United States Insulin Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Insulin Pumps, Insulin Pens, Insulin Jet Injectors, Insulin Syringes, and Others), By Application (Type I Diabetes and Type II Diabetes), By Distribution Channel (Online Sales, Hospital Pharmacies, Retail Pharmacies, and Other), and United States Insulin Delivery Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Insulin Delivery Devices Market Insights Forecasts to 2033

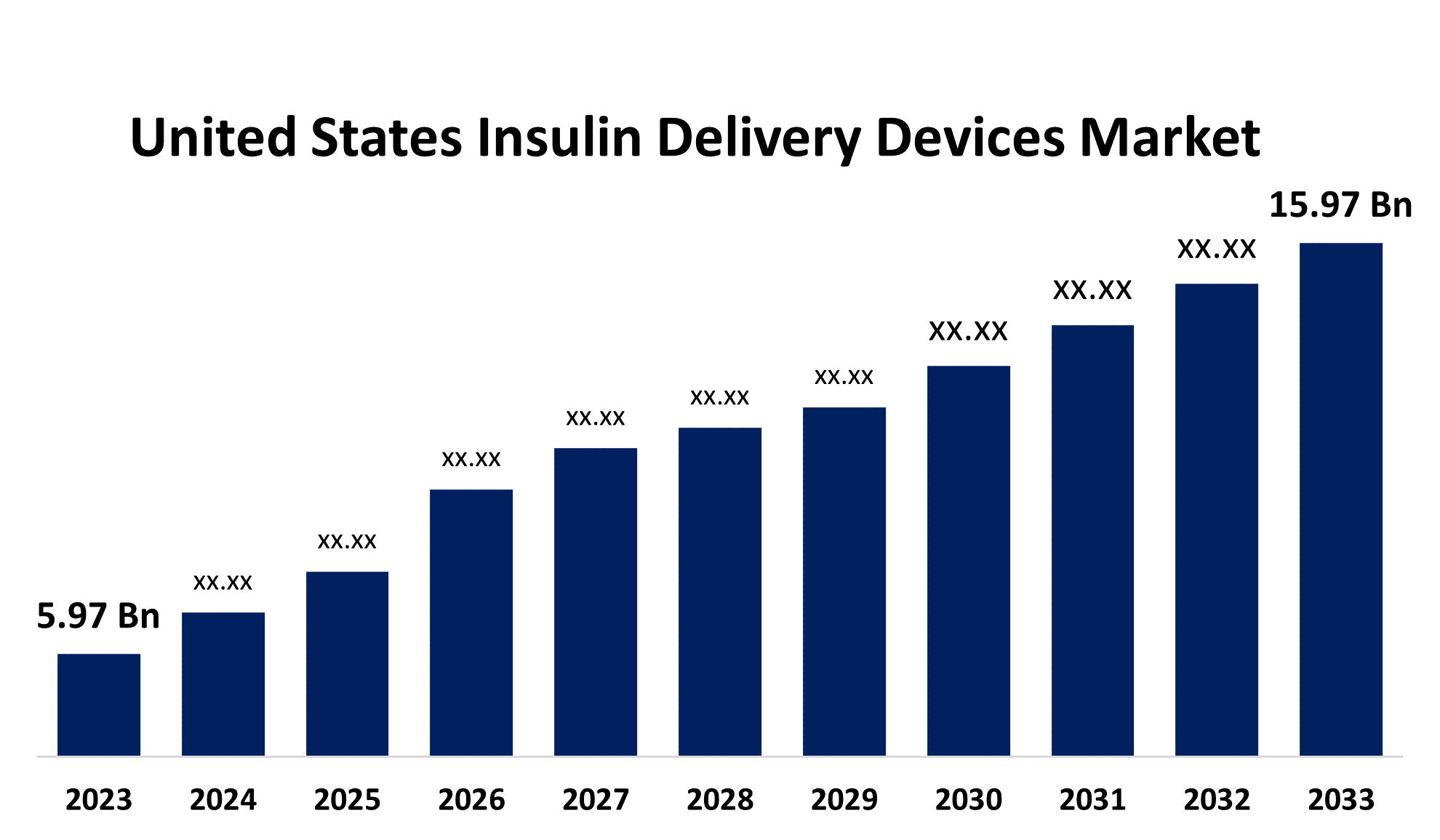

- The US Insulin Delivery Devices Market Size was valued at USD 5.97 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.34% from 2023 to 2033

- The U.S. Insulin Delivery Devices Market Size is Wxpected to Reach USD 15.97 Billion by 2033

Get more details on this report -

The United States Insulin Delivery Devices Market is anticipated to exceed USD 15.97 Billion by 2033, growing at a CAGR of 10.34% from 2023 to 2033.

Market Overview

Medical equipment with FDA approval that helps patients with type 1 and type 2 diabetes administer insulin is known as an insulin delivery system. These devices allow for the subcutaneous, transdermal, and other methods of insulin administration. There are numerous methods for giving a patient insulin. It is a hormone that aids in controlling diabetic patients' blood sugar levels. There are several ways to give this hormone: pens, pumps, jet sprays, and syringes. One major driver of the market's expansion is the rising incidence of diabetes. Insulin administration systems have undergone a substantial transformation due to technological advancements in diabetes management. Traditional injections have given way to more sophisticated, minimally intrusive approaches. Initially, blood glucose levels were difficult to maintain when insulin was administered. But the introduction of insulin pens simplified self-administering and lessened discomfort. The invention of insulin pumps made it possible to continuously infuse insulin, which enhanced glucose regulation. The development of continuous glucose monitoring (CGM) devices, which offer real-time glucose data necessary for well-informed decision-making, was a noteworthy advancement. This paved the way for the development of the artificial pancreas system (APS), which replicates the actions of the normal pancreas by combining CGM data with an insulin pump for automatic delivery.

Report Coverage

This research report categorizes the market for the United States insulin delivery devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US insulin delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US insulin delivery devices market.

United States Insulin Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.34% |

| 2033 Value Projection: | USD 15.97 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By Distribution Channel |

| Companies covered:: | Insulet Corporation, Tandem Diabetes Care, Abbott Laboratories, Animas Corporation, B. Braun Medical Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market's explosive growth is mainly due to the increasing prevalence of diabetes and escalating healthcare expenses. Additionally, the demand for these advanced insulin delivery devices and equipment is growing due to their increased acceptance. Significant research and development efforts in producing different insulin delivery devices are fueling the growth of the US insulin delivery devices market. The growth of the market in the U.S. is also fueled by a rise in the population of individuals with diabetes and the accessibility of advanced technological devices. The market for insulin delivery devices has been significantly influenced by the rising incidence of diabetes in the US. The need for insulin and related delivery systems rises in tandem with the number of persons receiving diabetes diagnoses. Continuous technological developments in insulin delivery devices have been a major factor in the market's expansion.

Restraining Factors

The use of insulin delivery devices may be constrained by the high out-of-pocket costs related to managing and treating diabetes. Despite massive government spending, there is still an issue with the high cost of insulin.

Market Segmentation

The United States insulin delivery devices market share is classified into product type, application, and distribution channel.

- The insulin pens segment is expected to hold the largest market share through the forecast period.

The United States insulin delivery devices market is segmented by product type into insulin pumps, insulin pens, insulin jet injectors, insulin syringes, and others. Among them, the insulin pens segment is expected to hold the largest market share through the forecast period. The insulin pen market is anticipated to grow significantly due to consumer desire for the product, technical advancements, and the various benefits that pens provide at an affordable price. Insulin pens have been shown to have considerable advantages over syringes in numerous clinical trials. Improved accuracy, usefulness, increases in quality of life, patient satisfaction, and adherence are some of these clinical benefits.

- The type I segment dominates the market with the largest market share over the predicted period.

The United States insulin delivery devices market is segmented by application into type I diabetes and type II diabetes. Among them, the type I segment dominates the market with the largest market share over the predicted period. The increased prevalence of type 1 diabetes mellitus would be beneficial for the market's growth. Because their bodies are unable to produce insulin, patients with type 1 diabetes require strict insulin therapy in order to survive. In order for muscle and fat cells to use blood glucose as fuel, insulin helps to deliver it there.

- The online sales segment dominates the market with the largest market share over the predicted period.

The United States insulin delivery devices market is segmented by distribution channel into online sales, hospital pharmacies, retail pharmacies and other. Among them, the online sales segment dominates the market with the largest market share over the predicted period. The simplicity of purchasing insulin delivery devices and other products online has increased with the emergence of e-commerce and new technologies, which allow clients to buy these items without physically visiting a store or clinic.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States insulin delivery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Insulet Corporation

- Tandem Diabetes Care

- Abbott Laboratories

- Animas Corporation

- B. Braun Medical Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2021, Tandem Diabetes has announced plans to introduce multiple new products by the end of 2027, with the goal of tripling its current clientele. Over the next five years, the company anticipates that its patient base will grow by one Billion due to the rising number of persons with type 1 diabetes.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Insulin Delivery Devices Market based on the below-mentioned segments:

United States Insulin Delivery Devices Market, By Product Type

- Insulin Pumps

- Insulin Pens

- Insulin Jet Injectors

- Insulin Syringes

- Others

United States Insulin Delivery Devices Market, By Application

- Type I Diabetes

- Type II Diabetes

United States Insulin Delivery Devices Market, By Distribution Channel

- Online Sales

- Hospital Pharmacies

- Retail Pharmacies

- Other

Need help to buy this report?