United States Industrial Design Market Size, Share, and COVID-19 Impact Analysis, By Product (Automotive, Furniture, and Packaging), By Application (Transportation, Consumer Goods, and Medical Devices), By End User (Automotive, Electronics, Healthcare, and Aerospace), and United States Industrial Design Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Industrial Design Market Insights Forecasts to 2035

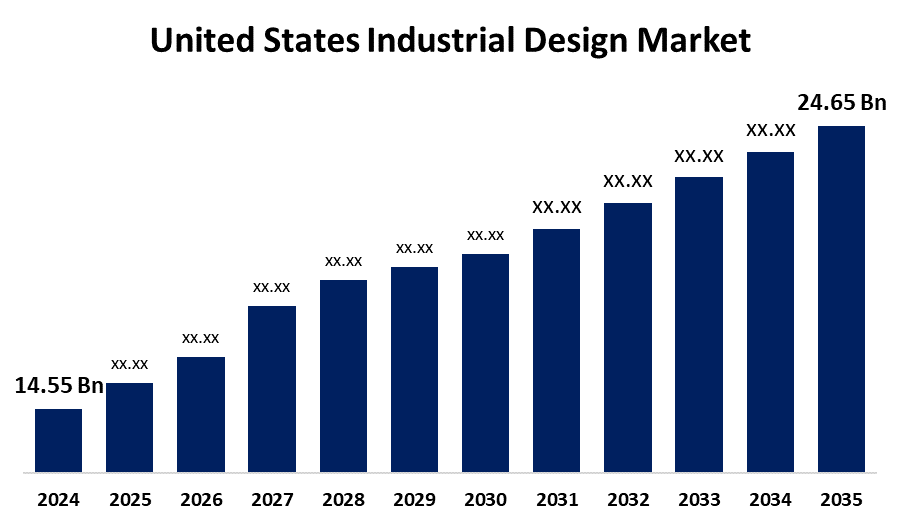

- The United States Industrial Design Market Size was Estimated at USD 14.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.91% from 2025 to 2035

- The United States Industrial Design Market Size is Expected to Reach USD 24.65 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Industrial Design Market Size is Anticipated to Reach USD 24.65 Billion by 2035, growing at a CAGR of 4.91% from 2025 to 2035. The U.S. industrial design Market Size is Growing due to rising demand for user-centric, innovative product designs across sectors like automotive, electronics, and healthcare. Technological advancements, increasing focus on aesthetics and functionality, and consumer preference for personalized experiences drive this growth. Additionally, strong R&D investments and design integration in product development further fuel market expansion.

Market Overview

The United States industrial design market defines the creation and development of products that combine functionality, aesthetics, and user experience across industries such as automotive, electronics, healthcare, and consumer goods. Industrial design enhances the visual appeal and usability of products, contributing significantly to brand identity and market competitiveness. Key market drivers include growing consumer demand for innovative and personalized products, rapid technological advancements, and the integration of design thinking in product development. The rise of electric vehicles, smart devices, and advanced medical equipment has further fueled the need for high-quality design solutions. Strengths of the U.S. market include a strong ecosystem of experienced design firms, skilled talent, and a culture of innovation. Opportunities are emerging through digital design tools, sustainability-focused design, and increased outsourcing of design services by manufacturers. Government initiatives that support intellectual property protection, innovation grants, and funding for design-centric start-ups further strengthen the market.

Report Coverage

This research report categorizes the market for the United States industrial design market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States industrial design market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States industrial design market.

United States Industrial Design Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.55 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.91% |

| 2035 Value Projection: | USD 24.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Application, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Ammunition Group, LUNAR Design, Astro Studios, Designworks/BMW Group, Smart Design, Frog Design, Pentagram, Continuum, Ziba Design, RKS Design, Fuseproject, Whipsaw, Method, Teague, IDEO and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for innovative, user-friendly, and aesthetically appealing products across industries such as automotive, healthcare, electronics, and consumer goods. As consumers seek more personalized and high-performing products, companies increasingly invest in design to differentiate themselves in a competitive market. Technological advancements, such as AI, 3D modelling, and virtual reality, have also streamlined the design process, enhancing creativity and efficiency. The growing importance of design in improving user experience and brand value further encourages businesses to prioritize industrial design. Additionally, the surge in demand for electric vehicles, smart devices, and sustainable product solutions continues to drive innovation, pushing the industrial design market forward in the United States.

Restraining Factors

The high development costs, strict regulatory standards, intense global competition, and rapid technological changes demand constant innovation, increasing pressure on design firms. Additionally, intellectual property concerns and shifting consumer preferences challenge market stability. These factors collectively hinder growth, especially for smaller players lacking the resources to adapt quickly and compete effectively.

Market Segmentation

The United States industrial design market share is classified into product, application and end user.

- The automotive segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States industrial design market is segmented by product into automotive, furniture, and packaging. Among these, the automotive segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This growth is due to its constant need for innovative, functional, and aesthetically appealing designs. The rise of electric and autonomous vehicles has increased demand for advanced design solutions that improve safety, efficiency, and user experience. Significant investments in automotive R&D further strengthen this segment’s market leadership.

- The transportation segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial design market is segmented by application into transportation, consumer goods, and medical devices. Among these, the transportation segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the sector’s constant demand for innovative, efficient, and ergonomic designs. Growing focus on electric and autonomous vehicles drives the need for advanced design solutions that enhance safety, functionality, and aesthetics. Additionally, heavy investment and technological advancements in transportation fuel this segment’s leadership.

- The automotive segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial design market is segmented by end user into automotive, electronics, healthcare, and aerospace. Among these, the automotive segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the industry’s emphasis on innovation, safety, and user experience. Rapid advancements in electric and autonomous vehicles demand cutting-edge design solutions. High consumer expectations for aesthetics and functionality, combined with significant R&D investments, drive the automotive sector’s leading role in industrial design.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial design market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ammunition Group

- LUNAR Design

- Astro Studios

- Designworks/BMW Group

- Smart Design

- Frog Design

- Pentagram

- Continuum

- Ziba Design

- RKS Design

- Fuseproject

- Whipsaw

- Method

- Teague

- IDEO

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2022, Teague, in collaboration with NORDAM, introduced the "Elevate" cabin concept, a single-aisle aircraft interior featuring innovative "floating" furniture. Using NORDAM’s Nbrace composite attachment system, the design suspended suite elements from the sidewalls, enhancing passenger privacy and comfort without reducing seating capacity. Elevate aimed to deliver a premium, hotel-like experience on narrowbody aircraft.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Industrial Design Market based on the below-mentioned segments:

United States Industrial Design Market, By Product

- Automotive

- Furniture

- Packaging

United States Industrial Design Market, By Process

- Transportation

- Consumer Goods

- Medical Devices

United States Industrial Design Market, By End User

- Automotive

- Electronics

- Healthcare

- Aerospace

Need help to buy this report?