United States Hydrocolloids Market Size, Share, and COVID-19 Impact Analysis, By Product (Gelatin, Xanthan Gum, Carrageenan, Alginates, Pectin, Guar Gum, Carboxy Methyl Cellulose, Agar, Gum Arabic, and Locust Bean Gum), By Function (Thickening, Gelling, Stabilizing, and Others), and United States Hydrocolloids Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Hydrocolloids Market Size Insights Forecasts to 2035

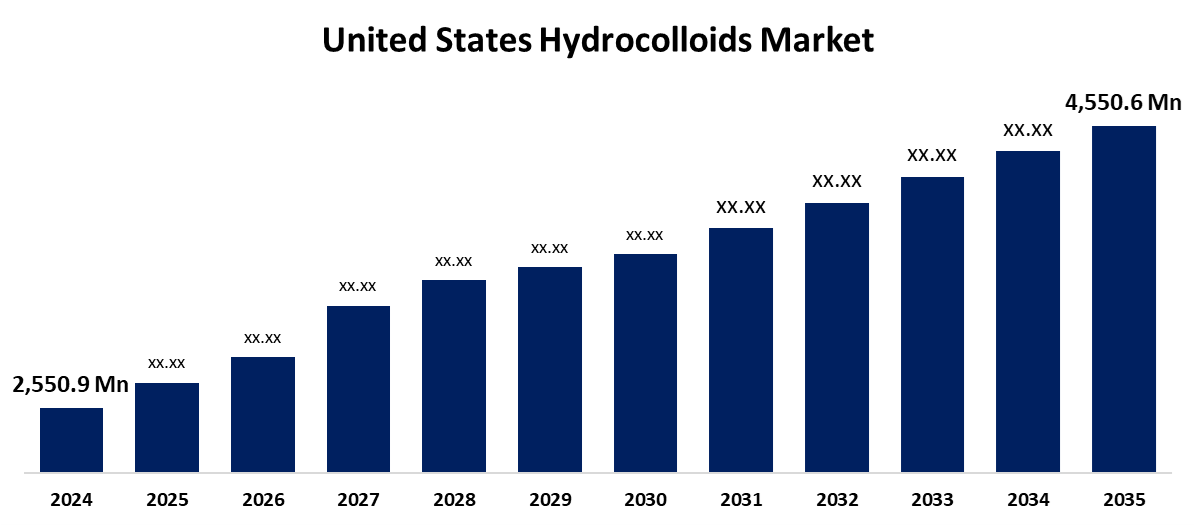

- The US Hydrocolloids Market Size Was Estimated at USD 2,550.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.40% from 2025 to 2035

- The US Hydrocolloids Market Size is Expected to Reach USD 4,550.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Hydrocolloids Market Size is anticipated to reach USD 4,550.6 Million by 2035, growing at a CAGR of 5.40% from 2025 to 2035. The expansion of the United States hydrocolloids market is propelled by growing demand from the food and beverage, personal care, cosmetics, and pharmaceutical industries for thickeners and gelling agents.

Market Overview

The term hydrocolloids refer to high-molecular-weight compounds, mainly proteins or polysaccharides, that disperse colloidally in water. During the forecast period, the market is expected to grow at a faster pace, owing to the increased utilization of hydrocolloid-based building materials and the increasing demand from the cosmetics industry. Also, the high demand for thickening and gelling applications from the food and beverage industry will be seen as the major influence towards increasing sales. The exceptional adaptability of hydrocolloids in the food business is one of the primary market drivers. The major ways hydrocolloids add value to food ingredients are their ability to hold water and modify the properties of ingredients. These roles in the food industry are the key factors leading to their wide variety of applications in the food industry, contributing to their high degree of usage. Demand is expected to grow as a result of increased use of hydrocolloids, as healthy food products are increasingly being introduced. The processed food industry's growth is predicted to benefit the industry from increased demand, as processed foods offer convenience.

In the United States, federal agencies are aggressively stimulating hydrocolloid innovation through public-private partnerships, SBIR awards, and R&D investment. As an example, ExoPolymer, Inc. received a Small Business SBIR grant ($648K) from the USDA's National Institute of Food and Agriculture (NIFA) to develop next-generation fermentation-derived biopolymer hydrocolloids, also increasing domestic production based on corn feedstock and enhancing performance over standard ingredients such as xanthan or alginate.

Report Coverage

This research report categorizes the market for the United States hydrocolloids market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hydrocolloids market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hydrocolloids market.

United States Hydrocolloids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,550.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.40% |

| 2035 Value Projection: | USD 4,550.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Function and COVID-19 Impact Analysis |

| Companies covered:: | CP Kelco, Cargill, Darling Ingredients Inc, Ashland Inc, Ingredion Inc, DuPont de Nemours Inc, Archer-Daniels Midland Co, DSM, Tate & Lyle, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hydrocolloids market is boosted because biopolymers are very commonly employed in the field of food technology. Hydrocolloids are also commonly added to food formulations for increased acceptability and preservation. Hydrocolloids have historically included a large spectrum of food intermediates, including marmalade, low-sugar per calorie gels, salad dressings, gravies, toppings, sauces, jellies, jam, restructured foods, and soups. It is also possible to use hydrocolloids to control flavours and prevent the formation of sugar and ice crystals in ice cream. In the baking industry, these substances also enhance food texture and moisture retention, delaying the retrogradation of starch and enhancing the quality of products during storage.

Restraining Factors

The United States hydrocolloids market faces obstacles, as there is no exact universal guidance on how different chemical ingredients may be incorporated into final products. Every region has its strategies and regulations. This has made it more costly to produce materials specific to a certain region.

Market Segmentation

The United States hydrocolloids market share is classified into product and function.

- The gelatin segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hydrocolloids market is segmented by product into gelatin, xanthan gum, carrageenan, alginates, pectin, guar Gum, carboxy methyl cellulose, agar, gum arabic, and locust bean gum. Among these, the gelatin segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its variety of medications, including hemostatic sponges, blood volume substitutes, and a variety of wound dressings as well. Market expansion is expected to greatly benefit from the development of pharmaceutical markets in the United States, considering the increasing costs of introducing new technology.

- The thickening segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the function, the United States hydrocolloids market is segmented into thickening, gelling, stabilizing, and others. Among these, the thickening segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by hydrocolloids as it can affect the rheology of food systems, which affects the mechanical solid characteristics (texture) and flow behaviour (viscosity) properties. Changing the viscosity and texture of food can change the sensory properties of food, because hydrocolloids are commonly used as food additives to achieve specific objectives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hydrocolloids market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CP Kelco

- Cargill

- Darling Ingredients Inc

- Ashland Inc

- Ingredion Inc

- DuPont de Nemours Inc

- Archer-Daniels Midland Co

- DSM

- Tate & Lyle

- Others

Recent Development

- In June 2024, DuPont (NYSE: DD) has completed the acquisition of Donatelle Plastics Incorporated, a leading medical device contract manufacturer specializing in the design, development, and manufacture of medical components and devices. This strategic move enhances DuPont’s capabilities in the medical device sector, particularly in areas requiring advanced manufacturing technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hydrocolloids market based on the following segments:

United States Hydrocolloids Market, By Product

- Gelatin

- Xanthan Gum

- Carrageenan

- Alginates

- Pectin

- Guar Gum

- Carboxy Methyl Cellulose

- Agar

- Gum Arabic

- Locust Bean Gum

United States Hydrocolloids Market, By Function

- Thickening

- Gelling

- Stabilizing

- Others

Need help to buy this report?