United States IMU and Inertial Navigation System (INS) Market Size, Share, and COVID-19 Impact Analysis, By Component (Accelerometer, Gyroscope, Magnetometer, and Inertial Navigation System), By Technology (Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, MEMS, Hemispherical Resonator Gyroscope (HRG), and Others), By Platform (Airborne, Ground, Maritime, and Space), By End-user (Aerospace and Defense, Consumer Electronics, Marine/Naval, Automotive, and Others), and US IMU and Inertial Navigation System (INS) Market Insights Forecasts to 2032

Industry: Aerospace & DefenseUnited States IMU and Inertial Navigation System (INS) Market Insights Forecasts to 2032

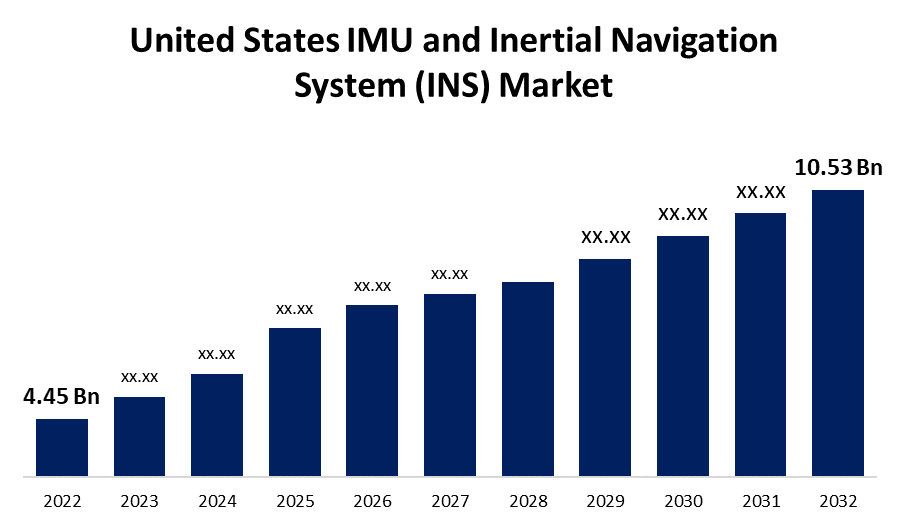

- The United States IMU and Inertial Navigation System (INS) Market Size was valued at USD 4.45 Billion in 2022.

- The Market Size is Growing at a CAGR of 9% from 2022 to 2032.

- The United States IMU and Inertial Navigation System (INS) Market Size is Expected to Reach USD 10.53 Billion by 2032.

Get more details on this report -

The United States IMU and Inertial Navigation System (INS) Market Size is Expected to Reach USD 10.53 Billion by 2032, at a CAGR of 9% during the forecast period 2022 to 2032.

Market Overview

An inertial measurement unit (IMU) device uses an accelerometer, gyroscope, and magnetometer to measure an object's movement and orientation. The angular rate is measured by the gyroscope, and the specific force is measured and reported by the accelerometer. Accelerometer sensors can also measure velocity and acceleration. The IMU device can also measure the specific gravity and angular rate of the object to which it is attached. The magnetometer measures the strength of the magnetic field. The current speed of any inertial sensor integrated platform can be measured by these sensors. They can measure turn rate, heading, inclination, and acceleration. An IMU device provides a three-dimensional target location. All of these components work together to determine an object's precise location. The INS also has a computational unit that analyzes and tracks the data collected by inertial sensors. Rising inertial measurement unit (IMU) and Inertial Navigation System applications in autonomous cars, UAVs, and robots will drive the market in the United States.

Report Coverage

This research report categorizes the market for the United States IMU and inertial navigation system (INS) market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States IMU and inertial navigation system (INS) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States IMU and inertial navigation system (INS) market.

United States IMU and Inertial Navigation System (INS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9% |

| 2032 Value Projection: | USD 10.53 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Technology, By Platform, By End-user. |

| Companies covered:: | General Electric Company, Gladiator Technologies, Honeywell International Inc., L3 Harris Technologies, Northrop Grumman Corporation, Parker Hannifin Corporation, Raytheon Technologies Corporation, Teledyne Technologies Incorporated, Trimble Inc., VectorNav Technologies LLC., EMCORE Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising demand for autonomous vehicles and unmanned aerial vehicles to drive United States IMU and inertial navigation system (INS) market growth during the forecast period. Autonomous driving is the future of the mobility industry; thus, leading automakers and technology firms are highly interested and focused on investing in autonomous vehicles. This increased investment in self-driving vehicles is expected to drive market growth over the forecast period. The increasing use of unmanned aerial vehicles (UAVs) in the military for attack, ISR, and search and rescue operations also driving market growth. Moreover, key industrial robot developments and adoption drive the inertial measurement unit market in the United States. An inertial measurement unit can validate a robot's position and movement data. It can also remotely command and control the robot. Robots are increasingly being programmed to perform hazardous or repetitive tasks with high accuracy and precision. Industrial robots are used in a variety of industries and applications.

Restraining Factors

Calibration errors may pose a significant challenge to the growth of the IMU and INS markets. The output of an inertial measurement unit (IMU) is used by an inertial navigation system, which combines information on acceleration and rotation with initial information on position, velocity, and attitude. With each new measurement, it then provides a navigation solution. A constant acceleration bias is converted into a linear velocity and quadratic position error. These mistakes have a big impact on navigation.

Market Segment

- In 2022, the inertial navigation system segment is expected to hold the largest share of the United States IMU and inertial navigation system (INS) market during the forecast period.

Based on the component, the United States IMU and inertial navigation system (INS) market is classified into accelerometer, gyroscope, magnetometer, and inertial navigation system. Among these, the inertial navigation system segment is expected to hold the largest share of the United States IMU and inertial navigation system (INS) market during the forecast period. As the use of autonomous vehicles grows, so does the demand for low-weight, small-size, high-performance INS. Furthermore, the IMU and inertial navigation systems are expected to grow due to increased adoption of the next-generation navigation grade system based on MEMS technology, which improves navigation system accuracy. The use of INS in UAVs, military vehicles, aircraft, and other applications is also propelling the segmental growth.

- In 2022, the MEMS segment accounted for the largest revenue share over the forecast period.

Based on the technology, the United States IMU and inertial navigation system (INS) market is segmented into mechanical gyro, ring laser gyro, fiber optics gyro, MEMS, hemispherical resonator gyroscope (HRG), and others. Among these, the MEMS segment has the largest revenue share over the forecast period. Integrating MEMS sensors into the navigation system due to higher accuracy and lightweight system drives the United States IMU and inertial navigation system (INS) market growth over the forecast period.

- In 2022, the ground segment accounted for the largest revenue share over the forecast period.

Based on the platform, the United States IMU and inertial navigation system (INS) market is segmented into airborne, ground, maritime, and space. Among these, the ground segment has the largest revenue share over the forecast period. For the ground segment, inertial sensors are used for ground-based applications such as automotive, smart wearable, medical services, and other uses.

- In 2022, the aerospace and defense segment accounted for the largest revenue share over the forecast period.

Based on the end-user, the United States IMU and inertial navigation system (INS) market is segmented into aerospace and defense, consumer electronics, marine/naval, automotive, and others. Among these, the aerospace and defense segment has the largest revenue share over the forecast period. Aeronautical devices play an essential role in the control, navigation, and stability of Unmanned Aerial Vehicles (UAVs) and aircraft. The aerospace industry is rapidly expanding as demand for unmanned aerial vehicles and aircraft fleets grows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States IMU and inertial navigation system (INS) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric Company

- Gladiator Technologies

- Honeywell International Inc.

- L3 Harris Technologies

- Northrop Grumman Corporation

- Parker Hannifin Corporation

- Raytheon Technologies Corporation

- Teledyne Technologies Incorporated

- Trimble Inc.

- VectorNav Technologies LLC.

- EMCORE Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Inertial Labs, a leading provider of advanced navigation, motion compensation, and remote sensing solutions, reached a significant milestone by securing a coveted GSA Multiple Award Schedule (MAS) contract. This contract strengthens the company's position as a reliable and innovative provider of GNSS Denied Navigation solutions to government agencies.

- In June 2023, Avnet formed a distribution partnership with ACEINNA, a leading MEMS-based sensing solutions company focused on developing innovative Inertial Measurement Units and current sensing technologies. The agreement allows Avnet to sell ACEINNA products worldwide.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States IMU and inertial navigation system (INS) market based on the below-mentioned segments:

United States IMU and Inertial Navigation System (INS) Market, By Component

- Accelerometer

- Gyroscope

- Magnetometer

- Inertial Navigation System

United States IMU and Inertial Navigation System (INS) Market, By Technology

- Mechanical Gyro

- Ring Laser Gyro

- Fiber Optics Gyro

- MEMS

- Hemispherical Resonator Gyroscope (HRG)

- Others

United States IMU and Inertial Navigation System (INS) Market, By Platform

- Airborne

- Ground

- Maritime

- Space

United States IMU and Inertial Navigation System (INS) Market, By End-User

- Aerospace and Defense

- Consumer Electronics

- Marine/Naval

- Automotive

- Others

Need help to buy this report?