United States Irrigation Machinery Market Size, Share, and COVID-19 Impact Analysis, By Type (Surface Irrigation, Drip Irrigation, Sprinkler Irrigation, and Subsurface Irrigation), By Component (Pumps, Valves, Sprinklers, Controllers, and Drip Lines), By Technology (Automated Irrigation Systems, Cloud-Based Irrigation Management, and Smart Irrigation Technologies), By End User (Field Crops, Orchards, Greenhouses, and Landscaping), and United States Irrigation Machinery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Machinery & EquipmentUnited States Irrigation Machinery Market Insights Forecasts to 2035

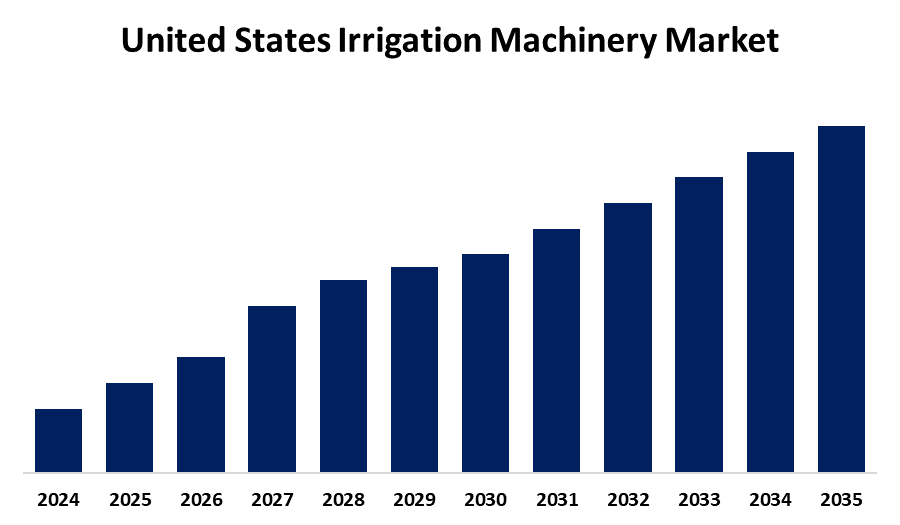

- The USA Irrigation Machinery Market Size is Expected to Grow at a CAGR of around 8.2% from 2025 to 2035.

- The U.S. Irrigation Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States irrigation machinery market is expected to hold a significant share by 2035, growing at a CAGR of 8.2% from 2025 to 2035. The U.S. irrigation machinery market is growing due to several factors, like the need for efficient water management amid climate change and droughts, advancements in precision irrigation technologies like AI and IoT, government incentives supporting sustainable farming, and the adoption of smart systems such as drones and automated sprinklers.

Market Overview

The United States irrigation machinery market defines the machinery like drip irrigation systems, sprinklers, center pivot systems, and lateral move irrigation machines, all of which are used to improve the efficiency and accuracy of water distribution to plants. The market drivers comprise several variables, such as growing water scarcity issues, labor cost inflation, and food production demand due to demographic pressure. Advances in technology, like the infusion of artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT), provide assistance to farmers to maximize water usage, enhance crop production, and minimize operational expenses. The market's strengths are its capacity to accommodate large-scale farming operations, flexibility across various crops and landscapes, and support for sustainable agriculture. There are also opportunities for advancement in precision agriculture, particularly in drought-prone areas or areas with unreliable rainfall. Government incentives continue to drive the market forward, with initiatives such as the Environmental Quality Incentives Program (EQIP) and the Agricultural Water Enhancement Program (AWEP) providing subsidies and technical support for water-saving technologies.

Report Coverage

This research report categorizes the market for the United States irrigation machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' irrigation machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States irrigation machinery market.

United States Irrigation Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Type, By Component, By Technology, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Nelson Irrigation Corporation, Netafim USA, T-L Irrigation Co., Valmont Industries, Inc., Jain Irrigation, Inc., The Toro Company, Deere & Company, Lindsay Corporation, Rain Bird Corporation, Rivulis Irrigation Ltd, Vermeer Corporation, Hunter Industries, Inc., and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Technological developments, including the convergence of artificial intelligence, machine learning, and Internet of Things (IoT) technologies, have transformed water management in agriculture. These technologies facilitate data analysis in real time, predictive modelling, and automatic decision-making, making water usage more optimal and enhancing crop production. Moreover, the rising instances of irregular weather patterns and droughts have expedited the use of effective irrigation systems such as drip and sprinkler technologies. Government support and subsidies for encouraging sustainable agriculture also favour the use of advanced irrigation equipment. In addition, food security demand and water conservancy requirements have heightened the installation of effective irrigation systems.

Restraining Factors

Large initial investment fees and maintenance costs discourage small and medium-scale farmers. Moreover, low awareness and technical capacity among users also limit the widespread embrace. Environmental issues arising from high water and energy consumption also present challenges. The water shortage and tough regulations limit irrigation activities, along with economic pressure and volatile commodity prices.

Market Segmentation

The United States irrigation machinery market share is classified into type, component, technology, and end-user.

- The drip irrigation segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States irrigation machinery market is segmented by type into surface irrigation, drip irrigation, sprinkler irrigation, and subsurface irrigation. Among these, the drip segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Drips give root-to-root watering and the most effective conservation of water. Government incentives and environmental concerns further drive its adoption, with its sustainable use which gives a life cycle of approximately ten years after installation.

- The drip lines segment accounted for the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States irrigation machinery market is segmented by component into pumps, valves, sprinklers, controllers, and drip lines. Among these, the drip lines segment accounted for the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because drip lines provide an effective, focused watering, which is essential in water-limited areas. These parts all help provide sustainable agricultural methods, enabling farmers to produce the most with the least number of resources used.

- The automated irrigation systems segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States irrigation machinery market is segmented by technology into automated irrigation systems, cloud-based irrigation management, and smart irrigation technologies. Among these, the automated irrigation systems segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its capacity to manage water resources efficiently by monitoring them in real-time, to optimize irrigation timing based on weather and soil conditions, minimize labor costs via automation, and increase overall agricultural production and sustainability with minimal human effort.

- The field crops segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States irrigation machinery market is segmented by end user into field crops, orchards, greenhouses, and landscaping. Among these, the field crops segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the extensive farming of field crops such as wheat and maize, their high water demand, and the growing use of micro-irrigation systems for maximum yield and efficient water utilization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States irrigation machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nelson Irrigation Corporation

- Netafim USA

- T-L Irrigation Co.

- Valmont Industries, Inc.

- Jain Irrigation, Inc.

- The Toro Company

- Deere & Company

- Lindsay Corporation

- Rain Bird Corporation

- Rivulis Irrigation Ltd

- Vermeer Corporation

- Hunter Industries, Inc.

- Others

Recent Developments:

- In December 2023, Netafim USA, the Fresno, California-based precision agricultural business of Orbia, has launched the Netafim ReGen AgVantage Certification Program, which it says creates a new standard for Netafim’s grower partners who have demonstrated a commitment to sustainability by working with them to reduce dripline plastic waste and minimize their environmental impact.

- In February 2023, T-L Irrigation Co. Introduced the Gooseneck Cradle Corner System Attachment. T-L Irrigation Co. adds a gooseneck cradle corner system attachment option and a simplified auto-reverse system to add stability and durability to two important pivot locations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States irrigation machinery market based on the below-mentioned segments:

U.S. Irrigation Machinery Market, By Type

- Surface Irrigation

- Drip Irrigation

- Sprinkler Irrigation

- Subsurface Irrigation

U.S. Irrigation Machinery Market, By Component

- Pumps

- Valves

- Sprinklers

- Controllers

- Drip Lines

U.S. Irrigation Machinery Market, By Technology

- Automated Irrigation Systems

- Cloud-Based Irrigation Management

- Smart Irrigation Technologies

U.S. Irrigation Machinery Market, By End User

- Field Crops

- Orchards

- Greenhouses

- Landscaping

Need help to buy this report?