United States Immersive Technology in Military & Defense Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software/Platform, and Services), By Application (Training & Learning, Sales & Marketing, Emergency Services, and Product Development), and United States Immersive Technology in Military & Defense Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseUnited States Immersive Technology in Military & Defense Market Insights Forecasts to 2035

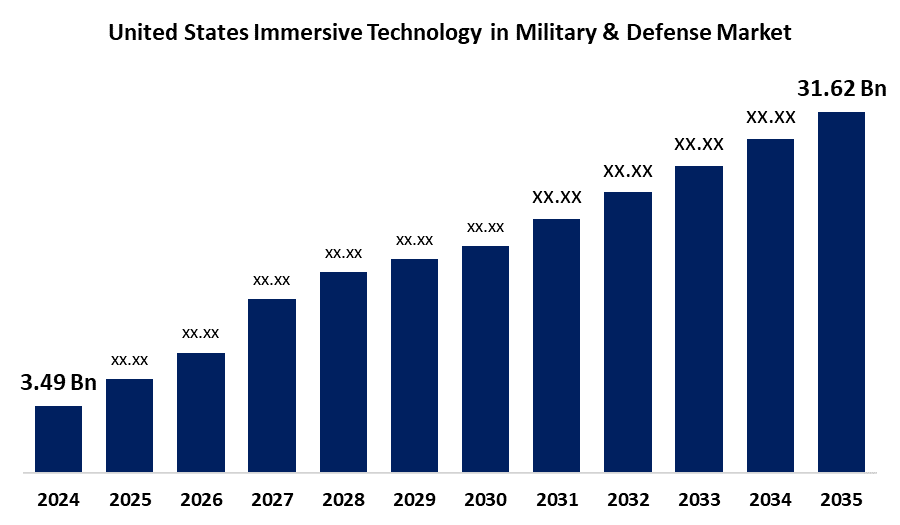

- The United States Immersive Technology in Military & Defense Market Size was Estimated at USD 3.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 22.18% from 2025 to 2035

- The United States Immersive Technology in Military & Defense Market Size is Expected to Reach USD 31.62 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The U.S. immersive technology in military & defense market Size is anticipated to reach USD 31.62 Billion by 2035, growing at a CAGR of 22.18% from 2025 to 2035. The U.S. immersive technology market in military and defense is growing rapidly due to its ability to deliver realistic, cost-effective training, enhance situational awareness, and support complex warfare simulations. Advances in VR, AR, AI, and 5G, combined with rising demand and diverse applications, are driving widespread adoption across the defense sector.

Market Overview

The United States immersive technology in military & defense market defines the use of cutting-edge technologies like Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR) to transform military training and operations. By creating realistic, interactive environments, these technologies help improve training, mission planning, and battlefield awareness. The market is experiencing rapid growth, driven by the integration of advanced technologies and their technological immersion to enhance training realism, improve situational awareness, and support complex mission planning, offering cost-effective and scalable solutions compared to traditional methods. Key strengths of the market include the ability to simulate diverse combat scenarios, facilitate remote collaboration, and provide real-time data visualization, thereby enhancing decision-making capabilities. Opportunities abound in areas such as pilot and medical training, cybersecurity, maintenance support, and urban warfare simulations, with increasing demand across all branches of the U.S. military. Government initiatives, including the Defense Innovation Unit (DIU) and the CHIPS and Science Act, are accelerating the adoption of commercial technologies in defense applications.

Report Coverage

This research report categorizes the market for the United States immersive technology in military & defense market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' immersive technology in military & defense market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States immersive technology in military & defense market.

United States Immersive Technology in Military & Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.49 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 22.18% |

| 2035 Value Projection: | USD 31.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Component and By Application |

| Companies covered:: | Raytheon Technologies, L3Harris Technologies, Motorola Solutions, Northrop Grumman, Unity Technologies, General Dynamics, Lockheed Martin, BAE Systems, Thales Group, Hexagon AB, Boeing, CIMdata, SAIC, VIVE, NVIDIA, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A growing need for realistic, cost-effective training solutions that prepare soldiers for complex and evolving combat scenarios. Immersive technologies like VR and AR offer safe, controlled environments where troops can practice missions without real-world risks, enhancing readiness and reducing training expenses. Advances in hardware, software, AI, and 5G connectivity further boost the effectiveness and adoption of these tools. Additionally, the increasing complexity of modern warfare, such as urban combat, asymmetric threats, and unmanned systems, requires sophisticated simulation capabilities. Government investments and initiatives supporting innovation in defense technology play a crucial role and further drive the growth of advancements.

Restraining Factors

The high development and implementation costs, cybersecurity risks, and technical limitations like hardware durability and software integration. Additionally, regulatory hurdles, data privacy concerns, and resistance to adopting new technologies within traditional military structures slow market growth despite its potential benefits.

Market Segmentation

The United States immersive technology in military & defense market share is classified into component and application.

- The hardware segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States' immersive technology in military & defense market is segmented by component into hardware, software/platform, and services. Among these, the hardware segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its high demand for advanced devices like VR headsets, AR glasses, sensors, and simulators. These physical components are essential for creating realistic training and operational environments, driving significant investment and innovation compared to software and services, which support but rely on the hardware infrastructure.

- The training & learning segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States' immersive technology in military & defense market is segmented by application into training & learning, sales & marketing, emergency services, and product development. Among these, the training & learning segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the critical need for realistic, risk-free environments where military personnel can practice complex combat scenarios, enhance skills, and improve preparedness. The effectiveness and cost savings of immersive training solutions make this segment the largest and fastest-growing within the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States immersive technology in military & defense market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Raytheon Technologies

- L3Harris Technologies

- Motorola Solutions

- Northrop Grumman

- Unity Technologies

- General Dynamics

- Lockheed Martin

- BAE Systems

- Thales Group

- Hexagon AB

- Boeing

- CIMdata

- SAIC

- VIVE

- NVIDIA

- Others

Recent Developments:

- In December 2024, Lockheed Martin announced the establishment of Astris AI, a new subsidiary dedicated to facilitating the adoption of artificial intelligence (AI) solutions. This strategic move aims to strengthen AI capabilities across the US defence industrial base and high-assurance commercial sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States immersive technology in military & defense market based on the below-mentioned segments:

USA Immersive Technology in Military & Defense Market, By Component

- Hardware

- Software/Platform

- Services

USA Immersive Technology in Military & Defense Market, By Application

- Training & Learning

- Sales & Marketing

- Emergency Services

- Product Development

Need help to buy this report?