies need to deploy appropriate security measures. IT service providers offer legitimate support solutions to build IoT security policies, secure AI and ML models, and use data for ethical purposes. Data analytics and big data solutions can play a significant role in risk management and regulatory compliance. The critical confusion in the areas of cybersecurity, health, and finance all depend on advanced analytics to detect anomalies, prevent fraud, and ensure compliance with the requirements of regulation.

Restraining Factors

The United States IT services market faces obstacles like custom projects that require the work of trained IT professionals, including developers, designers, and project managers. When resources are set aside for a custom project, those resources cannot be programmed for other work or projects.

Market Segmentation

The United States IT services market share is classified into technology and approach.

- The AI & ML segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States IT Services market is segmented by technology into AI & ML, big data analytics, threat intelligence, and others. Among these, the AI & ML segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the optimistic outlook that has occurred as the industrial verticals are being changed by automation progress. Improved customer service, predictive maintenance, and real-time fraud detection have led to the increased popularity of AI and ML.

- The reactive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the approach, the United States IT Services market is segmented into proactive and reactive. Among these, the reactive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the trend towards incident management, monitoring, and alerting, as cloud-based services play a role in this growth. Increased pressure on costs associated with downtime has forced industry leaders to invest in strong reactive IT services as well and focus on protecting their IT assets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States IT services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Juniper Networks Inc

- Avaya

- Cisco Systems Inc

- DXC Technology Company

- Hewlett-Packard Enterprise Co

- Fortinet Inc

- Broadcom Inc

- Microsoft Corp

- International Business Machines Corp

- Oracle Corp

- Others

Recent Development

- In January 2024, HPE announced the acquisition of Juniper Networks to expedite the AI-fueled innovation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States IT services market based on the following segments:

United States IT Services Market, By Technology

- AI & ML

- Big Data Analytics

- Threat Intelligence

- Others

United States IT Services Market, By Approach

- Proactive

- Reactive

Need help to buy this report?