United States Intrauterine Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Copper IUD, Hormonal IUD), By Age Group (15-24 years, 25-34 years, 35-44 years, Above 44 years), By End User (Hospitals, Gynaecology Clinics, Community Healthcare, Others), and United States Intrauterine Devices Market Insights Forecasts to 2033

Industry: HealthcareUnited States Intrauterine Devices Market Insights Forecasts to 2033

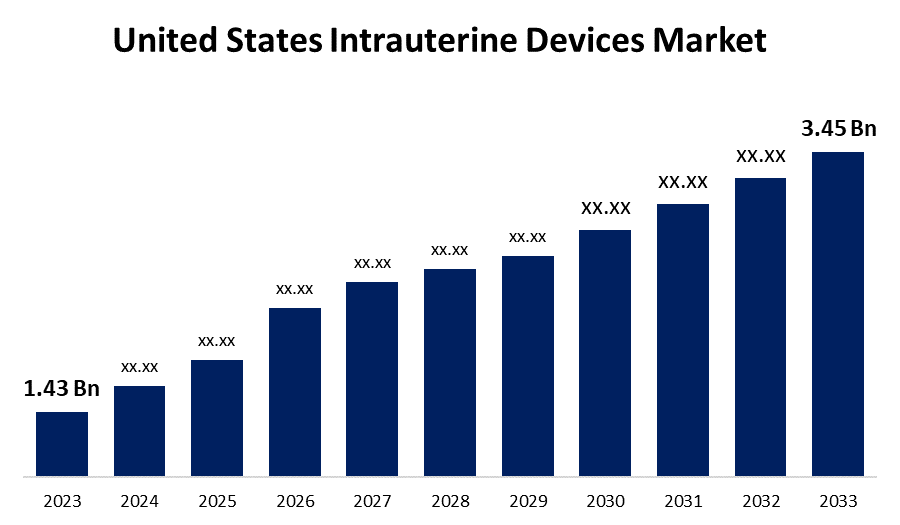

- The United States Intrauterine Devices Market Size was valued at USD 1.43 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.2% from 2023 to 2033.

- The United States Intrauterine Devices Market Size is Expected to Reach USD 3.45 Billion by 2033.

Get more details on this report -

The United States Intrauterine Devices Market Size is Expected to Reach USD 3.45 Billion by 2033, at a CAGR of 9.2% during the forecast period 2023 to 2033.

Market Overview

Intrauterine Devices (IUDs) are a form of long-term, reversible birth control, representing one of the most effective contraceptive methods available today. An IUD is a small, T-shaped device that is inserted into the uterus by a healthcare provider to prevent pregnancy. There are two main types of IUDs. Copper IUDs, which release a small amount of copper to deter sperm from reaching the egg, and hormonal IUDs, which release hormones to thicken cervical mucus and block sperm from fertilizing the egg. The copper intrauterine device plays an important role in preventing fertilization. IUDs provide an extended period of protection, ranging from three to ten years, depending on the type. They offer the convenience of minimal ongoing care and are favored for their efficacy, reversibility, and ease of use. In addition, the increase in government initiatives promoting family planning and reproductive health education has a positive impact on the market. The market is also boosted by favorable healthcare policies and insurance coverage, which make IUDs more accessible and affordable to a larger population.

Report Coverage

This research report categorizes the market for United States intrauterine devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States intrauterine devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States intrauterine devices market.

United States Intrauterine Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.43 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.2% |

| 2033 Value Projection: | USD 3.45 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Age Group, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Bayer AG, CooperSurgical, Inc., Teva Pharmaceutical Industries Ltd., Allergan (Now part of AbbVie Inc.), Merck & Co., Inc., Medicines360, Agile Therapeutics, Inc., Bayer HealthCare Pharmaceuticals Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The key factors driving the growth of the United States intrauterine device market are an increase in the number of unplanned and unintended pregnancies, an increase in the number of unsafe abortions, and a rise in awareness about the device's use. Furthermore, the increase in demand for intrauterine devices, a government initiative, and key players in the R&D sector working to develop advanced devices all contribute to the growth of the United States intrauterine device market. Moreover, the rise in the number of unintended pregnancies and supportive government initiatives drive market growth. Furthermore, the growing trend toward planned delayed pregnancy in the United States is expected to drive market growth. The adoption of novel strategies by the US government to promote access to sexual and reproductive health services and products is expected to increase the preference for planned delayed pregnancy.

Restraining Factors

Lack of awareness about intrauterine device use, as well as side effects such as bleeding and pain or discomfort, are the primary reasons why women have their intrauterine devices removed, accounting for more than half of all removals before the recommended replacement time. Few patients experience other side effects after the IUD is placed, such as cramps, irregular periods, spotting between periods, heavier periods with stronger cramping, and so on, which hamper the growth of the United States intrauterine device market.

Market Segment

- In 2023, the copper IUD segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States intrauterine devices market is segmented into copper IUD and hormonal IUD. Among these, the copper IUD segment has the largest revenue share over the forecast period. The copper intrauterine device helps to prevent fertilization. Copper acts as a spermicide in the uterus, increasing the concentration of copper ions, prostaglandins, and white blood cells. Hormone-releasing intrauterine devices are contraceptive devices that are implanted in a woman's uterus to prevent pregnancy by continuously releasing a low dose of specific hormones, such as progesterone. The hormonal intrauterine device is used long-term to prevent pregnancy.

- In 2023, the 25-34 years segment accounted for the largest revenue share over the forecast period.

Based on the age group, the United States intrauterine devices market is segmented into 15-24 years, 25-34 years, 35-44 years, and above 44 years. Among these, the 25-34 years segment has the largest revenue share over the forecast period owing to increased awareness of intrauterine devices and increased concern about adolescent sexual activity, premarital and unplanned pregnancy frequently results in early school termination or abortion.

- In 2023, the hospitals segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States intrauterine devices market is segmented into hospitals, gynaecology clinics, community healthcare, and others. Among these, the hospitals segment has the largest revenue share over the forecast period. The availability of specialized professionals ensures access to expert care, while modern tools and technologies make insertion easier. Comprehensive services, such as consultation, insertion, and follow-up, help to streamline the patient experience. Hospitals remain a key setting for IUD administration, combining specialized care with cutting-edge technology to serve a large population base.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States intrauterine devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- CooperSurgical, Inc.

- Teva Pharmaceutical Industries Ltd.

- Allergan (Now part of AbbVie Inc.)

- Merck & Co., Inc.

- Medicines360

- Agile Therapeutics, Inc.

- Bayer HealthCare Pharmaceuticals Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Bayer AG has received FDA approval for its new Mirena IUD, a hormonal IUD that lasts up to 8 years. The Mirena IUD is intended to provide women with a long-acting, reversible form of contraception that is extremely effective in preventing pregnancy.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States intrauterine devices market based on the below-mentioned segments:

United States Intrauterine Devices Market, By Product

- Copper IUD

- Hormonal IUD

United States Intrauterine Devices Market, By Age Group

- 15-24 years

- 25-34 years

- 35-44 years

- Above 44 years

United States Intrauterine Devices Market, By End User

- Hospitals

- Gynaecology Clinics

- Community Healthcare

- Others

Need help to buy this report?