United States Interventional Cardiology Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Coronary Stents, Balloon Catheters, Guidewires, IVUS Catheters, and Others), By Procedure Type (Coronary Angioplasty, Coronary Bypass Surgery, Peripheral Angioplasty, and Transcatheter Aortic Valve Replacement), and United States Interventional Cardiology Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Interventional Cardiology Market Insights Forecasts to 2035

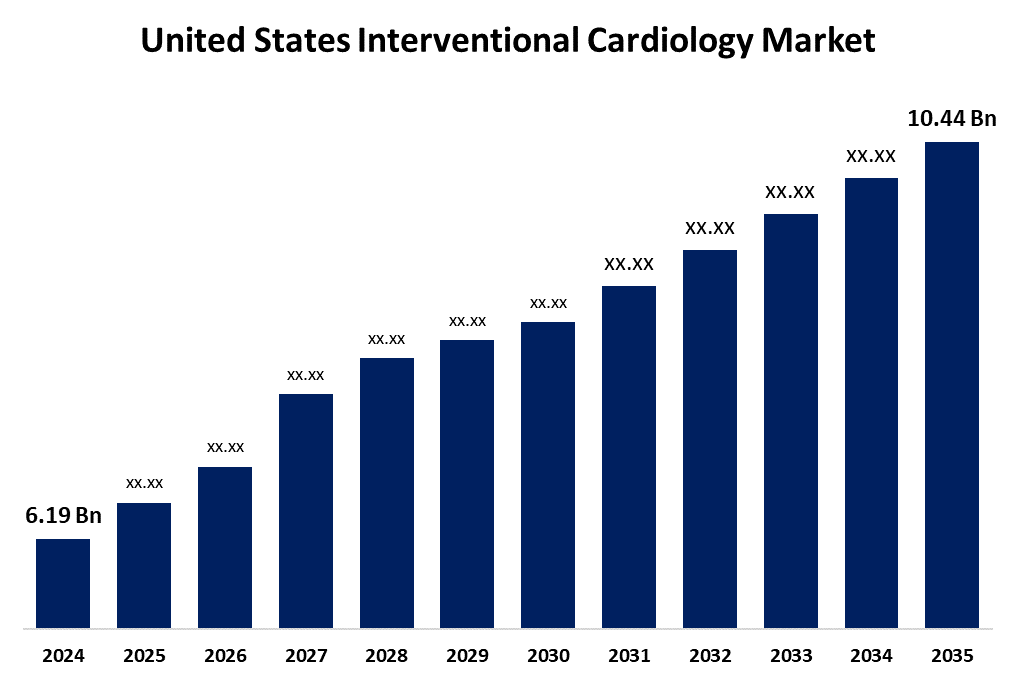

- The USA Interventional Cardiology Market Size was Estimated at USD 6.19 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.87% from 2025 to 2035

- The U.S. Interventional Cardiology Market Size is Expected to Reach USD 10.44 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Interventional Cardiology Market Size is anticipated to reach USD 10.44 Billion by 2035, Growing at a CAGR of 4.87% from 2025 to 2035. The USA interventional cardiology market is growing due to rising cardiovascular disease prevalence, an aging population, and increasing demand for minimally invasive procedures. Technological advancements in stents and imaging, supportive reimbursement policies, and growing awareness about early disease diagnosis further fuel market expansion. Additionally, expanding healthcare infrastructure and higher healthcare spending contribute to sustained market growth.

Market Overview

The United States interventional cardiology market refers to the segment of healthcare focused on minimally invasive procedures used to diagnose and treat cardiovascular diseases, particularly coronary artery disease, structural heart defects, and peripheral vascular conditions. These procedures, including angioplasty and stent placement, are performed using catheters and imaging technologies, offering faster recovery and reduced risks compared to traditional surgeries. The market is driven by the rising prevalence of cardiovascular diseases, an aging population, and growing demand for less invasive treatment options. Technological advancements, such as drug-eluting stents, bioresorbable vascular scaffolds, and real-time imaging tools, have significantly improved procedural outcomes, boosting adoption rates. The U.S. market presents strengths including a robust healthcare infrastructure, the presence of leading medical device companies, and high patient awareness. Various opportunities lie in expanding outpatient settings like ambulatory surgical centers and office-based labs, which lower costs and increase accessibility. Government initiatives, including favourable reimbursement policies from the Centers for Medicare & Medicaid Services (CMS) and fast-track FDA approvals for innovative devices, further support market growth.

Report Coverage

This research report categorizes the market for the United States interventional cardiology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA interventional cardiology market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. interventional cardiology market.

United States Interventional Cardiology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.19 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.87% |

| 2035 Value Projection: | USD 10.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Procedure Type, and COVID-19 Impact Analysis |

| Companies covered:: | Merit Medical Systems, Edwards Lifesciences, Abbott Laboratories, Shockwave Medical, Boston Scientific, AngioDynamics, Cardinal Health, Cook Medical, Inari Medical, Medtronic, Penumbra, Abiomed, Teleflex, BD, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing prevalence of cardiovascular diseases such as coronary artery disease and heart failure, particularly among the aging population. The increasing demand for minimally invasive procedures, which offer shorter hospital stays and quicker recovery, is accelerating market growth. Advancements in medical technologies, such as drug-eluting stents, robotic-assisted systems, and advanced imaging tools are enhancing the precision and safety of interventions. Rising healthcare expenditures and improved access to healthcare services also contribute significantly. Furthermore, the shift toward outpatient care in settings like ambulatory surgical centers and office-based labs supports cost-effective delivery. Supportive reimbursement policies and faster regulatory approvals from agencies like the FDA further encourage the adoption of innovative interventional cardiology solutions.

Restraining Factors

The high cost of advanced devices and procedures limits access for some patients and facilities. A shortage of skilled professionals trained in complex interventional techniques also hinders growth. Additionally, regulatory challenges and reimbursement limitations for certain procedures can slow the adoption of innovative technologies in clinical practice.

Market Segmentation

The United States interventional cardiology market share is classified into product type and procedure type.

- The coronary stents segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA interventional cardiology market is segmented by product type into coronary stents, balloon catheters, guidewires, IVUS catheters, and others. Among these, the coronary stents segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their critical role in treating coronary artery disease. Stents are widely used to restore blood flow and prevent artery re-narrowing after angioplasty. Their proven clinical effectiveness, technological advancements like drug-eluting variants, and broad adoption across cardiac procedures drive their leading market position.

- The coronary angioplasty segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. interventional cardiology market is segmented by procedure type into coronary angioplasty, coronary bypass surgery, peripheral angioplasty, and transcatheter aortic valve replacement. Among these, the coronary angioplasty segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its minimally invasive nature, high success rate, and widespread use in treating coronary artery disease. It is often preferred over surgical options for its shorter recovery time and lower complication risk. The rising prevalence of heart conditions further reinforces its leading position among procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States interventional cardiology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merit Medical Systems

- Edwards Lifesciences

- Abbott Laboratories

- Shockwave Medical

- Boston Scientific

- AngioDynamics

- Cardinal Health

- Cook Medical

- Inari Medical

- Medtronic

- Penumbra

- Abiomed

- Teleflex

- BD

- Others

Recent Developments:

- In April 2024, Teleflex announced the limited market release of the Wattson Temporary Pacing Guidewire. This innovative device combined pacing and catheter delivery in a single guidewire, designed to simplify structural heart procedures like TAVR and BAV. The launch marked a significant advancement in improving procedural efficiency and patient outcomes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. interventional cardiology market based on the below-mentioned segments:

United States Interventional Cardiology Market, By Product Type

- Coronary Stents

- Balloon Catheters

- Guidewires

- IVUS Catheters

- Others

United States Interventional Cardiology Market, By Procedure Type

- Coronary Angioplasty

- Coronary Bypass Surgery

- Peripheral Angioplasty

- Transcatheter Aortic Valve Replacement

Need help to buy this report?