United States Hoverboard Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-wheel and Double-wheel), By Wheel Size (6.5-inch, 8-inch, and 10-inch and Above), and United States Hoverboard Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Hoverboard Market Insights Forecasts to 2035

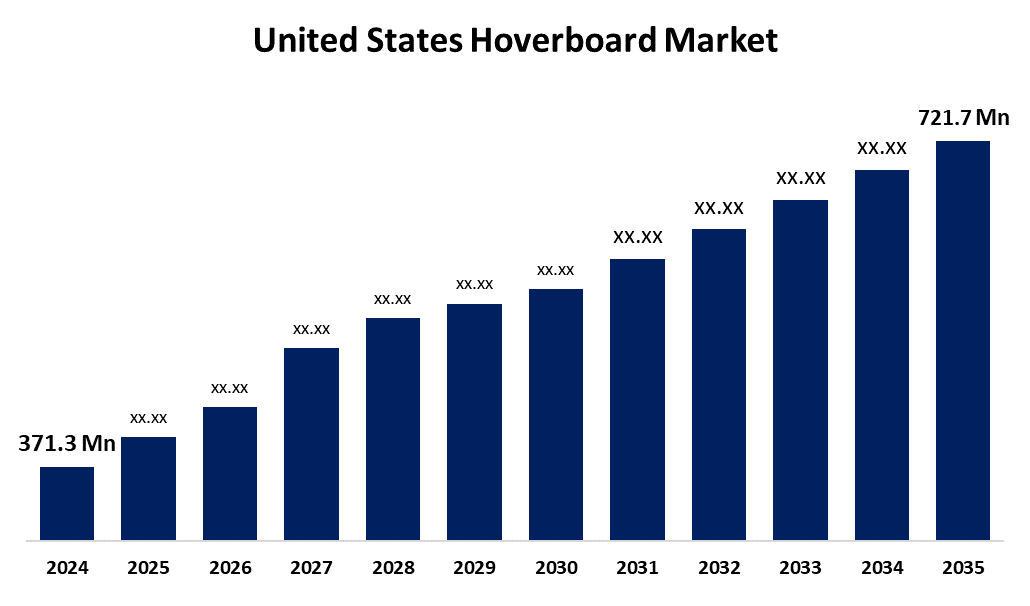

- The US Hoverboard Market Size Was Estimated at USD 371.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.23% from 2025 to 2035

- The US Hoverboard Market Size is Expected to Reach USD 721.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Hoverboard Market Size is Anticipated to Reach USD 721.7 Million by 2035, Growing at a CAGR of 6.23% from 2025 to 2035. The expansion of the United States hoverboard market is propelled by many consumers, particularly younger ones, who view hoverboards as entertaining devices that provide a fun and fashionable way to participate in outdoor activities.

Market Overview

A hoverboard, often called a self-balancing board, is a two-wheeled electric scooter that is intended for individual use. The hoverboard market has experienced explosive growth in recent years among younger demographics, particularly teens and young adults. The popularity of social media, viral marketing initiatives, and the perception of hoverboards as a cool recreational device all provide some context for the prevalence of hoverboards recently. Hoverboards appeal to this age demographic because they create opportunities to perform stunts, the boards can be customised in various colourful graphics, and the users can share their experiences on social media. Demand has further accelerated by the increasing supply of features, models, and price points, abjectly meeting the financial means of younger consumers. As hoverboard technology progressed, smart features and safety features have been overlaid. Battery improvements for hoverboards also improved performance, which directly augmented the user experience with modern hoverboards. Policy in many jurisdictions is promoting eco-friendly alternatives to transport, akin to climate change initiatives and lowered carbon emissions further promote the adoption of hoverboards. Hoverboards have the potential to improve individuals' health by getting them away from sedentary activities, and riding a hoverboard inherently promotes balanced riding through focus and proper riding posture.

Report Coverage

This research report categorizes the market for the United States hoverboard market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hoverboard market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hoverboard market.

United States Hoverboard Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 371.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.23% |

| 2035 Value Projection: | USD 721.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Wheel Size and COVID-19 Impact Analysis. |

| Companies covered:: | Razor, Hover1, Segway, Swagtron, Epikgo, Gyroor, Xprit, Sisigad and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hoverboard market is boosted by workplace locations, such as malls, airports, and businesses. Hoverboards allow for quicker movement across these workplace locations, especially in an industrial work environment, i.e., travel from a warehouse to delivery docks. Several businesses use these transportation devices to manage work in every department, thereby saving time. By minimizing the time spent doing extensive site research in larger areas, security businesses in malls and airports can reduce time spent securing the public, employees, and their structures by also using these as security vehicles. And New York has given tour guides hoverboards to include tourists in a fun way while in museums, historical landmarks, and towns. Photographers, parking cops, and planners also use hoverboards to simplify their jobs and make them easier.

Restraining Factors

The United States hoverboard market faces obstacles like high-tech models of it can be costly and not affordable to underdeveloped and poor regions. However, these electric vehicles may not be designed for outdoor spaces, possibly depending on the outdoor weather. Hoverboards can be purchased online and often for dirt-cheap prices.

Market Segmentation

The United States hoverboard market share is classified into type and wheel size.

- The double-wheel segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hoverboard market is segmented by type into single-wheel and double-wheel. Among these, the double-wheel segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it can tackle surfaces from smooth indoor flooring to tough outdoor surfaces like grass or gravel. This means that double-wheel hoverboards have more versatility in their use, something that is important to consumers who want a multi-functional device for use for leisure and transportation.

- The 6.5-inch segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the wheel size, the United States hoverboard market is segmented into 6.5-inch, 8-inch, and 10-inch and above. Among these, the 6.5-inch segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because offline retailers typically provide the opportunity to interact with several models, which may give consumers confidence in their choice to purchase. An additional advantage of this technology, in particular, is to talk to a knowledgeable salesperson who is capable of answering questions and providing personalized suggestions for a more satisfying purchase experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hoverboard market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Razor

- Hover1

- Segway

- Swagtron

- Epikgo

- Gyroor

- Xprit

- Sisigad

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hoverboard market based on the following segments:

United States Hoverboard Market, By Type

- Single-wheel

- Double-wheel

United States Hoverboard Market, By Wheel Size

- 6.5-inch

- 8-inch

- 10-inch and Above

Need help to buy this report?