United States Internal Combustion Engine Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Gasoline, Diesel, Natural Gas, and Liquefied Petroleum Gas), By Engine Type (In-Line, V-Type, W-Type, and Radial), and United States Internal Combustion Engine Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited States Internal Combustion Engine Market Insights Forecasts to 2035

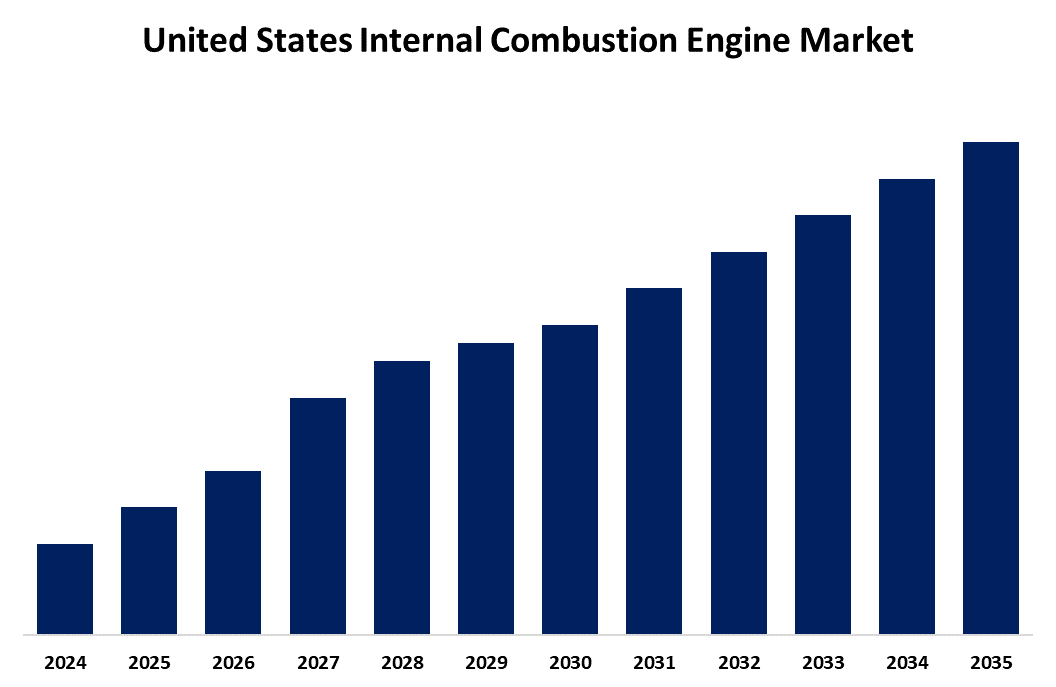

- The USA Internal Combustion Engine Market Size is Expected to Grow at a CAGR of around 8.5% from 2025 to 2035.

- The United States Internal Combustion Engine Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. Combustion Engine Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 8.5% from 2025 to 2035. The U.S. internal combustion engine market grows due to ongoing demand for efficient, durable powertrains in commercial and industrial sectors. Advances in fuel efficiency and emission control technologies meet regulatory standards, while hybrid and alternative fuel engines create new opportunities. Government policies promoting cleaner engines further drive innovation and market expansion despite rising EV adoption.

Market Overview

The United States internal combustion engine (ICE) market defines the production and application of engines that convert fuel into mechanical energy through combustion. These engines power a wide range of vehicles and industrial machinery, including automobiles, trucks, construction equipment, and agricultural machinery. The market is driven by sustained demand for efficient and reliable powertrains, especially in heavy-duty and commercial vehicles, despite the gradual shift towards electric vehicles (EVs). Key drivers include technological advancements enhancing fuel efficiency and emission reductions, alongside stringent regulatory standards set by the Environmental Protection Agency (EPA) to limit harmful emissions. Strengths of the U.S. ICE market lie in its robust manufacturing infrastructure, strong research and development capabilities, and the presence of established automotive and engine manufacturers. Opportunities exist in developing hybrid powertrains that integrate ICE with electric motors, and in improving engine designs for alternative fuels like natural gas and biofuels. Government initiatives such as fuel economy standards and emission reduction programs encourage innovation and cleaner ICE technologies, supporting market resilience amid the evolving automotive landscape.

Report Coverage

This research report categorizes the market for the United States internal combustion engine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' internal combustion engine market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States internal combustion engine market.

United States Internal Combustion Engine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Fuel Type, By Engine Type, and COVID-19 Impact Analysis |

| Companies covered:: | Cummins Inc., Caterpillar Inc., General Motors, Ford Motor Company, Briggs & Stratton Corporation, Kohler Co., John Deere, Navistar International Corporation, Harley-Davidson, Inc., PACCAR Inc., Oshkosh Corporation, Detroit Diesel Corporation, Polaris Inc., Textron Inc., AM General LLC, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The demand for reliable and powerful engines in commercial vehicles, construction equipment, and agricultural machinery fuels market growth. Technological advancements have significantly improved fuel efficiency and reduced emissions, helping manufacturers comply with stringent EPA regulations and meet consumer expectations. The integration of alternative fuels such as natural gas, biofuels, and hydrogen has further expanded the market by offering cleaner combustion options. Additionally, hybrid powertrain development, combining internal combustion engines with electric motors, provides enhanced performance and reduced environmental impact. Government incentives and policies focused on emission reduction and energy efficiency encourage innovation and adoption of advanced ICE technologies. These factors collectively sustain market growth despite the gradual rise of electric vehicles.

Restraining Factors

The increasing adoption of electric vehicles reduces the demand for traditional engines, and strict emission regulations raise production costs and require costly technological upgrades. Additionally, fluctuating fuel prices and growing environmental concerns discourage reliance on fossil fuel-based engines, limiting long-term market growth potential.

Market Segmentation

The United States internal combustion engine market share is classified into fuel type and engine type.

- The gasoline segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States internal combustion engine market is segmented by fuel type into gasoline, diesel, natural gas, and liquefied petroleum gas. Among these, the gasoline segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use in passenger vehicles, which dominate the country’s transportation landscape. Gasoline engines are generally more affordable, have lower emissions than diesel, and offer smoother operation, making them a preferred choice for everyday consumers. Additionally, a well-established refuelling infrastructure and ongoing advancements in fuel efficiency further support the dominance of gasoline-powered internal combustion engines across various vehicle categories.

- The V-type segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States internal combustion engine market is segmented by engine type into in-line, V-type, W-type, and radial. Among these, the V-type segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its compact design and ability to deliver high power output, making it ideal for performance-oriented and heavy-duty applications. V-type engines offer better balance, smoother operation, and greater efficiency in packaging within limited engine bays, especially in sports cars, SUVs, and trucks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States internal combustion engine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cummins Inc.

- Caterpillar Inc.

- General Motors

- Ford Motor Company

- Briggs & Stratton Corporation

- Kohler Co.

- John Deere

- Navistar International Corporation

- Harley-Davidson, Inc.

- PACCAR Inc.

- Oshkosh Corporation

- Detroit Diesel Corporation

- Polaris Inc.

- Textron Inc.

- AM General LLC

- Others

Recent Developments:

- In October 2022, Briggs & Stratton Commercial Power launched new products at Bauma, introducing advanced commercial engines focused on enhanced performance, durability, and compliance with stricter emissions standards. These new engines targeted construction and industrial equipment markets, emphasizing improved fuel efficiency and reliability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. internal combustion engine market based on the below-mentioned segments:

United States Internal Combustion Engine Market, By Fuel Type

- Gasoline

- Diesel

- Natural Gas

- Liquefied Petroleum Gas

United States Internal Combustion Engine Market, By Engine Type

- In-Line

- V-Type

- W-Type

- Radial

Need help to buy this report?