United States Hydroxyapatite Market Size, Share, and COVID-19 Impact Analysis, By Product (Nano-Sized, Micro-Sized, and Greater than Micrometers), By End-use (Dental Care, Plastic Surgery, Orthopedics, and Others), and United States Hydroxyapatite Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Hydroxyapatite Market Insights Forecasts to 2035

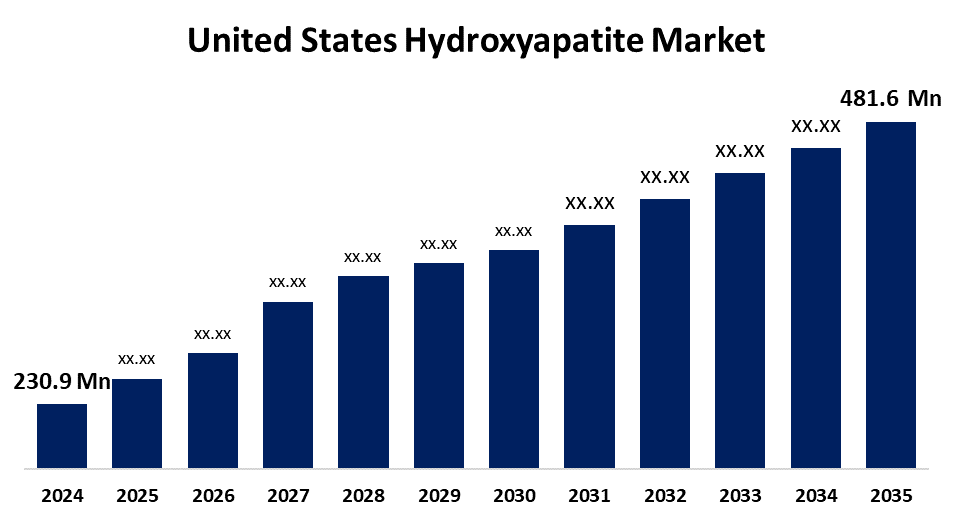

- The US Hydroxyapatite Market Size Was Estimated at USD 230.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.91% from 2025 to 2035

- The US Hydroxyapatite Market Size is Expected to Reach USD 481.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Hydroxyapatite Market Size is Anticipated to Reach USD 481.6 Million by 2035, Growing at a CAGR of 6.91% from 2025 to 2035. The expansion of the United States hydroxyapatite market is propelled by the growing need for biocompatible materials in dentistry and medical applications. As medical practitioners use more sophisticated regenerative medicine methods, there is a greater requirement for hydroxyapatite in fillers, coatings, and implants.

Market Overview

Hydroxyapatite is a naturally occurring mineral form of calcium apatite. Due to the increasing rate of orthopaedic conditions, including osteoporosis and bone fractures, mostly among the elderly, the demand for hydroxyapatite-based products for use in bone grafting and implant coatings has grown, supporting market growth. In addition, the market is growing because of the increasing states of awareness of oral health and dental treatment, including hydroxyapatite as a bioactive ingredient in toothpaste and other dental products, indicating its increasing importance for dental restoration. The development of hydroxyapatite based on nanotechnology offers an excellent opportunity for expanded use in tissue engineering, drug delivery, and regenerative medicine. Nano-hydroxyapatite has improved surface modification, being more bioactive and having greater bone regeneration attributes, making it an excellent candidate for both bone graft substitutes and next-generation medical implants. The leading research institutes and biomaterials companies are investing in nanostructured hydroxyapatite coatings for orthopaedic implants in order to improve osteointegration and decrease rates of implant failure.

The U.S. government has taken a number of steps to encourage the market expansion for hydroxyapatite, especially in the biomedical industry. Clinical acceptance of several hydroxyapatite-based graft materials for orthopaedic applications has been aided by FDA approval. Additionally, the FDA improved consumer access to fluoride-free dental care options by updating its oral care standards to permit more precise marketing claims for toothpaste formulations containing nano-hydroxyapatite.

Report Coverage

This research report categorizes the market for the United States hydroxyapatite market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hydroxyapatite market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hydroxyapatite market.

United States Hydroxyapatite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 230.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.91% |

| 2035 Value Projection: | USD 481.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | SigmaGraft, Aps materials, Berkeley Advanced Biomaterials, Inc., The Lubrizol Corp, Bio-Rad Laboratories Inc, Zimmer Biomet Holdings Inc, Berkeley Advanced Biomaterials, CGbioFluidinova and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hydroxyapatite market is boosted by the future value of the hydroxyapatite market will be underpinned by the increasing need for biocompatibility in healthcare applications. Hydroxyapatite is a preferred option for surgeons and medical researchers as it is biocompatible and has a chemical structure similar to that of human bone mineral. Hydroxyapatite is frequently employed in bone grafts, dental fillers and orthopaedic implants. Hydroxyapatite is being used increasingly in joint replacement and reconstructive surgery due to a growing patient cohort. Global demand is driven by the high rates of osteoporosis and arthritis, especially in the elderly population.

Restraining Factors

The United States hydroxyapatite market faces obstacles like the raw material price volatility. Producers face supplier price volatility, including variations in sector pricing and raw materials. The price volatility is a consequence of supply chain interruptions, national interests in response to resource availability, and price changes for complementary items.

Market Segmentation

The United States hydroxyapatite market share is classified into product and end-use.

- The nano-sized segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hydroxyapatite market is segmented by product into nano-sized, micro-sized, and greater than micrometers. Among these, the nano-sized segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the hydroxyapatite particles that are modified at the nanoscale, thus changing their properties for many possible applications. These nanoparticles can be used in the biological field, such as drug delivery and bone tissue engineering, as a result of their high surface area and reactivity.

- The orthopedics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States hydroxyapatite market is segmented into dental care, plastic surgery, orthopedics, and others. Among these, the orthopedics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because hydroxyapatite is used in orthopedics for bone grafts, joint replacements, and fracture healing. Hydroxyapatite is biocompatible, and it can help with bone growth as well, which makes hydroxyapatite ideal for improving the integration of implants while assisting with bone regeneration for orthopedic procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hydroxyapatite market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SigmaGraft

- Aps materials

- Berkeley Advanced Biomaterials, Inc.

- The Lubrizol Corp

- Bio-Rad Laboratories Inc

- Zimmer Biomet Holdings Inc

- Berkeley Advanced Biomaterials

- CGbioFluidinova

- Others

Recent Development

- In May 2023, HAPPE Spine, an orthopedic implants manufacturer and medical device company, announced that one of its products, INTEGRATE-C Interbody Fusion System, got 510(k) clearance from the FDA. This system is the first interbody fusion cage fully integrated with hydroxyapatite and designed with porosity, promoting bone ingrowth and enhancing cell signaling. It is intended to be radiolucent and radiovisible, enhancing imaging during and after surgery. The significance of this advancement is that the system offers various sizes and angles to suit different patient anatomies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hydroxyapatite market based on the following segments:

United States Hydroxyapatite Market, By Product

- Nano-Sized

- Micro-Sized

- Greater than Micrometers

United States Hydroxyapatite Market, By End-use

- Dental Care

- Plastic Surgery

- Orthopedics

- Others

Need help to buy this report?