United States Insulin Market Size, Share, and COVID-19 Impact Analysis, By Product (Rapid-Acting Insulin, Long-Acting Insulin, Combination Insulin, Biosimilar, and Others), By Application (Type 1 Diabetes Mellitus and Type 2 Diabetes Mellitus), and United States Insulin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Insulin Market Size Insights Forecasts to 2035

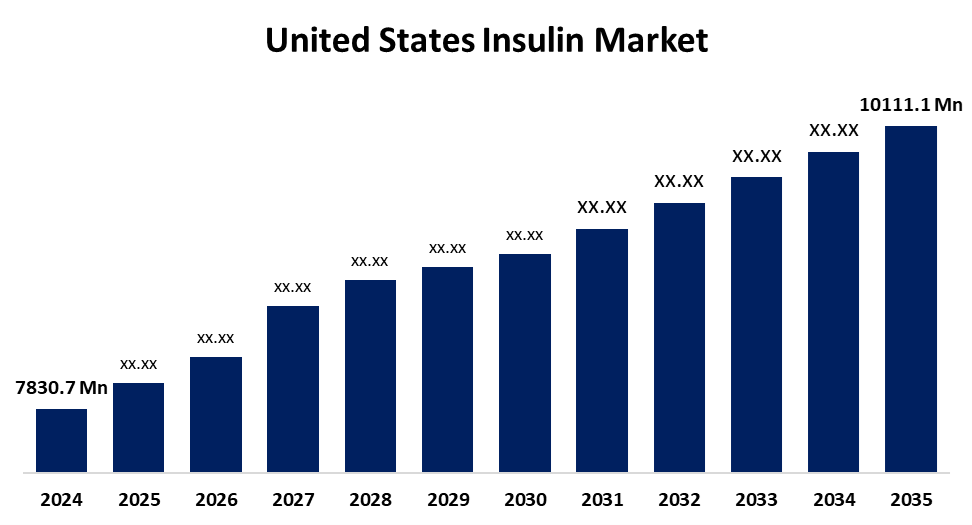

- The US Insulin Market Size Was Estimated at USD 7830.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.35% from 2025 to 2035

- The US Insulin Market Size is Expected to Reach USD 10111.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Insulin Market Size is anticipated to reach USD 10111.1 million by 2035, growing at a CAGR of 2.35% from 2025 to 2035. The expansion of the United States insulin market is propelled by long-acting and rapid-acting formulations, which are advances in medicine that improve patient adherence and treatment alternatives.

Market Overview

Insulin is a peptide hormone produced by the beta cells of the pancreas, specifically those in the islets of Langerhans. The rise in diabetes cases, elevated R&D investments, and the presence of a few large pharmaceutical companies operating in the country are combining to promote growth and development in the market. The rapidly expanding aging demographic, the increase in diabetes awareness, and rising obesity levels are further augmenting market demand. Obesity elevates the risk of type 2 diabetes, worsens insulin resistance, and affects blood glucose management. Approximately two out of five US adults have obesity, according to the Centers for Disease Control and Prevention. As the percentage of obese US individuals continues to rise, demand for effective diabetes management will continue to rise in the USA, creating an enormous amount of opportunity for the industry. Multi-sector coalitions between pharmaceutical, biotechnology companies, and healthcare systems are fast-tracking insulin creation and distribution across the country by sharing resources, expertise, and production capacity. These coalitions also provide access to new insulin and other products from pharmaceutical collaborators to ensure their ability to attend to patient needs and expand their market outreach.

Report Coverage

This research report categorizes the market for the United States insulin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States insulin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States insulin market.

United States Insulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7830.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.35% |

| 2035 Value Projection: | USD 10111.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Eli Lilly and Co, Novo Nordisk, Sanofi, MannKind Corporation, Nektar Therapeutics, Biocon Ltd, Wockhardt, Boehringer Ingelheim International GmbH, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States insulin market is boosted because it is combined with digital technologies that are changing diabetes care for patients so that they can lead ordinary lives. Patients can now better monitor and manage their blood sugar levels due to insulin pumps, continuous glucose monitors, and smart insulin pens. Using smartphone apps, these advanced devices provide real-time data sharing and decision support tools that promote better patient outcomes and adherence. Manufacturers of medical devices are also increasing their development of new products and technology to enhance comfort for patients and ensure compliance. One of the first systems that incorporates meal detection technology is the MiniMed 780G system with Guardian 4 sensor, which was authorized by the US Food and Drug Administration (FDA) in April 2023.

Restraining Factors

The United States insulin market faces obstacles like patient adherence, repeated and appropriate use of recommended insulin regimens. Non-compliance with treatment plans may result in complications, poor glycaemic control, and increased medical costs.

Market Segmentation

The United States insulin market share is classified into product and application.

- The long-acting insulin segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States insulin market is segmented by product into rapid-acting insulin, long-acting insulin, combination insulin, biosimilar, and others. Among these, the long-acting insulin segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is important to the management of diabetes. These products provide consistently long-term and reliable glucose control by reducing the risk of hypoglycemia and increasing patient adherence. The demand for long-acting formulations of insulin is largely attributed to the increasing incidence of type 2 diabetes and the growing need for simple dosing schedules.

- The type 1 diabetes mellitus segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States Insulin market is segmented into type 1 diabetes mellitus and type 2 diabetes mellitus. Among these, the type 1 diabetes mellitus segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the growing incidence of this autoimmune disease in adults and children alike. The need for other insulin formulations, such as long-acting, combination, and rapid-acting insulins, will only increase because type 1 diabetes necessitates lifelong therapy to maintain blood glucose control. The growth of this market is also being fueled by advancements in delivery systems, such as replacement pumps and pens.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States insulin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eli Lilly and Co

- Novo Nordisk

- Sanofi

- MannKind Corporation

- Nektar Therapeutics

- Biocon Ltd

- Wockhardt

- Boehringer Ingelheim International GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States insulin market based on the following segments:

United States Insulin Market, By Product

- Rapid-Acting Insulin

- Long-Acting Insulin

- Combination Insulin

- Biosimilar

- Others

United States Insulin Market, By Application

- Type 1 Diabetes Mellitus

- Type 2 Diabetes Mellitus

Need help to buy this report?