United States Intravascular Catheter Market Size, Share, and COVID-19 Impact Analysis, By Product (Short PIVC Catheters and Integrated/Closed PIVC Catheters), By Application (Renal Disease, Cancer, Gastrointestinal Diseases, Infectious Diseases, and others), and United States Intravascular Catheter Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Intravascular Catheter Market Insights Forecasts to 2035

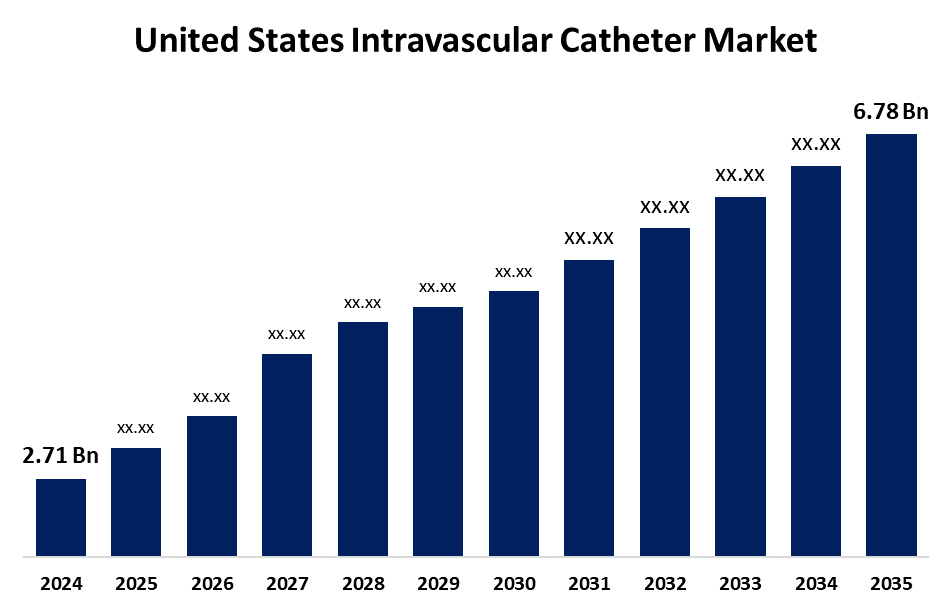

- The USA Intravascular Catheter Market Size was Estimated at USD 2.71 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.69% from 2025 to 2035

- The U.S. Intravascular Catheter Market Size is Expected to Reach USD 6.78 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Intravascular Catheter Market Size is anticipated to reach USD 6.78 Billion by 2035, Growing at a CAGR of 8.69% from 2025 to 2035. The U.S. intravascular catheter market growth is driven by rising chronic disease prevalence, increasing demand for minimally invasive procedures, and technological advancements like antimicrobial and bioresorbable catheters. Additionally, the shift toward outpatient care and supportive government reimbursement policies enhances accessibility, fueling adoption.

Market Overview

The U.S. intravascular catheter market encompasses devices such as peripherally inserted central catheters (PICCs), central venous catheters (CVCs), and midline catheters, essential for administering medications, fluids, and nutrition directly into patients' vascular systems. The market is driven by the increasing prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer, necessitating frequent vascular access. Technological advancements, including the development of antimicrobial-coated and bioresorbable catheters, have enhanced patient safety by reducing infection risks and improving catheter longevity. The shift towards minimally invasive procedures and outpatient care settings has further propelled the demand for intravascular catheters, as these devices facilitate efficient and less invasive treatments. The market can benefit from strengthening healthcare systems in emerging areas and designing smart catheters with embedded sensors for live monitoring, which also contributes by providing various opportunities across this market area. Government initiatives, such as favourable reimbursement policies and the establishment of clear regulatory pathways by the FDA, have supported market growth by ensuring the availability of safe and effective devices.

Report Coverage

This research report categorizes the market for the United States intravascular catheter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA intravascular catheter market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. intravascular catheter market.

United States Intravascular Catheter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.71 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.69% |

| 2035 Value Projection: | USD 6.78 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Boston Scientific Corporation, McKesson Corporation, Merit Medical Systems, Becton Dickinson (BD), Teleflex Incorporated, Edwards Lifesciences, Abbott Laboratories, Baxter International, Johnson & Johnson, Medline Industries, AngioDynamics, Smiths Medical, Cook Medical, ConvaTec, C.R. Bard, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing prevalence of chronic diseases, such as cardiovascular disorders, cancer, and diabetes which requires frequent and reliable vascular access for treatment. The growing demand for minimally invasive procedures has further accelerated the need for advanced catheter technologies. Innovations like antimicrobial-coated and bioresorbable catheters have significantly reduced infection rates and improved patient outcomes, driving market adoption. Additionally, the rise of outpatient care and home healthcare settings has boosted the use of intravascular catheters due to their convenience and effectiveness. Supportive government initiatives, including favourable reimbursement policies and stringent regulatory frameworks, have ensured patient safety and encouraged product development.

Restraining Factors

The high device costs and potential complications, such as infections and thrombosis, can limit widespread adoption. Strict regulatory requirements and lengthy approval processes may delay product launches. Additionally, a lack of awareness in some healthcare settings and competition from alternative vascular access methods can hinder market growth.

Market Segmentation

The United States intravascular catheter market share is classified into product and application.

- The short PIVC catheters segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA intravascular catheter market is segmented by product into short PIVC catheters and integrated/closed PIVC catheters. Among these, the short PIVC catheters segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their widespread use in hospitals for short-term intravenous access. Their ease of insertion, cost-effectiveness, and suitability for a broad range of clinical settings contribute to their high demand. Frequent use in emergency and routine care further reinforces their market leadership.

- The renal disease segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. intravascular catheter market is segmented by application into renal disease, cancer, gastrointestinal diseases, infectious diseases, and others. Among these, the renal disease segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the high prevalence of chronic kidney conditions requiring frequent vascular access for dialysis. The recurring need for catheter-based treatments in renal care drives consistent demand. This segment surpasses others owing to the critical, ongoing nature of vascular access in kidney disease management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States intravascular catheter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- McKesson Corporation

- Merit Medical Systems

- Becton Dickinson (BD)

- Teleflex Incorporated

- Edwards Lifesciences

- Abbott Laboratories

- Baxter International

- Johnson & Johnson

- Medline Industries

- AngioDynamics

- Smiths Medical

- Cook Medical

- ConvaTec

- C.R. Bard

- Others

Recent Developments:

- In October 2024, BD (Becton, Dickinson and Company) launched the BD® Intraosseous Vascular Access System, enabling rapid vascular access for fluid and medication delivery in critical emergencies. This system is designed for both adult and pediatric patients, offering features such as integrated passive needle tip safety and a rechargeable powered driver. It is now commercially available in the U.S.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA intravascular catheter market based on the below-mentioned segments:

United States Intravascular Catheter Market, By Product

- Short PIVC Catheters

- Integrated/Closed PIVC Catheters

United States Intravascular Catheter Market, By Application

- Renal Disease

- Cancer

- Gastrointestinal Diseases

- Infectious Diseases

- Others

Need help to buy this report?