United States Isosorbide Market Size, Share, and COVID-19 Impact Analysis, By Application (PEIT, Polycarbonate, Polyurethane, Polyester Polyisosorbide Succinate (PIS), Isosorbide Diesters, and Others), By End Use (Resins & Polymers, Additives, and Others), Isosorbide Diesters, and Others), and United States Isosorbide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Isosorbide Market Insights Forecasts to 2035

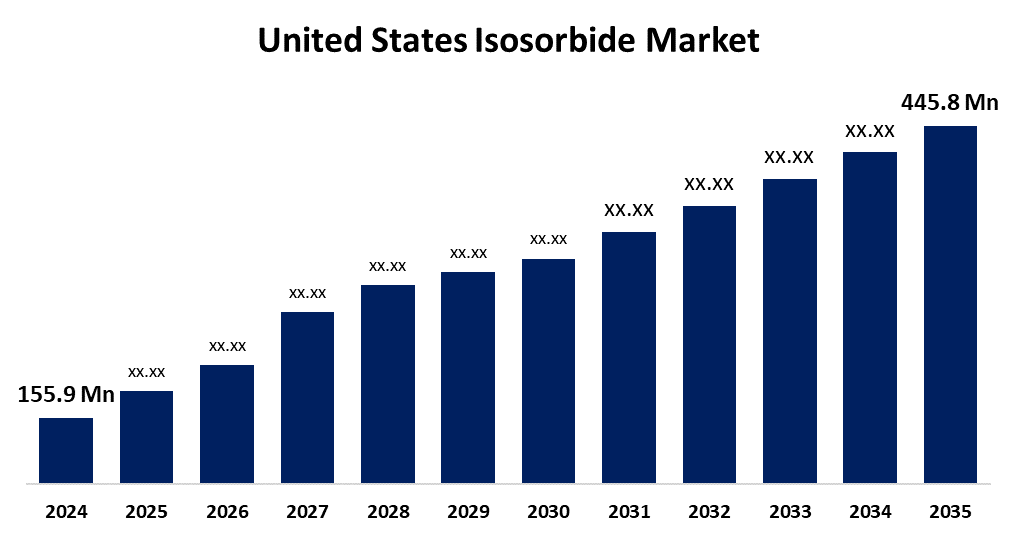

- The US Isosorbide Market Size Was Estimated at USD 155.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.02% from 2025 to 2035

- The US Isosorbide Market Size is Expected to Reach USD 445.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Isosorbide Market Size is Anticipated to Reach USD 445.8 Million by 2035, Growing at a CAGR of 10.02% from 2025 to 2035. The expansion of the United States isosorbide market is propelled by the rising need for the manufacture of isosorbide bioplastics.

Market Overview

Isosorbide is a plant-based compound derived from D-sorbitol, a bicyclic diol. One of the primary factors driving growth in the isosorbide market during the forecast period is the increasing demand for bio-based chemical products and sustainable substitutes. With benefits such as high biodegradability, low toxicity, sustainability, and specialty oleochemicals, which are made primarily from natural feedstocks like palm, soybean, and coconut oils, they have gradually gained acceptance in food and beverage, pharmaceutical, personal care, and industrial uses. Several specialty oleochemicals are primed for rapid acceptance with favourable environmental regulations, and increased consumer interest in natural products that are inherently more sustainable. Technological advances in renewable chemistry have substantially improved the cost of production and manufacturing efficiency of isosorbide, and advances in production methods, like catalytic and enzymatic conversion of sorbitol, are enabling higher yields and better product quality.

The U.S. government has aggressively encouraged the growth of the isosorbide market through multi-agency programs to boost the manufacture of biobased chemicals. USDA initiatives such as the Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program ("Section 9003") offer loan guarantees up to $250 million and subsidies up to about $10 million per project to businesses expanding biomass-to-chemical facilities.

Report Coverage

This research report categorizes the market for the United States isosorbide market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States isosorbide market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States isosorbide market.

United States Isosorbide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 155.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.02% |

| 2035 Value Projection: | USD 445.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Application, By End Use and COVID-19 Impact Analysis. |

| Companies covered:: | Rocket Companies Inc Ordinary Shares Class A, J and K Scientific, Roquette Frères, ADM, BASF, Ecogreen Oleochemicals, Rochem International Inc, DuPont, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States isosorbide market is boosted by increasing demand for sustainable and bio-based polymers, particularly PEIT, as consumers and regulations move away from plastics made from petroleum. Growth is also being fuelled by an ageing population and an increase in the usage of pharmaceuticals, particularly for cardiovascular medicines like isosorbide mononitrate. Stricter environmental laws and developments in industrial technologies that increase scalability and cost effectiveness support these trends.

Restraining Factors

The United States isosorbide market faces obstacles like the manufacturing isosorbide requires high temperature and acidic conditions for the dehydration of sorbitol, which requires a dedicated catalyst and non-corrosive reactor.

Market Segmentation

The United States isosorbide market share is classified into application and end use.

- The PEIT segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States isosorbide market is segmented by application into PEIT, polycarbonate, polyurethane, polyester polyisosorbide succinate (PIS), isosorbide diesters, and others. Among these, the PEIT segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the product's increasing usage in thermoplastics and packaging uses, such as bottles, jars, and hot-fill containers. The PEIT polymer has even more enhanced material properties compared with polyethylene terephthalates (PET) with regard to film stiffness, UV protection, and a sought-after higher glass transition temperature when compared with thermally-sensitive plastics.

- The resins & polymers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States isosorbide market is segmented into resins & polymers, additives, and others. Among these, the resins & polymers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing importance of products in the bio-refinery industry to create new bio-based resins and polymers. Isosorbide-methacrylate is a low-viscosity cross-linking polymer used to develop thermoset polymers that improve thermomechanical properties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States isosorbide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rocket Companies Inc Ordinary Shares Class A

- J and K Scientific

- Roquette Frères

- ADM

- BASF

- Ecogreen Oleochemicals

- Rochem International Inc

- DuPont

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States isosorbide market based on the following segments:

United States Isosorbide Market, By Application

- PEIT

- Polycarbonate

- Polyurethane

- Polyester Polyisosorbide Succinate (PIS)

- Isosorbide Diesters

- Others

United States Isosorbide Market, By End Use

- Resins & Polymers

- Additives

- Others

Need help to buy this report?