United States Image Sensor Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions, Services), By Technology (CCD Sensor, CMOS Sensor), By Processing Type (2D, 3D), By Application (Consumer Electronics, Automotive, Healthcare, Surveillance & Security, Others), and United States Image Sensor Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Image Sensor Market Insights Forecasts to 2033

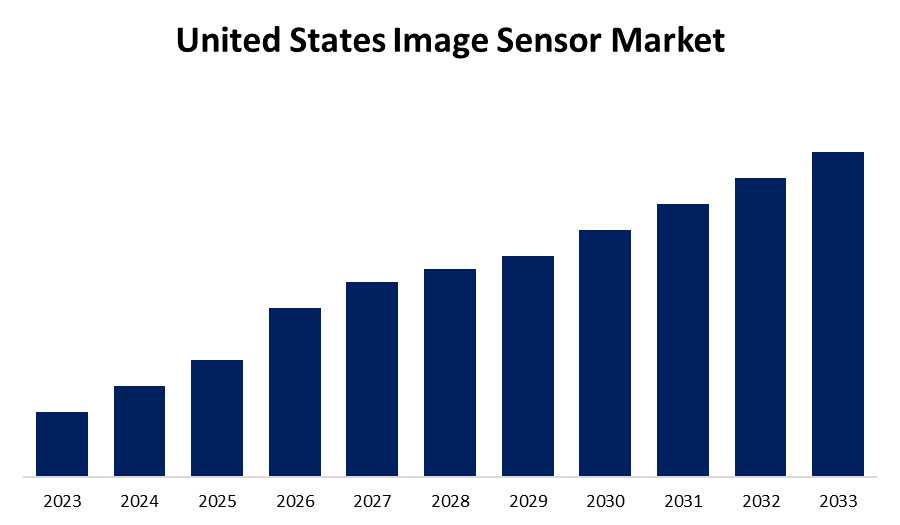

- The Market Size is Growing at a CAGR of 8.2% from 2023 to 2033.

- The United States Image Sensor Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Image Sensor Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 8.2% during the forecast period 2023 to 2033.

Market Overview

There several factors are driving significant growth in the United States image sensor market. With the constant advancement of technology, image sensors have found widespread use in a variety of industries, particularly consumer electronics, automotive, and surveillance. The proliferation of smartphones with high-quality cameras, combined with the growing trend of automation and advanced driver-assistance systems in the automotive industry, has increased demand for image sensors. Furthermore, the growing use of image sensors in security and surveillance systems contributes to the market's upward trend. Furthermore, the advancement of novel sensor technologies, such as CMOS and CCD sensors, has improved image quality and responsiveness. This, in turn, attracts investments from both established players and new entrants, accelerating the market's growth. As the United States remains at the forefront of technological innovation, the image sensor market is poised for continued growth and innovation in the near future.

Report Coverage

This research report categorizes the market for United States Image Sensor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Image Sensor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Image Sensor market.

United States Image Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.2% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Technology, By Processing Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Sony Corporation, OmniVision Technologies, Inc., ON Semiconductor Corporation, Samsung Electronics Co., Ltd., Panasonic Corporation, Canon Inc., Teledyne Technologies Incorporated, STMicroelectronics N.V., Hamamatsu Photonics K.K., Himax Technologies, Inc., PixelPlus Co., Ltd., Sharp Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States Image Sensor Market is being driven by increased demand from the consumer electronics industry. One of the primary factors driving this demand is the widespread availability of smartphones. Modern consumers expect high-quality camera performance from their mobile devices, and image sensors play an important role in meeting those expectations. Manufacturers are constantly working to improve the image quality, resolution, and low-light performance of smartphone cameras. As a result, image sensor technologies such as CMOS (Complementary Metal Oxide Semiconductor) and CCD (Charge-Coupled Device) sensors are constantly evolving to provide better imaging capabilities. Furthermore, the use of multiple-camera setups in smartphones for features such as zoom, wide-angle, and depth sensing increases the demand for image sensors. This trend is expected to continue as consumers prioritize photography and videography in their daily lives, making image sensors an important component in the consumer electronics industry.

Restraining Factors

LiDAR systems use millions of laser pulses to measure distance changes, requiring finely tuned systems to make more accurate and faster decisions than humans. These systems provide higher accuracy and precision than image sensor cameras, but have some drawbacks such as high-power consumption, poor performance in difficult weather, heavyweight, and high costs. This restraining market growth.

Market Segment

- In 2023, the services segment accounted for the largest revenue share over the forecast period.

Based on the component, the United States Image Sensor market is segmented into solutions and services. Among these, the services segment has the largest revenue share over the forecast period. Services are important in the image sensor market because they cover a wide range of offerings such as installation, maintenance, repair, and technical support. With the increasing adoption of image sensors across various industries such as automotive, consumer electronics, healthcare, and industrial, the demand for image sensor services has grown significantly.

- In 2023, the CMOS segment accounted for the largest revenue share over the forecast period.

Based on the technology, the United States image sensor market is segmented into CCD Sensor and CMOS sensor. Among these, the CMOS segment has the largest revenue share over the forecast period. CMOS (Complementary Metal-Oxide-Semiconductor) sensors have grown in popularity and market share in recent years, owing to their numerous advantages over CCD (Charge-Coupled Device) sensors. Compared to CCD sensors, CMOS sensors consume less power, have greater integration capabilities, faster readout speeds, and perform better in terms of noise. These benefits make CMOS sensors more suitable for a variety of applications, including consumer electronics, automotive, industrial, and healthcare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States image sensor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sony Corporation

- OmniVision Technologies, Inc.

- ON Semiconductor Corporation

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Canon Inc.

- Teledyne Technologies Incorporated

- STMicroelectronics N.V.

- Hamamatsu Photonics K.K.

- Himax Technologies, Inc.

- PixelPlus Co., Ltd.

- Sharp Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, ImageSense Technologies, a leading image sensor manufacturer, has unveiled its next-generation image sensor portfolio, which is designed to meet the growing demand for advanced imaging solutions. These innovative sensors incorporate advanced pixel architectures and noise reduction algorithms, resulting in higher image quality and color accuracy. ImageSense Technologies' new image sensors also have high-speed readout capabilities, allowing for real-time image capture and processing. With applications in healthcare, surveillance, and robotics, these image sensors enable organizations to achieve precise imaging and analysis for critical operations.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States image sensor market based on the below-mentioned segments:

United States Image Sensor Market, By Component

- Solutions

- Services

- Others

United States Image Sensor Market, By Technology

- CCD Sensor

- CMOS Sensor

United States Image Sensor Market, By Processing Type

- 2D

- 3D

United States Image Sensor Market, By Application

- Consumer Electronics

- Automotive

- Healthcare

- Surveillance & Security

- Others

Need help to buy this report?