United States Integral Drill Steels Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Integral Drill Steels and Heavy-Duty Integral Drill Steels), By Material Type (High-Carbon Steel and Alloy Steel), and United States Integral Drill Steels Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Integral Drill Steels Market Insights Forecasts to 2035

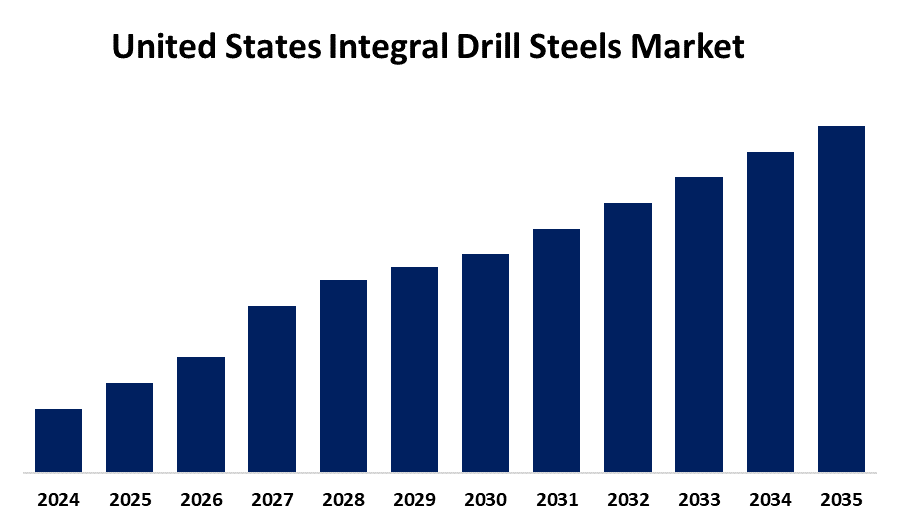

- The USA Integral Drill Steels Market Size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035.

- The United States Integral Drill Steels Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. integral drill steels market is expected to hold a significant share by 2035, growing at a CAGR of 5.4% from 2025 to 2035. The U.S. integral drill steels market grows due to increased infrastructure and mining activities demanding efficient drilling tools. Advances in metallurgy enhance steel durability and performance, driving adoption. Rising focus on cost reduction and precision drilling, combined with ongoing R&D for lightweight, corrosion-resistant materials, further fuels market expansion across construction, mining, and energy sectors.

Market Overview

The United States' integral drill steels market refers to the industry supplying drill rods with integrated bits, commonly used in mining, construction, tunnelling, and quarrying. These tools are essential for achieving deeper and more efficient drilling operations, especially in hard rock conditions. Market growth is driven by the expansion of infrastructure development, increased mining activity, and a surge in demand for high-performance, durable drilling equipment. The primary strengths of integral drill steels include reduced energy consumption, faster drilling rates, and greater accuracy, making them ideal for both large-scale industrial applications and smaller construction projects. Opportunities lie in further innovation, particularly in developing lightweight, corrosion-resistant, and wear-resistant materials to meet evolving operational demands. Additionally, automation in drilling processes and the use of smart technologies in equipment monitoring present growth prospects. U.S. government initiatives specific to integral drill steels, broader support for mining, energy, and infrastructure sectors, through funding and policy, indirectly boost demand, making the market promising in the coming years.

Report Coverage

This research report categorizes the market for the United States' integral drill steels market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' integral drill steels market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States' integral drill steels market.

United States Integral Drill Steels Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By Material Type and COVID-19 Impact Analysis |

| Companies covered:: | Precision Kidd Steel Company, Inc., Hudson Tool Steel Corporation, O’Hare Precision Metals, LLC, Drill Rod & Tool Steels Inc., MSC Industrial Supply Co., Imperial Carbide, Inc., Freedom Metals, Inc., S & S Fasteners, Inc., Kennametal Inc., 6G Tools LLC, Boone Steel, G.L. Huyett, Diehl Steel, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing infrastructure development projects, including highways, tunnels, and urban construction, increase the demand for efficient drilling solutions. Expanding mining activities, especially in minerals and energy sectors, require durable and high-performance drill steels to enhance operational efficiency. Technological advancements in metallurgy, heat treatment, and manufacturing processes improve the strength, wear resistance, and lifespan of integral drill steels, attracting widespread adoption. Additionally, rising focus on reducing operational costs and energy consumption encourages the use of more efficient drilling tools. The growing need for precision drilling in challenging geological conditions also fuels market growth. Furthermore, increasing investments in research and development to innovate lighter and more corrosion-resistant drill steels offer new opportunities, supporting overall market expansion in the U.S.

Restraining Factors

The high manufacturing and maintenance costs can limit adoption, especially among smaller contractors. Supply chain disruptions and raw material price volatility also impact production. Additionally, the specialized nature of integral drill steels requires skilled labor and advanced equipment, posing challenges for widespread implementation and scalability.

Market Segmentation

The United States' integral drill steels market share is classified into product type and material type.

- The standard integral drill steels segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States' integral drill steels market is segmented by product type into standard integral drill steels and heavy-duty integral drill steels. Among these, the standard integral drill steels segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its versatility and cost-effectiveness. Widely used in mining, construction, and quarrying, these steels efficiently handle common drilling tasks like blast hole and exploratory drilling. Their broad applicability and availability make them the preferred choice for most drilling operations across industries.

- The high-carbon steels segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States' integral drill steels market is segmented by material type into high-carbon steel and alloy steel. Among these, the high-carbon steel segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its excellent hardness, strength, and affordability. It provides reliable performance in general drilling applications and is widely preferred for its cost-effectiveness. These qualities make high-carbon steel the most popular choice for manufacturing integral drill steels across various industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States' integral drill steels market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Precision Kidd Steel Company, Inc.

- Hudson Tool Steel Corporation

- O’Hare Precision Metals, LLC

- Drill Rod & Tool Steels Inc.

- MSC Industrial Supply Co.

- Imperial Carbide, Inc.

- Freedom Metals, Inc.

- S & S Fasteners, Inc.

- Kennametal Inc.

- 6G Tools LLC

- Boone Steel

- G.L. Huyett

- Diehl Steel

- Others

Recent Developments:

- In September 2024, Kennametal Inc. announced the expansion of its comprehensive product line of tooling and wear protection solutions for mining applications. The new additions included picks to meet diverse customer demands as well as an innovative round drill steel system designed to improve efficiency and safety.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA integral drill steels market based on the below-mentioned segments:

United States Integral Drill Steels Market, By Product Type

- Standard Integral Drill Steels

- Heavy-Duty Integral Drill Steels

United States Integral Drill Steels Market, By Material Type

- High-Carbon Steel

- Alloy Steel

Need help to buy this report?