United States Industrial Fasteners Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Metal, Plastic), By Product (Externally Threaded Fasteners, Internally Threaded Fasteners, Non-threaded Fasteners, Aerospace Grade Fasteners), By Application (Automotive, Aerospace, Building and construction, Industrial Machinery, Home appliances, Lawns and Gardens, Motors & Pumps, Furniture, Plumbing Products, Others), and United States Industrial Fasteners Market Insights Forecasts to 2033

Industry: Advanced MaterialsUnited States Industrial Fasteners Market Insights Forecasts to 2033

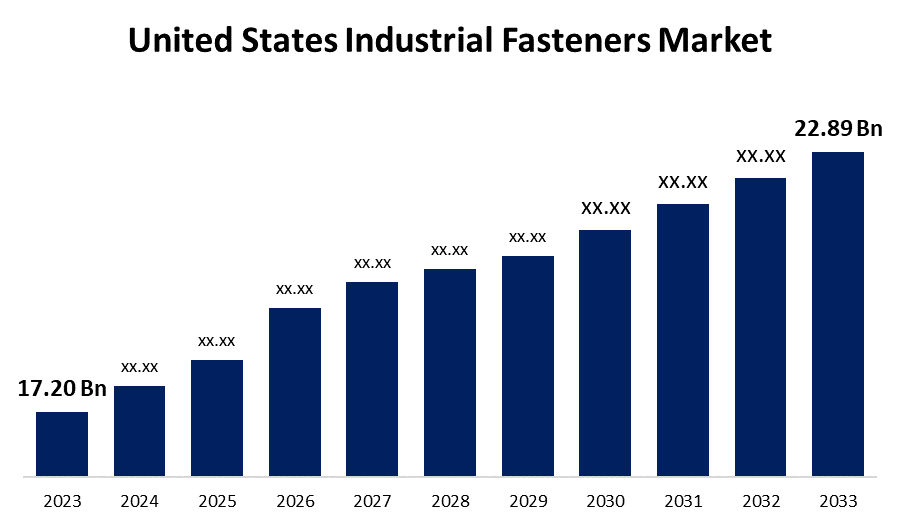

- The United States Industrial Fasteners Market Size was valued at USD 17.20 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.9% from 2023 to 2033.

- The United States Industrial Fasteners Market Size is Expected to Reach USD 22.89 Billion by 2033.

Get more details on this report -

The United States Industrial Fasteners Market Size is expected to reach USD 22.89 Billion by 2033, at a CAGR of 2.9% during the forecast period 2023 to 2033.

Market Overview

Fasteners are stainless steel components used in a variety of industries to join, fix, or connect two or more objects. They are commonly made of stainless steel, alloy steel, and carbon steel. They are covered with corrosion-resistant paint or coating. Industrial fasteners encompass a diverse range of high-quality fastening products used primarily in the construction, automotive, aerospace, and marine industries. These fasteners can withstand a variety of weather and chemical elements because they are designed for long-term industrial use. As a result, these products are widely used in growing industries that require high-quality fasteners to withstand corrosion and natural abrasion. Carbon fiber and alloy are the most popular materials for producing corrosion-resistant, lightweight, and superconducting industrial fasteners for heavy-duty applications. Hybrid fasteners made from injection-molded plastics and metals are lighter, easier to install, and cheaper. Bolts, nuts, screws, rivets, nails, washers, and studs are some of the most popular industrial fasteners.

Report Coverage

This research report categorizes the market for the United States industrial fasteners market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States industrial fasteners market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States industrial fasteners market.

United States Industrial Fasteners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.20 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.9% |

| 2033 Value Projection: | USD 22.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Raw Material, By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Arconic Fastening Systems and Rings Inc, Hilti Corporation, Illinois Tool Works, Inc, Acument Global Technologies, Inc, ATF, Inc, MW Industries, Inc, Birmingham Fastener and Supply, Inc, SESCO Industries, Inc, Elgin Fastener Group LLC, Slidematic Inc and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing demand for commercial and residential housing projects and U.S. government spending on infrastructure activities will contribute to the construction market growth. Industrial fasteners are used in the construction industry to temporarily join two or more objects together. Building and construction fasteners are used in heavy-duty applications to connect materials because the industry requires strength and precision. Furthermore, different types of fasteners used in the construction industry include stainless steel, alloy steel, and carbon steel. Also, common building construction products include nuts, bolts, washers, screws, and rivets. Each infrastructure project necessitates a different type of fastening product to ensure safe and sturdy construction. Moreover, carbon steel is used in the majority of products because it is inexpensive, strong, and easy to work with. Additionally, plastic fasteners are used in the building and construction industries due to their superior strength. Corrosion resistance properties will result in significant investment in new product development to meet demand. Increasing consumer interest in residential and commercial building aesthetics will drive U.S. industrial fasteners market growth in the interiors and cable management applications during the forecast period.

Restraining Factors

An increase in the use of metal fasteners for tapes, adhesives, and bonding applications may hamper industrial fasteners market growth. The emergence of alternatives such as welding and auto parts clinching has hampered the fastener market. Variations in automobile sales, combined with fluctuating economies, may pose a challenge to overall industry growth. Currently, most automotive fastening product manufacturers are facing numerous challenges. Also, manufacturers must adhere to certain specifications and restrictions because the manufacturing method is difficult.

Market Segment

- In 2023, the metal segment accounted for the largest revenue share over the forecast period.

Based on the raw material, the United States industrial fasteners market is segmented into metal and plastic. Among these, the metal segment has the largest revenue share over the forecast period. Metals are valued because of their inherent strength and durability. This makes them ideal for fastener applications that require reliable performance. Metal fasteners can withstand high levels of stress, vibration, and environmental factors when they are used to hold heavy machinery, construction structures, or automotive components together. The metal segment provides a diverse range of materials that can be customized for specific applications. Steel, stainless steel, aluminum, and various alloys are among the most commonly used metals for fasteners. Each of these materials has unique properties that can be tailored to meet the needs of various industries.

- In 2023, the externally threaded fasteners segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States industrial fasteners market is segmented into externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, aerospace grade fasteners. Among these, the externally threaded fasteners segment has the largest revenue share over the forecast period. Externally threaded fasteners include screws, bolts, and studs. These fasteners are versatile and can be used in a wide range of applications across industries. Their external threading allows for easy insertion into pre-drilled or pre-tapped holes, making them suitable for a variety of materials and structures. The externally threaded segment provides a diverse range of fasteners, each with unique characteristics and applications. This includes machine screws, wood screws, self-tapping screws, and a wide range of bolts with various head shapes and materials. This range enables fastener manufacturers to meet the specific requirements of various industries and applications.

- In 2023, the automotive segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States industrial fasteners market is segmented into automotive, aerospace, building and construction, industrial machinery, home appliances, lawns & gardens, motors & pumps, furniture, plumbing products, and others. Among these, the automotive segment has the largest revenue share over the forecast period. The auto industry is one of the largest manufacturing sectors in the United States. The sheer volume of vehicles produced each year creates a significant demand for fasteners. These vehicles require a large number of fasteners to assemble, secure various components, and ensure structural integrity. Automotive assembly necessitates a wide range of fasteners, from basic screws and nuts to highly specialized fasteners designed for critical components. Each vehicle's construction includes fasteners of varying size, material, and functionality to meet the specific needs of various parts, ranging from engines to interiors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial fasteners market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arconic Fastening Systems and Rings Inc

- Hilti Corporation

- Illinois Tool Works, Inc

- Acument Global Technologies, Inc

- ATF, Inc

- MW Industries, Inc

- Birmingham Fastener and Supply, Inc

- SESCO Industries, Inc

- Elgin Fastener Group LLC

- Slidematic Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, Acument has introduced a new line of lightweight fasteners for the auto industry. The new fasteners, made of aluminum and carbon fiber, are up to 50% lighter than conventional steel fasteners. This can help automakers reduce vehicle weight and increase fuel efficiency.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Industrial Fasteners Market based on the below-mentioned segments:

United States Industrial Fasteners Market, By Raw Material

- Metal

- Plastic

United States Industrial Fasteners Market, By Product

- Externally Threaded Fastener

- Internally Threaded Fasteners

- Non-threaded Fasteners

- Aerospace Grade Fasteners

United States Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building and construction

- Industrial Machiner

- Home appliances

- Lawns and Gardens

- Motors & Pumps

- Furniture, Plumbing Products

- Others

Need help to buy this report?