United States Hydroponics Market Size, Share, and COVID-19 Impact Analysis, By Type (Aggregate Systems and Liquid Systems), By Crop Type (Tomatoes, Lettuce, Peppers, Cucumbers, Herbs, and Others), and United States Hydroponics Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Hydroponics Market Size Insights Forecasts to 2035

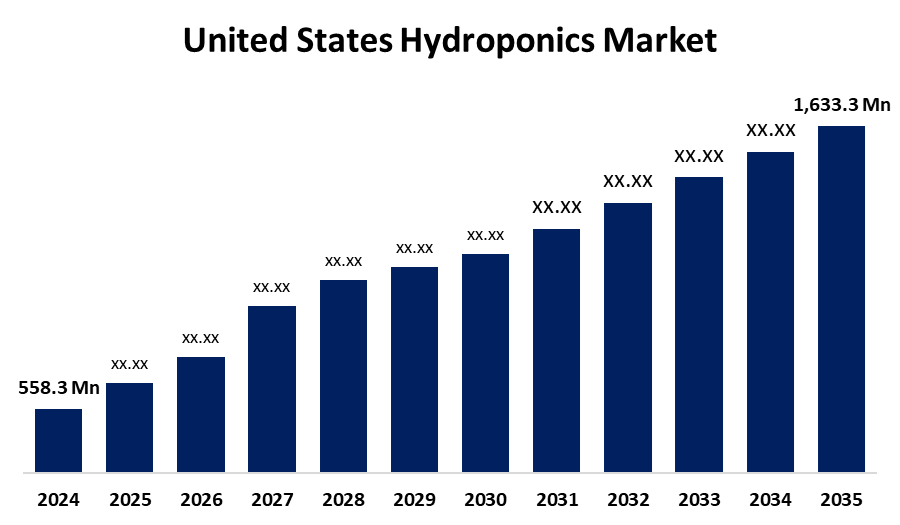

- The US Hydroponics Market Size Was Estimated at USD 558.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.25% from 2025 to 2035

- The US Hydroponics Market Size is Expected to Reach USD 1,633.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Hydroponics Market Size is anticipated to reach USD 1,633.3 million by 2035, growing at a CAGR of 10.25% from 2025 to 2035. The expansion of the United States' hydroponics market is propelled by the growing use of hydroponic systems for vegetable farming indoors.

Market Overview

Hydroponics is the science and art of growing plants without soil by using a water-based nutritional solution, sometimes accompanied by an inert medium such as perlite, rock wool, or coconut coir to offer mechanical support. In 2023, the United States held a 10.1% share in the hydroponics market. As the population of the United States increases, food security issues are forcing producers to resort to advanced or urban production systems, such as indoor farming. Many growers or farmers in the United States have embraced hydroponics technology as a type of indoor farming because of its simple setup and maintenance. The growth of the U.S. market is being driven by many significant factors, including a continuously increasing population, limited arable land, government subsidies, and a demand for fresh, quality food. Urban areas have extremely limited land, thus innovative hydroponics have emerged. Hydroponic systems can enable plant growth in water and nutrients without using soil as a medium. Hydroponic systems can be applied to both indoor and outdoor planting and growing. Hydroponic systems are an excellent alternative for growing a variety of plants in limited spaces, like inside. Indoor hydroponic gardening easily manages and controls all factors that impact plant growth humidity, light, temperature, nutrients, pH, and water. For this reason, indoor hydroponic gardening is easier to manage and usually takes shorter periods to accomplish than earth-farming or growing.

The U.S. Department of Agriculture (USDA) actively supports controlled-environment and hydroponic agriculture through a variety of financing and research avenues. To examine food safety concerns, plant diseases, and substrate management in hydroponic lettuce systems, for example, the University of Arkansas received a $300,000 grant from the National Institute of Food and Agriculture (USDA-NIFA) in August 2024.

Report Coverage

This research report categorizes the market for the United States hydroponics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hydroponics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hydroponics market.

United States Hydroponics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 558.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.25% |

| 2035 Value Projection: | USD 1,633.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By Crop Type and COVID-19 Impact Analysis |

| Companies covered:: | AmHydro, AeroFarms, Argus Worldwide Corp, ScottsMiracle-Gro, Green Sense Farms, Gotham Greens, Hydrodynamics International, Emerald Harvest, Freight Farms, AmHydro, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hydroponics market is boosted as there is a limited supply of available farmland in the USA, and traditional agriculture is being seriously challenged by urbanisation. Alternative farming processes such as hydroponics and vertical farming are necessary as cities grow while the countryside declines; these new techniques allow for urban gardening, taking advantage of neglected spaces like rooftops and internal venues. Urban farmers can take advantage of technology to maximise crop growth and yield by regulating the environmental factors of light, temperature, and nutrient quantity. By moving towards urban agriculture, it alleviates the issues related to the food supply and sustainability, as well as reinforcing local food systems in populated urban regions, while reducing travelling distances and material inputs.

Restraining Factors

The United States hydroponics market faces obstacles, like the cost of setting up a hydroponic system may dissuade potential growers with its prohibitive costs. Next, the complexity of hydroponics requires a degree of technical skill and hands-on experience, which may be intimidating to those who are less familiar or on the fringes of farming.

Market Segmentation

The United States hydroponics market share is classified into type and crop type.

- The aggregate systems segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hydroponics market is segmented by type into aggregate systems and liquid systems. Among these, the aggregate systems segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the use of non-living, solid substrates such as peat or rock wool, vermiculite, sand, sawdust, or perlite, or coconut coir. The significance of the segment is further made clear by the several important technologies, such as wick systems, ebb and flow systems, and drip systems.

- The tomatoes segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the crop type, the United States hydroponics market is segmented into tomatoes, lettuce, peppers, cucumbers, herbs, and others. Among these, the tomatoes segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is the most cultivated hydroponic vegetable crops in the US, simply because tomatoes grow much faster than the traditional way of growing tomatoes and require much less water than the traditional way. Hydroponic tomato farming utilizes growing materials such as coconut coir, perlite, or rock wool.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hydroponics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AmHydro

- AeroFarms

- Argus Worldwide Corp

- ScottsMiracle-Gro

- Green Sense Farms

- Gotham Greens

- Hydrodynamics International

- Emerald Harvest

- Freight Farms

- AmHydro

- Others

Recent Development

- In January 2024, American Hydroponics (AmHydro), provider of best-in-class hydroponic growing systems and CEA grower support, and Ryzee, an Agtech startup that develops hardware and data-driven software systems for CEA markets, announced the strategic partnership and collaboration to develop a groundbreaking all-in-one farm optimization platform, designed from the ground up to address pain points that growers deal with daily.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hydroponics market based on the following segments:

United States Hydroponics Market, By Type

- Aggregate Systems

- Liquid Systems

United States Hydroponics Market, By Crop Type

- Tomatoes

- Lettuce

- Peppers

- Cucumbers

- Herbs

- Others

Need help to buy this report?