United States Industrial Absorbents Market Size, Share, By Material (Natural Organic Materials, Natural Inorganic Materials, and Synthetic Polymers), By Product (Pads & Rolls, Booms & Socks, Pillows, Sheets & Mats, Loose Absorbents, Other Products), By End Use (Oil & Gas, Food & Beverage Processing, Chemical & Petrochemical, Pharmaceutical & Healthcare, Automotive & Transportation, Water & Wastewater Treatment, Other End Use), United States Industrial Absorbents Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Industrial Absorbents Market Insights Forecasts to 2035

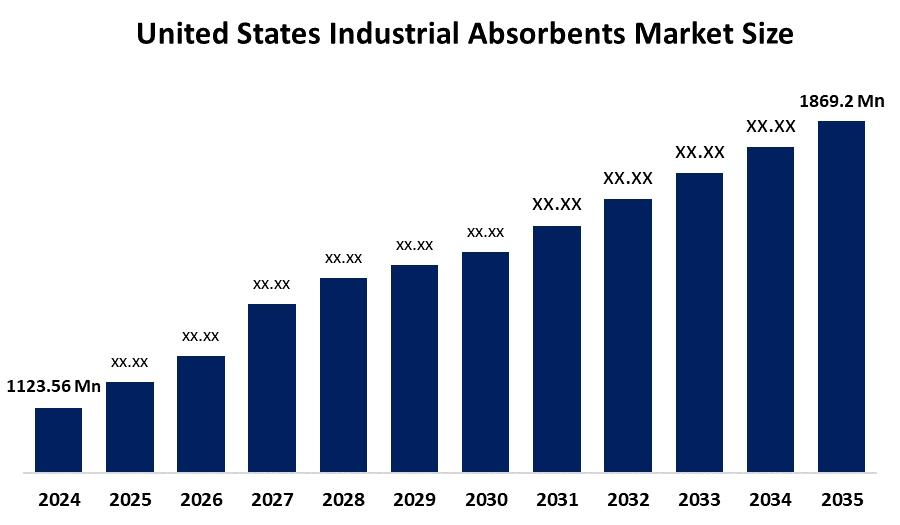

- United States Industrial Absorbents Market Size 2024: USD 1123.56 Mn

- United States Industrial Absorbents Market Size 2035: USD 1869.2 Mn

- United States Industrial Absorbents Market CAGR 2024: 4.74%

- United States Industrial Absorbents Market Segments: Material, Product, and End Use

Get more details on this report -

The US Industrial Absorbents Market Size is made up of different kinds of materials that are specially designed to absorb or to hold in a controlled way liquids, chemicals, oils, or spills, thus ensuring safety, preventing contamination, and enabling smooth operations. Industrial absorbents are widely used in many industries such as manufacturing, oil and gas, chemicals, automotive, and environmental management mainly for spill control, leak containment, waste clean-up, and protection of workers and equipment

In April 2025, Kimberly-Clark Professional decided to make some major modifications to WypAll X70 and X80 industrial cleaning cloths, and the aim of these enhancements was to improve the products' performance in the manufacturing and maintenance sectors. To this effect, in October 2025, the 3M Company had already introduced a new series of lightweight, high-capacity recycled cellulose absorbent mats, which were specifically designed for the automotive and machinery sectors, thus adding to the company's portfolio of sustainable product offerings.

US government measures aimed at spill prevention and environmental safety, such as EPA SPCC regulations, OSHA HAZWOPER standards, National Contingency Plan, and the Pollution Prevention Act, serve not only to promote the use of industrial absorbents for compliance purposes but also for safety.

The booming industrialization along with stringent environmental regulations and the increasing demand for eco-friendly and reusable absorbents, are all reasons that lead and create the right conditions for the expansion of the manufacturing, oil & gas, chemical, and environmental sectors.

Market Dynamics of the United States Industrial Absorbents Market:

The United States industrial absorbents market is driven by the uninterrupted activities in the manufacture of, combined with the oil & gas and chemical sectors, and the measures imposed to protect the environment and safety in the workplace. Plus, the developing concerns about spill management, the gaining of eco-friendly and reusable absorbents’ acceptance, and the demand are among the factors that would keep on pushing the market to grow. The industries will prefer to be less harmful to the environment, compliant with the regulations and having safe and efficient operations.

The United States industrial absorbents market is restrained by achieving its full potential mainly due to the high costs of advanced absorbent materials, small industries not being aware of eco-friendly options, and the challenges faced when getting rid of the used absorbents. Furthermore, the fluctuating raw material prices and the competition from other spill control methods are also factors that will limit market growth.

The future of the United States industrial absorbents market is bright and promising, as the demand for eco-friendly, reusable absorbents, stricter environmental regulations, technological innovations, and the extension of applications to oil & gas, chemical, and manufacturing industries will all play a role in sustainable growth.

United States Industrial Absorbents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1123.56 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.74% |

| 2035 Value Projection: | USD 1869.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material, By Product |

| Companies covered:: | 3m, New Pig Corporation., Oil-Dri Corporation of America, Meltblown Technologies Inc., Brady Worldwide, Inc., Twin Specialties Corp, American Textile & Supply, Textile Absorbent Products Co., Llc, Spilltech Environmental Incorporated., Kimberly-Clark Worldwide, Inc., Itu Absorbtech, Inc, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United States Industrial Absorbents Market share is classified into material, product, and end use.

By Material:

The United States industrial absorbents market is divided by material into natural organic materials, natural inorganic materials, and synthetic polymers. Among these, the synthetic polymers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The United States industrial absorbents market is mainly ruled by synthetic polymers that offer various advantages, such as high absorption capacity, chemical resistance, durability, and versatility in usage in different industries like oil & gas, chemicals, and manufacturing, which makes them more efficient than natural organic or inorganic materials.

By Product:

The United States industrial absorbents market is divided by product into pads & rolls, booms & socks, pillows, sheets & mats, loose absorbents, and other products. Among these, the pads & rolls segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. United States Pads & Rolls' absorption market holds its position as the topmost supplier, as they are multifunctional, user-friendly, economical, and capable of handling many kinds of liquid spills in various industries such as oil & gas, chemical, manufacturing, and automotive.

By End Use:

The United States industrial absorbents market is divided by end use into oil & gas, food & beverage processing, chemical & petrochemical, pharmaceutical & healthcare, automotive & transportation, water & wastewater treatment, and others. Among these, the oil & gas segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Oil & Gas industry has the upper hand when it comes to the United States industrial absorbents market as a result of the regular movement of huge quantities of oil, spill occurrences, and stringent environmental rules.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States industrial absorbents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United States Industrial Absorbents Market:

- 3m

- New Pig Corporation.

- Oil-Dri Corporation of America

- Meltblown Technologies Inc.

- Brady Worldwide, Inc.

- Twin Specialties Corp

- American Textile & Supply

- Textile Absorbent Products Co., Llc

- Spilltech Environmental Incorporated.

- Kimberly-Clark Worldwide, Inc.

- Itu Absorbtech, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United States industrial absorbents market based on the below-mentioned segments:

United States Industrial Absorbents Market, By Material

- Natural Organic Materials

- Natural Inorganic Materials

- Synthetic Polymers

United States Industrial Absorbents Market, By Product

- Pads & Rolls

- Booms & Socks

- Pillows

- Sheets & Mats

- Loose Absorbents

- Other Products

United States Industrial Absorbents Market, By End Use

- Oil & Gas

- Food & Beverage Processing

- Chemical & Petrochemical

- Pharmaceutical & Healthcare

- Automotive & Transportation

- Water & Wastewater Treatment

- Other End Use

Need help to buy this report?