United States Industrial Air Purifiers Market Size, Share, and COVID-19 Impact Analysis, By Technology (HEPA Filters, Activated Carbon Filters, Ionic Air Purifiers, UV-C Light Purifiers, and Electrostatic Precipitators), By End-Use Industry (Manufacturing, Healthcare, Education, Commercial Buildings, and Residential), and United States Industrial Air Purifiers Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Industrial Air Purifiers Market Insights Forecasts to 2035

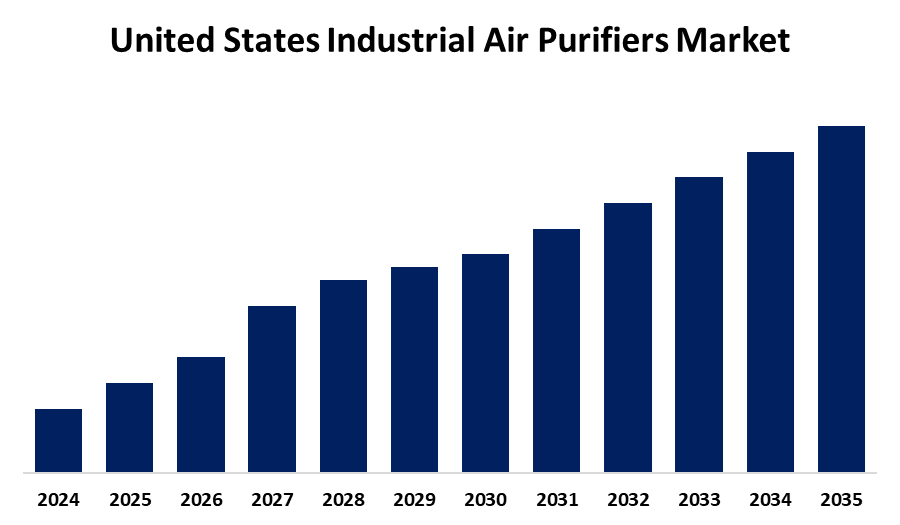

- The USA Industrial Air Purifiers Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035.

- The United States Industrial Air Purifiers Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According Report Published by Spherical Insights & Consulting, The U.S. Industrial Air Purifiers Market Size is Expected to Hold a Significant Share by 2035, Growing at a CAGR of 5.2% from 2025 to 2035. The U.S. Industrial Air Purifier Market Size is Growing due to strict environmental regulations, rising health awareness, and increased industrial activity. Technological innovations like smart sensors and energy-efficient systems enhance performance and appeal. The shift toward sustainable practices, focus on employee safety, and corporate responsibility goals further support demand, making air purifiers essential in modern industrial operations.

Market Overview

The United States Industrial Air Purifier Market Size refers to systems designed to remove harmful airborne contaminants in industrial settings such as manufacturing, power plants, chemical processing, and food production facilities. These systems are essential for maintaining air quality, ensuring worker safety, and meeting regulatory standards. The market is experiencing strong growth, driven by stringent environmental regulations from agencies like the EPA and OSHA, which mandate clean air standards across various industries. Rising awareness of the health risks associated with airborne pollutants, including respiratory conditions and long-term exposure to toxins, is pushing industries to invest in more advanced air purification technologies. Strengths of the market include the integration of smart technologies such as IoT-enabled monitoring, energy-efficient filtration systems, and modular designs that allow easy scalability. Opportunities are emerging through increasing industrialization, aging infrastructure requiring retrofits, and the demand for sustainable, eco-friendly air solutions. Government initiatives supporting green technology and workplace safety further fuel market adoption.

Report Coverage

This research report categorizes the market size for United States industrial air purifiers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA industrial Air Purifiers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. industrial air purifiers market.

United States Industrial Air Purifiers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Technology, By End-Use Industry |

| Companies covered:: | Donaldson Company Inc., AAON Inc., Aerus Holdings, Molekule, Alen Corporation, Honeywell International Inc., Whirlpool Corporation, Hamilton Beach Brands, Inc., Guardian Technologies, AprilAire, IQAir North America, Inc., Blueair Inc., Sharp Electronics Corporation, Winix America Inc., Coway USA Inc., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing awareness of health hazards linked to airborne pollutants, such as respiratory diseases and allergic reactions, is prompting companies to invest in reliable air purification systems. The growth of sectors like manufacturing, pharmaceuticals, food processing, and power generation is also expanding the need for industrial-grade filtration solutions. Technological advancements, including smart sensors, IoT integration, and energy-efficient designs, are making these systems more effective and appealing. The push toward sustainable and eco-friendly industrial operations further drive the market. Additionally, the growing emphasis on corporate social responsibility (CSR) and employee wellness supports long-term adoption, ensuring continued demand across various industrial sectors.

Restraining Factors

The price volatility of raw materials, especially copper, a commodity that is traded internationally, is one of the main issues facing the Japanese market for electrodeposited copper foils. This hurdles for producers to maintain cost effectiveness and stable pricing structures since copper prices are impacted by geopolitical factors, supply chain interruptions, and variations in mining output.

Market Segmentation

The United States industrial air purifiers market share is classified into technology, end-use industry.

- The HEPA filters segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA industrial air purifiers market is segmented by technology into HEPA filters, activated carbon filters, ionic air purifiers, UV-C light purifiers, and electrostatic precipitators. Among these, the HEPA filters segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The HEPA filters are highly sought-after because they're incredibly effective at cleaning the air. They're like super-powered filters that can trap tiny particles, like dust, pollen, and smoke, that can be harmful if inhaled. These filters can remove almost all airborne particles, including those as small as 0.3 microns, with 99.97% efficiency.

- The manufacturing segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. industrial air purifiers market is segmented by end-use industry into manufacturing, healthcare, education, commercial buildings, and residential. Among these, the manufacturing segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because in manufacturing industries, keeping workplaces clean and safe is crucial, and there's a rising demand for solutions that not only control air pollution but also shield workers from harmful particles in the air, making this a rapidly growing area of focus.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial air purifiers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Donaldson Company, Inc.

- AAON, Inc.

- Aerus Holdings

- Molekule

- Alen Corporation

- Honeywell International Inc.

- Whirlpool Corporation

- Hamilton Beach Brands, Inc.

- Guardian Technologies

- AprilAire

- IQAir North America, Inc.

- Blueair Inc.

- Sharp Electronics Corporation

- Winix America Inc.

- Coway USA Inc.

- Others

Recent Developments:

- In January 2024, Coway, a leading wellness tech company, launched the Airmega 100 air purifier, adding an affordable option for smaller spaces to its U.S. lineup of best-in-class products for cleaner air. The newest product is Airmega's first cylindrical model, and launched at Coway's most affordable price point ever.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States industrial air purifiers market based on the below-mentioned segments:

USA Industrial Air Purifiers Market, By Technology

- HEPA Filters

- Activated Carbon Filters

- Ionic Air Purifiers

- UV-C Light Purifiers

- Electrostatic Precipitators

USA Industrial Air Purifiers Market, By End-Use Industry

- Manufacturing

- Healthcare

- Education

- Commercial Buildings

- Residential

Need help to buy this report?