United States Industrial Diesel Turbocharger Market Size, Share, and COVID-19 Impact Analysis, By Application (Marine, Power Generation, Construction Equipment, Mining, and Agricultural Equipment), By Engine Type (Internal Combustion Engine, Diesel Engine, Natural Gas Engine, Dual Fuel Engine, and Heavy Fuel Engine), and United States Industrial Diesel Turbocharger Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Industrial Diesel Turbocharger Market Insights Forecasts to 2035

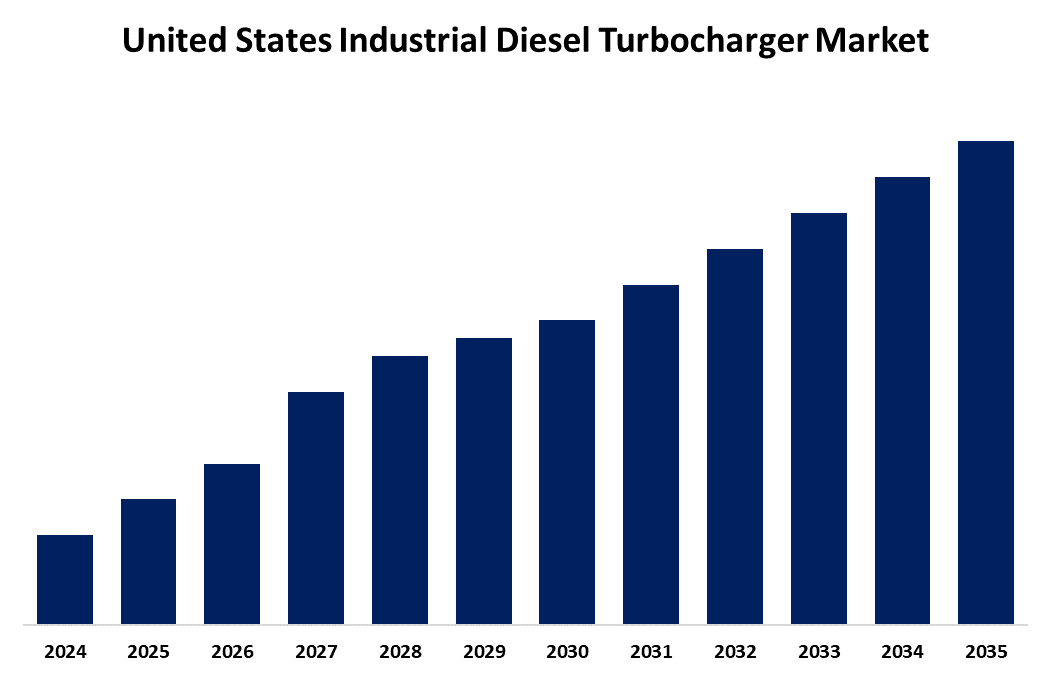

- The USA Industrial Diesel Turbocharger Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035.

- The United States Industrial Diesel Turbocharger Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. Industrial Diesel Turbocharger Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The U.S. industrial diesel turbocharger market grows due to rising demand for fuel-efficient, low-emission engines in industries like construction and power generation. Strict environmental regulations and advancements in turbocharger technology, such as variable geometry and electric turbochargers, enhance engine performance.

Market Overview

The United States industrial diesel turbocharger market refers to the design, production, and application of turbocharging systems that boost the performance and efficiency of diesel engines used across various industrial sectors such as power generation, construction, agriculture, and transportation. Turbochargers work by utilizing exhaust gases to compress incoming air, improving engine combustion, fuel efficiency, and reducing emissions. Market growth is driven by increasing demand for fuel-efficient and low-emission engines, along with stringent environmental regulations. Technological advancements like variable geometry and electric turbochargers further enhance engine performance, supporting market expansion. Strengths of the market include a strong manufacturing base, advanced R&D capabilities, and a skilled workforce within the U.S. Opportunities exist in integrating turbochargers with hybrid powertrains, developing durable materials, and expanding into emerging industrial sectors. Government initiatives such as the Diesel Emissions Reduction Act (DERA) and the Inflation Reduction Act (IRA) provide funding and incentives to promote cleaner diesel technologies, further accelerating market growth and innovation in the industrial diesel turbocharger sector.

Report Coverage

This research report categorizes the market for the United States industrial diesel turbocharger market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States industrial diesel turbocharger market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States industrial diesel turbocharger market.

United States Industrial Diesel Turbocharger Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Engine Type, and COVID-19 Impact Analysis |

| Companies covered:: | International Truck and Engine Corporation, Isuzu Commercial Truck of America, Inc., Navistar International Corporation, General Electric (GE) Gas Power, Gale Banks Engineering, Gale Banks Engineering, Stewart & Stevenson, Garrett Motion Inc., Mack Trucks, Inc., Elliott Company, Woodward, Inc., Stanadyne LLC, Caterpillar Inc., Cummins Inc., PACCAR Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing need for enhanced engine performance and fuel efficiency across various industrial applications, such as construction, agriculture, power generation, and stricter environmental regulations, including emission standards enforced by agencies like the Environmental Protection Agency (EPA), compel manufacturers to adopt advanced turbocharging technologies that reduce harmful emissions. Technological innovations, such as variable geometry turbochargers (VGT) and electric turbochargers, enable better engine control and efficiency, further propelling market growth. Additionally, the expanding industrial sector and infrastructure development in the U.S. increase demand for robust and efficient diesel engines. Government initiatives like the Diesel Emissions Reduction Act (DERA) provide funding and incentives to upgrade existing engines with cleaner technologies, accelerating the adoption of turbochargers. These factors collectively fuel steady growth in the market.

Restraining Factors

The high initial costs of advanced turbocharger systems, which may deter small-scale operators. Complex integration with existing engines and maintenance challenges can limit adoption. Additionally, the gradual shift toward electric and hybrid powertrains poses a long-term threat, potentially reducing reliance on diesel engine technologies.

Market Segmentation

The United States industrial diesel turbocharger market share is classified into application and engine type.

- The power generation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial diesel turbocharger market is segmented by application into marine, power generation, construction equipment, mining, and agricultural equipment. Among these, the non-ferrous segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the need for reliable and cost-effective power sources, especially in remote areas and for backup power applications. Additionally, the transition towards sustainable energy practices and renewable energy integration has heightened the emphasis on optimizing diesel engines for power generation, thereby boosting the demand for advanced turbocharging technologies.

- The press-and-sinter segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial diesel turbocharger market is segmented by engine type into internal combustion engine, diesel engine, natural gas engine, dual fuel engine, and heavy fuel engine. Among these, the press-and-sinter segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to diesel engines' high-power output, efficiency, and torque, making them ideal for heavy-duty applications such as power generation, construction, and mining. Additionally, diesel engines offer better fuel economy and durability compared to gasoline engines, further driving their preference in industrial settings. Technological advancements, including variable geometry turbochargers (VGTs), have enhanced diesel engine performance, making them more efficient and environmentally friendly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial diesel turbocharger market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- International Truck and Engine Corporation

- Isuzu Commercial Truck of America, Inc.

- Navistar International Corporation

- General Electric (GE) Gas Power

- Gale Banks Engineering

- Gale Banks Engineering

- Stewart & Stevenson

- Garrett Motion Inc.

- Mack Trucks, Inc.

- Elliott Company

- Woodward, Inc.

- Stanadyne LLC

- Caterpillar Inc.

- Cummins Inc.

- PACCAR Inc.

- Others

Recent Developments:

- In February 2024, Cummins Inc. launched its next-generation X15 diesel engine in 2024, marking a significant advancement in heavy-duty on-highway powertrains. As part of the Cummins HELM™ 15-liter fuel-agnostic platform, the X15 was designed to meet U.S. EPA and CARB 2027 emissions standards. It delivered up to 605 horsepower and 2,050 lb-ft of torque, offering improved fuel efficiency and reduced greenhouse gas emissions compared to its predecessor.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. industrial diesel turbocharger market based on the below-mentioned segments:

United States Industrial Diesel Turbocharger Market, By Application

- Marine

- Power Generation

- Construction Equipment

- Mining

- Agricultural Equipment

United States Industrial Diesel Turbocharger Market, By Engine Type

- Internal Combustion Engine

- Diesel Engine

- Natural Gas Engine

- Dual Fuel Engine

- Heavy Fuel Engine

Need help to buy this report?