United States Ice Cream Market Size, Share, and COVID-19 Impact Analysis, By Product (Bars & Pops, Cups, Tub, Others), By Category (Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream), By Flavor (Chocolate, Vanilla, Fruit), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, and Others), and United States Ice Cream Market Insights Forecasts 2023 – 2033

Industry: Food & BeveragesUnited States Ice Cream Market Insights Forecasts to 2033

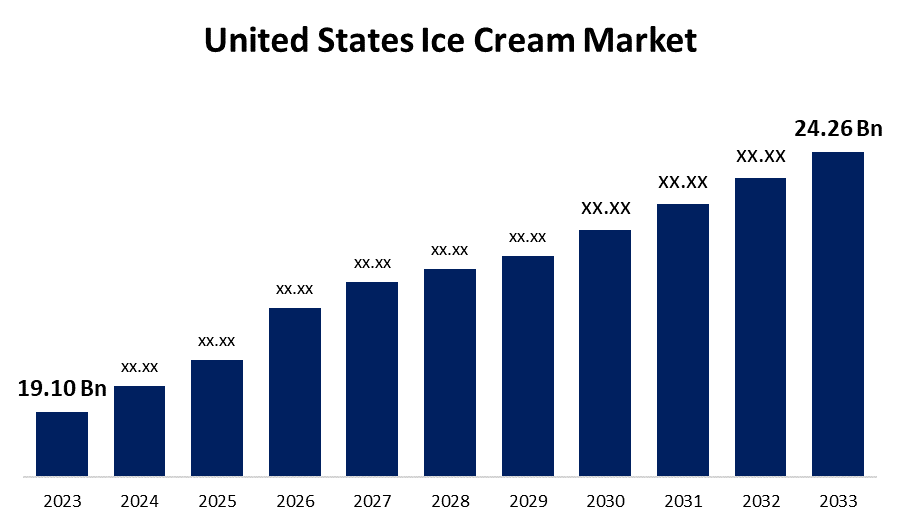

- The United States Ice Cream Market Size was valued at USD 19.10 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.42% from 2023 to 2033.

- The United States Ice Cream Market Size is Expected to Reach USD 24.26 Billion by 2033.

Get more details on this report -

The United States Ice Cream Market Size is Expected to Reach USD 24.26 Billion by 2033, at a CAGR of 6.45% during the forecast period 2023 to 2033.

Market Overview

Ice cream is a sweetened solidified nourishment that is commonly consumed as a snack or dessert. It is becoming increasingly composed of dairy drain or cream and flavored with a sweetener, either sugar or a substitute, and any zest, such as cocoa or vanilla. It can be made by combining a flavored cream base and fluid nitrogen. Colorings and stabilizers are usually included. To prevent recognizable ice gems from forming, the blend is mixed to incorporate discussed spaces and cooled beneath the softening point of water. The result is a smooth, semi-solid froth that is strong even at extremely low temperatures (below 2 °C or 35 °F). It becomes more pliable as the temperature rises. Solidified desserts can also be served in dishes, eaten with a spoon, or licked from edible cones. Ice cream can also be served with other sweets, such as pie, or as a topping in frozen dessert drifts, sundaes, milkshakes, ice cream cakes, and even heated things. In the United States, factors such as rising demand for innovative flavors and types, as well as rising demand for impulse ice creams such as cones, sandwiches, and pops, are expected to drive market growth.

Report Coverage

This research report categorizes the market for the United States ice cream market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ice cream market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ice cream market.

United States Ice Cream Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.10 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.45% |

| 2033 Value Projection: | USD 24.26 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Category, By Flavor, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | Blue Bell Creameries LP, Dairy Farmers of America Inc., Focus Brands LLC, Froneri International Limited, Giffords Dairy Inc., Tilamook CCA, Turkey Hill Dairy, Unilever PLC, Van Leeuwen Ice Cream, Wells Enterprises Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Traditional ice cream contains nutrients but no health benefits. As a result, market participants' growing interest in fortification and the addition of functional ingredients may encourage consumers to select the product as a healthy snack option. Functional foods go beyond basic nutrition and may help to reduce or minimize the risk of certain diseases. The increased production of fortified or functional products is expected to increase product consumption in the United States. In recent years, quick commerce and e-commerce have evolved, allowing customers to consume ice cream in the comfort of their own homes with a few taps on their smartphones. This ease of use increased home ice cream consumption. Since manufacturers have used proper branding techniques, healthy product options such as fortified, low-fat, and many others are readily available in the market. These businesses are reaching out to customers through local distribution channels such as hotels, restaurants, and shopping malls. The product's easy availability, combined with rising expenditure on such fast foods, is expected to drive the United States market.

Restraining Factors

Ice cream is a frozen dairy product that will spoil in a short period (usually 2-3 months), but if not stored properly, it will spoil within a few days. In a stale storage environment, the product will usually develop a foul odor and microorganisms. It can also detect volatile flavors absorbed from the storage environment, such as paint and ammonia. So, the high storage cost of the product is expected to hamper the market growth

Market Segment

- In 2023, the cups segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States ice cream market is segmented into bars & pops, cups, tubs, and others. Among these, the cup segment has the largest revenue share over the forecast period. Consumption of cup ice cream is a popular and convenient option. It is typically sold in single-serving containers, allowing people to enjoy their favorite flavors without the need for extra serving utensils. Cup ice cream is popular with on-the-go customers who value portability and portion control. Companies have capitalized on this segment by providing a wide range of flavors, including classic and innovative combinations. Furthermore, single-serving cups allow for simple customization, such as adding mix-ins or toppings.

- In 2023, the impulse ice cream segment accounted for the largest revenue share over the forecast period.

Based on category, the United States ice cream market is segmented into impulse ice cream, take-home ice cream, and artisanal ice cream. Among these, the impulse ice cream segment has the largest revenue share over the forecast period. Impulse ice cream, also known as on-the-go or single-serve ice cream, is designed for quick purchases and consumption. These items are typically sold in convenience stores, ice cream trucks, and kiosks, making them easily accessible to customers looking for a quick snack. Ice cream cones, bars, and novelty items are frequently included in impulse ice cream. Convenience, affordability, and a wide variety of flavor options are key drivers for the impulse ice cream segment. Consumers frequently choose these products because of their portability and instant gratification.

- In 2023, the chocolate segment accounted for a significant revenue share over the forecast period.

Based on the flavor, the United States ice cream market is segmented into chocolate, vanilla, and fruit. Among these, the chocolate segment has a significant revenue share over the forecast period. Chocolate ice cream, with its rich and decadent flavor, commands a significant market share. It satisfies the cravings of chocolate lovers in the United States. This segment is diverse, with dark chocolate, milk chocolate, and white chocolate variations appealing to a wide audience. Chocolate ice cream is changing to meet the needs of different people. Dark chocolate ice cream, for instance, has grown in popularity among consumers looking for a more intense cocoa flavor with potential health benefits. Furthermore, there is a trend toward using premium chocolate sources, such as single-origin cocoa, to make gourmet chocolate ice cream.

- In 2023, the supermarkets/hypermarkets segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States ice cream market is segmented into supermarkets/hypermarkets, convenience stores, ice cream parlors, online stores, and others. Among these, the supermarkets/hypermarkets segment has the largest revenue share over the forecast period. Supermarkets are a significant ice cream distribution channel. In their frozen food sections, they have a wide selection of ice cream brands, flavors, and formats. Customers value the convenience of purchasing ice cream while doing their regular grocery shopping. Supermarkets frequently run promotions and discounts to entice price-conscious customers. To stand out on supermarket shelves, effective packaging, branding, and promotional strategies are required. Supermarkets play a significant role in ice cream sales. These larger retail outlets have even more extensive product selections and frequently have dedicated frozen dessert sections. Hypermarkets provide consumers with a one-stop shopping experience, making it easy to buy ice cream alongside groceries and household items. Ice cream companies can benefit from hypermarket bulk sales opportunities. In these vast retail spaces, marketing efforts such as in-store displays and promotions are critical to attracting customers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ice cream market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blue Bell Creameries LP

- Dairy Farmers of America Inc.

- Focus Brands LLC

- Froneri International Limited

- Giffords Dairy Inc.

- Tilamook CCA

- Turkey Hill Dairy

- Unilever PLC

- Van Leeuwen Ice Cream

- Wells Enterprises Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Unilever collaborated with ASAP to deliver its ice cream products. According to the terms of the agreement, ASAP will also deliver ice cream and treats from Unilever's virtual storefront, The Ice Cream Shop.

- In October 2022, Dairy Farmers of America completed the USD 433 million acquisition of Dean Foods properties, and Kemps replaced Dean Goods throughout Iowa. The company purchased the Le Mars milk factory, which can process a wide range of Kemps products, from cottage cheese to ice cream.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Ice Cream Market based on the below-mentioned segments:

United States Ice Cream Market, By Product

- Bars & Pops

- Cups

- Tub

- Others

United States Ice Cream Market, By Category

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

United States Ice Cream Market, By Flavor

- Chocolate

- Vanilla

- Fruit

United States Ice Cream Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

Need help to buy this report?