United States Industrial Machinery Repair/Aftermarket Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Repair Type and Service Type), By End-use Industry (Automotive, Food & Beverage, Healthcare, Oil & Gas, and Others), and United States Industrial Machinery Repair/Aftermarket Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Industrial Machinery Repair/Aftermarket Services Market Insights Forecasts to 2035

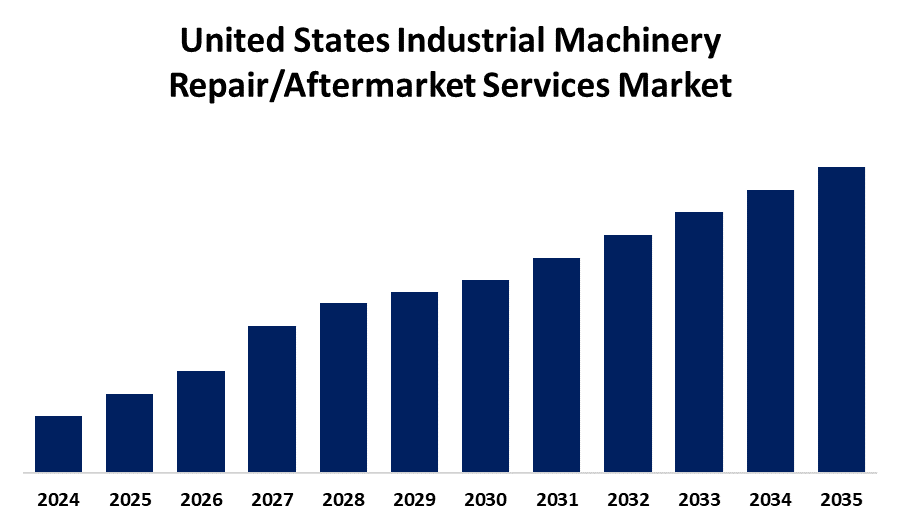

- The United States Industrial Machinery Repair/Aftermarket Services Market Size is Expected to Grow at a CAGR of around 6.3% from 2025 to 2035.

- The U.S. Industrial Machinery Repair/Aftermarket Services Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Industrial Machinery Repair/Aftermarket Services Market is expected to hold a significant share by 2035, growing at a CAGR of 6.3% from 2025 to 2035. The market is experiencing growth due to aging equipment across industries necessitates regular maintenance and part replacements. Technological advancements and IoT-based monitoring enhance service effectiveness and reduce unplanned failures. Additionally, the growing emphasis on sustainability encourages refurbishment over full equipment replacement.

Market Overview

The U.S. industrial machinery repair and aftermarket services market defines the repair, replacement, and maintenance of machinery components to improve equipment lifespan and provide continuous industrial performance. It is fueled by the aging fleet of machinery, mounting operational complexity, and the necessity to reduce costly downtime. Major market strengths are a large industrial base, technological skills, and uptake of sophisticated technologies like predictive maintenance and IoT-based diagnostics. These technologies increase service accuracy and lower failure rates, increasing demand for advanced aftermarket solutions. There are opportunities in industries such as manufacturing, energy, and construction, where intense machinery usage requires frequent maintenance. Moreover, the wave of circular economy supports refurbishment instead of replacement, which further fuels the aftermarket market. Government programs, including manufacturing support initiatives, infrastructure investment, and workforce development grants, also drive the market.

Report Coverage

This research report categorizes the market for the United States industrial machinery repair/aftermarket services market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States industrial machinery repair/aftermarket services market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States industrial machinery repair/aftermarket services market.

United States Industrial Machinery Repair/Aftermarket Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By End-use Industry and COVID-19 Impact Analysis |

| Companies covered:: | ABB, ACRA Machinery, Astro Machine Works, Caterpillar, ATS Advanced Technology Services, Inc., Exline, Inc., Indufit Machine Industrial Projects Company, Kiefer Tool and Mold, Inc., TAVENGINEERING, L&H Industrial, CNH Industrial NV, Linde AG, Pamco Machine Ltd., Deere & Company, Lee Industries., and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The United States industrial machinery repair and aftermarket services market is driven by a few major factors. Established assets across various sectors like manufacturing, energy, and transport lead to the requirement of routine servicing and replacement of parts. Growing demand for operational efficiency and minimal downtime also supports increasing dependence on repair. Innovations such as predictive maintenance and IoT-enabled monitoring improve service and drive down unscheduled failures. Furthermore, increasing focus on sustainability promotes refurbishment rather than complete equipment replacement. Government incentives via infrastructure spending and worker training initiatives also deepen market expansion by enhancing industrial resilience and enabling skilled workforce availability.

Restraining Factors

In the market of United States industrial machinery repair/aftermarket services, the major challenge is the lack of competent technicians, further compounded by an aging population and a lack of training courses, resulting in higher labor expenses and delayed service. Also affecting demand are high expenses related to sophisticated diagnostic equipment and specialized tools, as well as economic instability, where businesses might postpone maintenance in times of economic decline, where service providers' income would be reduced.

Market Segmentation

The United States industrial machinery repair/aftermarket services market share is classified into type and end-use industry.

- The repair type segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial machinery repair/aftermarket services market is segmented by type into repair type and service type. Among these, the repair type segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of cost-effectiveness, operating efficiency, and the increasing complexity of industrial equipment. Repair services are a less costly alternative to the replacement of the entire machine, and they also enable businesses to stay at an optimal level and reduce downtime.

- The oil & gas segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial machinery repair/aftermarket services market is segmented by end-use industry into automotive, food & beverage, healthcare, oil & gas, and others. Among these, the oil & gas segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of oil and gas is primarily attributed to its substantial reliance on industrial services for operational efficiency, safety, and regulatory compliance, as well as the complexity and scale of its operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial machinery repair/aftermarket services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- ACRA Machinery

- Astro Machine Works

- Caterpillar

- ATS Advanced Technology Services, Inc.

- Exline, Inc.

- Indufit Machine Industrial Projects Company

- Kiefer Tool and Mold, Inc.

- TAVENGINEERING

- L&H Industrial

- CNH Industrial NV

- Linde AG

- Pamco Machine Ltd.

- Deere & Company

- Lee Industries.

- Others

Recent Developments:

- In April 2023, ABB accelerated its growth strategy in the United States by investing approximately $170 million and creating highly skilled jobs in manufacturing, innovation, and distribution operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States industrial machinery repair/aftermarket services market based on the below-mentioned segments:

USA Industrial Machinery Repair/Aftermarket Services Market, By Type

- Repair Type

- Service Type

USA Industrial Machinery Repair/Aftermarket Services Market, By End-use Industry

- Automotive

- Food & Beverage

- Healthcare

- Oil & Gas

- Others

Need help to buy this report?