United States Hot-Rolled Steel Market Size, Share, and COVID-19 Impact Analysis, By Thickness (Less Than or Equal To 3mm and Greater Than 3mm), By End-Use (Construction & Infrastructure, Oil & Gas, Automotive, Industrial Equipment, Shipbuilding & Marine, and Others), and United States Hot-Rolled Steel Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Hot-Rolled Steel Market Size Insights Forecasts to 2035

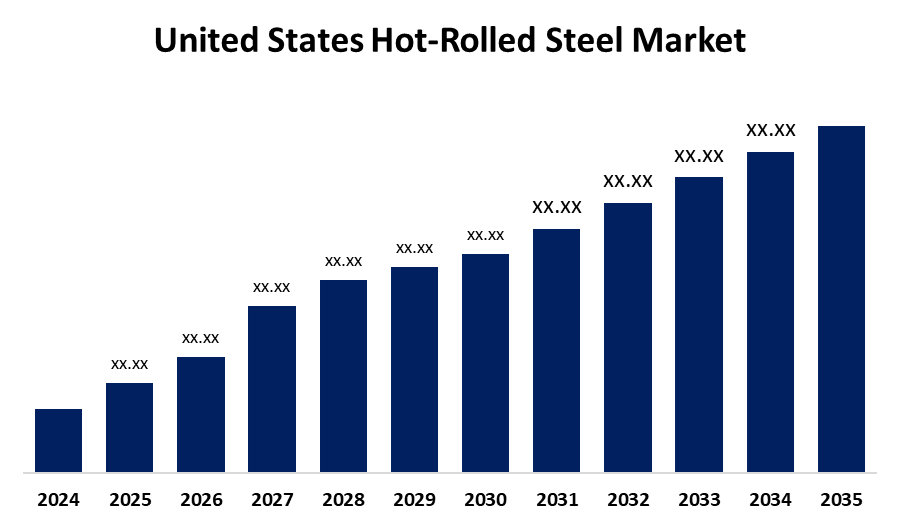

- The USA Hot-Rolled Steel Market Size is Expected to Grow at a CAGR of around 3.2% from 2025 to 2035.

- The United States Hot-Rolled Steel Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the U.S. Hot-Rolled Steel Market Size is Expected to hold a significant share by 2035, growing at a CAGR of 3.2% from 2025 to 2035. The Growth in the U.S. Hot-Rolled Steel Sector Market is driven by strong demand from the infrastructure, automotive, and energy industries. Government investments, domestic manufacturing incentives, and technological advancements like electric arc furnaces enhance efficiency and output. Additionally, a shift toward sustainable production and increased reshoring efforts further supports the market’s expansion and long-term development.

Market Overview

The United States Hot-Rolled Steel Market refers to the production and distribution of steel that has been roll-processed at high temperatures, making it suitable for use in construction, automotive, heavy machinery, and energy applications. Market growth is primarily driven by rising demand in infrastructure development, automotive manufacturing, and increased energy sector activity, particularly in pipelines and renewable energy structures. A major strength of the U.S. hot-rolled steel market lies in its robust domestic production capacity, led by key players like Nucor, U.S. Steel, and Cleveland-Cliffs, who continue to invest in technological upgrades and sustainability. Opportunities are emerging from advancements in electric arc furnace (EAF) technology, increasing emphasis on decarbonization, and growing demand for domestically sourced materials under reshoring efforts. Furthermore, government initiatives such as the Infrastructure Investment and Jobs Act and tariffs on imported steel have fostered local industry growth by protecting domestic producers and encouraging investment in modern, energy-efficient manufacturing facilities, positioning the U.S. as a globally competitive steel producer.

Report Coverage

This research report categorizes the market for the United States hot-rolled steel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' hot-rolled steel market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hot-rolled steel market.

United States Hot-Rolled Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Thickness, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | Commercial Metals Company (CMC), United States Steel Corporation, North Star BlueScope Steel, California Steel Industries, Evraz North America, Nucor Corporation, Gerdau Ameristeel, Steel Dynamics, Inc., Cleveland-Cliffs Inc., Worthington Steel, ArcelorMittal USA, SSAB Americas, NLMK USA, TMK Ipsco, AK Steel, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising infrastructure investments, fueled by federal programs like the Infrastructure Investment and Jobs Act, have significantly increased demand for steel in bridges, highways, and public transportation projects. The automotive and construction sectors remain major consumers, supported by a shift toward electric vehicles and housing development. Growth in the energy sector, especially in pipeline construction and renewable energy infrastructure, further propels steel demand. Additionally, reshoring efforts and a focus on domestic manufacturing are boosting reliance on locally produced steel. Technological advancements, such as electric arc furnaces, enhance production efficiency and sustainability, making domestic steel more competitive. These factors collectively support long-term growth in the hot-rolled steel market.

Restraining Factors

The volatile raw material prices, particularly for iron ore and scrap metal, impact production costs. Additionally, global supply chain disruptions and competition from low-cost international producers pose challenges. Environmental regulations and the high capital investment required for modernization also limit rapid expansion and add pressure on profit margins.

Market Segmentation

The United States hot-rolled steel market share is classified into thickness and end-use.

- The less than or equal to 3mm segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States hot-rolled steel market is segmented by thickness into less than or equal to 3mm and greater than 3mm. Among these, the less than or equal to 3mm segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because thinner steel sheets are widely used in automotive manufacturing, appliance production, and light construction. Their versatility, ease of shaping, and cost-effectiveness make them ideal for applications requiring precision and lightweight materials without compromising strength.

- The construction & infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States hot-rolled steel market is segmented by end-use into construction & infrastructure, oil & gas, automotive, Industrial Equipment, shipbuilding & marine, and Others. Among these, the construction & infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to strong demand for building roads, bridges, and commercial structures. Government investments, especially under the Infrastructure Investment and Jobs Act, boost usage. Hot-rolled steel’s strength, affordability, and versatility make it ideal for large-scale, long-lasting infrastructure and construction projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hot-rolled steel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Commercial Metals Company (CMC)

- United States Steel Corporation

- North Star BlueScope Steel

- California Steel Industries

- Evraz North America

- Nucor Corporation

- Gerdau Ameristeel

- Steel Dynamics, Inc.

- Cleveland-Cliffs Inc.

- Worthington Steel

- ArcelorMittal USA

- SSAB Americas

- NLMK USA

- TMK Ipsco

- AK Steel

- Others

Recent Developments:

- In January 2025, Nucor Corporation (NYSE: NUE) announced consolidated net earnings attributable to Nucor stockholders of $287 million, or $1.22 per diluted share, for the fourth quarter of 2024. By comparison, Nucor had reported consolidated net earnings attributable to Nucor stockholders of $250 million, or $1.05 per diluted share, for the third quarter of 2024.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. hot-rolled steel market based on the below-mentioned segments:

United States Hot-Roled Steel Market, By Thickness

- Less Than or Equal To 3mm

- Greater Than 3mm

United States Hot-Rolled Steel Market, By End-use

- Construction & Infrastructure

- Oil & Gas

- Automotive

- Industrial Equipment

- Shipbuilding & Marine

- Others

Need help to buy this report?