United States Industrial Boiler Market Size, Share, and COVID-19 Impact Analysis, By Fuel (Fossil, Oil & Gas, Biomass), By Capacity (Small, medium, Large), By End-use (Food & Beverages, Paper & Pulp, Chemicals & Petrochemicals, Metals & Mining), and US Industrial Boiler Market Insights Forecasts to 2032

Industry: Energy & PowerUnited States Industrial Boiler Market Insights Forecasts to 2032

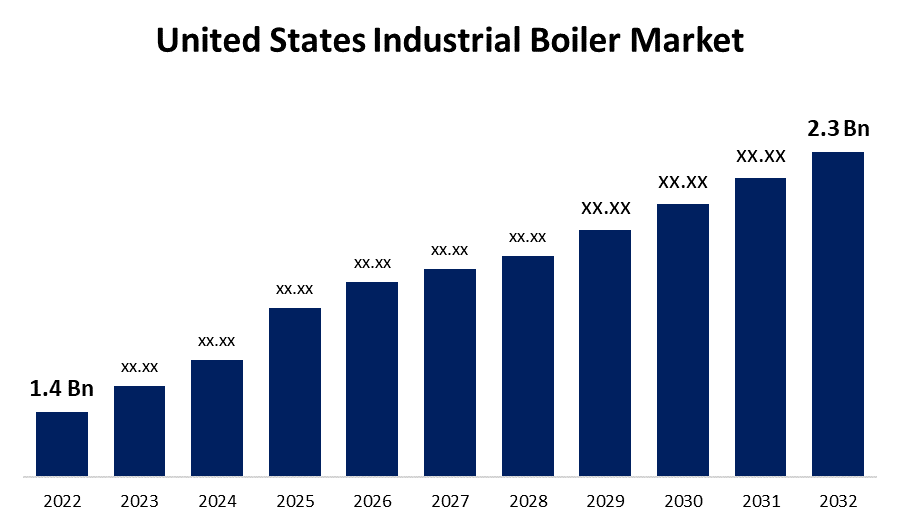

- The United States Industrial Boiler Market Size was valued at USD 1.4 Billion in 2022.

- The Market is Growing at a CAGR of 5.0% from 2022 to 2032.

- The United States Industrial Boiler Market Size is expected to reach 2.3 Billion by 2032.

.

.

Get more details on this report -

The United States Industrial Boiler Market Size is expected to reach USD 2.3 Billion by 2032, at a CAGR of 5.0% during the forecast period 2022 to 2032.

Market Overview

An industrial boiler is a steam or high-temperature water kettle that is powered by combustible gas, biomass, oil, or coal. Modern boilers heat or cool the water contained within them and distribute it to customers via line structures. The growing emphasis in industries on energy efficiency, emission reduction, and sustainable practices emphasizes the critical role of modern boiler systems in achieving these goals. Industrial boilers are essential to processes in industries such as manufacturing, chemical, food and beverage, and others, where they enable critical steam and hot water production. The industrial boiler market is poised to emerge as a pivotal player in the transition to cleaner and more efficient industrial processes, solidifying its significance in the evolving landscape of combustion technology and energy systems.

Report Coverage

This research report categorizes the market for the United States industrial boiler market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States industrial boiler market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States industrial boiler market.

United States Industrial Boiler Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.0% |

| 2032 Value Projection: | USD 2.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fuel, By Capacity, By End-use, and COVID-19 Impact Analysis. |

| Companies covered:: | Babcock & Wilcox Enterprises, The Fulton Companies, Hurst Boiler & Welding Co, Cleaver-Brooks, Clayton Industries, Rentech Boilers, Victory Energy Operations, Miura America Co., Superior Boiler Works, Simoneau, Vapor Power International, Columbia Boiler Company, Powermaster, York-Shipley, Bosch Industriekessel and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Strict standards imposed to regulate harmful air emissions will result in the enhancement of existing products, which is expected to boost the market even further. New and improved products are additionally anticipated to boost the adoption rate of industrial boilers over the forecast period. Rapid industrialization and stringent government regulations governing carbon emissions from coal-fired boilers drive the United States industrial boilers market during the forecast period. In the U.S. rise in demand for industrial boilers across multiple industry verticals, as well as government initiatives to develop large-capacity industrial boilers, are driving market growth. The US government intends to generate approximately 20% of its electricity from renewable sources by 2030, fueling the country's biomass boiler market.

Restraining Factors

Industrial boilers require a significant investment in terms of purchase, installation, and maintenance. These boilers have a high maintenance cost because they require routine repair and inspection to function properly. The cost of installing industrial boilers is also high because it includes costs for site preparation, engineering, and labor. This cost may vary depending on the location and complexity of the installation, making it one of the most important manufacturing plant expenditures.

Market Segment

- In 2022, the oil & gas segment is expected to hold the largest share of the United States industrial boiler market during the forecast period.

Based on the fuel, the United States industrial boiler market is classified into fossil, oil & gas, and biomass. Among these, the oil & gas segment is expected to hold the largest share of the United States industrial boiler market during the forecast period. This dominance can be attributed to its high availability and low cost in comparison to other types of fuel used in industrial boilers. This section is also commonly used in industrial boilers.

- In 2022, the large segment accounted for the largest revenue share over the forecast period.

Based on the capacity, the United States industrial boiler market is segmented into small, medium, and large. Among these, the large segment has the largest revenue share over the forecast period. In the petroleum industry, large-capacity boilers are used for a variety of processes such as process heating, fractionation, stripping, quenching, dilution, and pressure control. Rising-demand for large capacity boilers in the pulp and paper and chemical and petrochemical industries is expected to drive market growth over the forecast period.

- In 2022, the food & beverages segment accounted for the largest revenue share over the forecast period.

Based on the end-use, the United States industrial boiler market is segmented into food & beverages, paper & pulp, chemicals & petrochemicals, and metals & mining. Among these, the food & beverages segment has the largest revenue share over the forecast period. Boilers used in the food and beverage industry include brewing, distillation, cleaning or sterilizing equipment, cooking, drying, curing, and neutralizing microbiological, or antigen threats in the food. Boilers in food processing plants produce hot water for heating, power, sanitation, processing, and cooking. In the food and beverage industry, large industrial boilers are used for wet corn milling, pasteurization, and Ultra-high Temperature Processing (UHT).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial boiler market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Babcock & Wilcox Enterprises

- The Fulton Companies

- Hurst Boiler & Welding Co

- Cleaver-Brooks

- Clayton Industries

- Rentech Boilers

- Victory Energy Operations

- Miura America Co.

- Superior Boiler Works

- Simoneau

- Vapor Power International

- Columbia Boiler Company

- Powermaster

- York-Shipley

- Bosch Industriekessel

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, For an American petroleum refinery, Babcock & Wilcox supplied two package boilers, auxiliary equipment, and advanced emission control technologies. These package boilers and emission control solutions offer customers a variety of features and options to meet the unique demands and challenges of the petroleum refining industry.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States industrial boiler market based on the below-mentioned segments:

United States Industrial Boiler Market, By Fuel

- Fossil

- Oil & Gas

- Biomass

United States Industrial Boiler Market, By Capacity

- Small

- Medium

- Large

United States Industrial Boiler Market, By End-Use

- Chemicals & Petrochemicals

- Metals & Mining

- Food & Beverages

- Paper & Pulp

Need help to buy this report?