United States Hot Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Coffee, Tea, Others (Malt-Based Drinks, Hot Chocolate, and Apple Cider)), By Distribution Channel (Supermarkets/Hypermarkets, Coffee Shops, Departmental Stores, Online, Others), and United States Hot Drinks Market Insights Forecasts to 2033

Industry: Food & BeveragesUnited States Hot Drinks Market Insights Forecasts to 2033

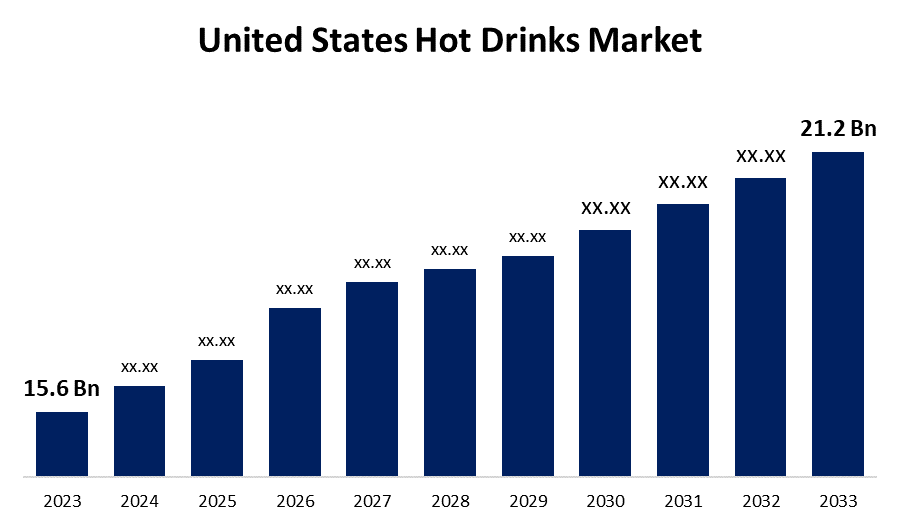

- The United States Hot Drinks Market Size was valued at USD 15.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.1% from 2023 to 2033.

- The United States Hot Drinks Market Size is Expected to Reach USD 21.2 Billion by 2033.

Get more details on this report -

The United States Hot Drinks Market Size is expected to reach USD 21.2 Billion by 2033, at a CAGR of 3.1% during the forecast period 2023 to 2033.

Market Overview

Hot drinks, unlike cold drinks, are beverages that are served hot. Tea, coffee, hot chocolate, apple cider, mulled wine, coffee, and other drinks are frequently served. Drinking hot beverages has numerous benefits, including relaxing brain muscles, eliminating unwanted laziness, increasing energy levels, relieving chest congestion, and keeping the body warm, among others. Furthermore, coffee is a popular hot beverage in the United States, with a long-standing coffee culture that is deeply ingrained in many Americans' daily lives. The U.S. has large number of coffee shops, both independent and chain, that provide a diverse range of coffee options. Espresso, cappuccino, latte, and drip coffee are a few of the many coffee options available. During the forecast period, there has been a surge in artisanal and specialty coffee, driven by a desire for high-quality, ethically sourced beans and innovative brewing methods. Moreover, tea consumption has also been increasing in the United States. While usually surpassed by coffee, the market for tea, particularly herbal and specialty varieties, has expanded significantly. This trend is being driven by health-conscious consumers seeking tea's wellness benefits, as well as an increasing interest in unique and exotic flavors. Traditional black tea, green tea, and herbal infusions are popular choices.

Report Coverage

This research report categorizes the market for the United States hot drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hot drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hot drinks market.

United States Hot Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.1% |

| 2033 Value Projection: | USD 21.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Nestle USA, Starbucks Corporation, Keurig Dr Pepper Inc., The J. M. Smucker Company, Peet's Coffee & Tea, LLC, The Kraft Heinz Company, Unilever United States, Inc., Tata Consumer Products US Holdings Inc., The Hain Celestial Group, Inc., Lavazza Premium Coffees Corp., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

A growing working population, rising demand for ready-to-use products, and expanding retail marketplaces are among the factors that will drive the hot drinks and soft drinks market forward. The market for hot drinks is expected to grow owing to the increased use of natural hot drink components such as tea and coffee extracts in the food and beverage industry. Effective packaging equipment will serve as an additional driving force in United States. It helps to preserve the flavor and quality of hot beverages. Furthermore, the use of simple packaging materials has reduced production costs and energy consumption. As a result, manufacturers are investing more in research and development for flexible packaging. Companies in the U.S. hot drinks market use innovative technologies for roasting beans to improve flavor and reduce holding times, which is expected to increase customer base. These technologies process ingredients at lower temperatures, preventing the evaporation of volatile components and increasing consumer demand in the United States.

Restraining Factors

Fluctuating raw material prices would slow the rate of growth in the hot beverage market. Hot beverages are popular during the winter. This will also have an adverse effect on summer sales. Excessive consumption of hot drinks is harmful. Someone who becomes addicted may have constant anxiety. As a result, may hamper the growth of United States hot drinks market during the forecast period.

Market Segment

- In 2023, the coffee segment accounted for the largest revenue share over the forecast period.

Based on the product type, the United States hot drinks market is segmented into coffee, tea, and others (malt-based drinks, hot chocolate, apple cider). Among these, the coffee segment has the largest revenue share over the forecast period. Coffee is one of the most popular beverages in the United States, owing to its cultural, social, and economic importance. Coffee is deeply embedded in American culture and everyday life. It's not just a drink; it's a ritual and a social custom. Morning routines frequently revolve around the essential cup of coffee, which serves as a means of connecting with others, whether for a business meeting, catching up with friends, or simply enjoying a quiet moment. The coffee shop culture, exemplified by major chains such as Starbucks, has emphasized the social aspect of coffee consumption. Because of its cultural and social significance, coffee remains in high demand in the United States.

- In 2023, the supermarkets/hypermarkets segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States hot drinks market is segmented into supermarkets/hypermarkets, coffee shops, departmental stores, online, and others. Among these, the supermarkets/hypermarkets segment has the largest revenue share over the forecast period. Mass merchandisers, grocery stores, and hypermarkets account for the majority of the market. Many people prefer to purchase hot drinks from supermarkets and general merchandisers because of the shopping experiences they offer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hot drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle USA

- Starbucks Corporation

- Keurig Dr Pepper Inc.

- The J. M. Smucker Company

- Peet's Coffee & Tea, LLC

- The Kraft Heinz Company

- Unilever United States, Inc.

- Tata Consumer Products US Holdings Inc.

- The Hain Celestial Group, Inc.

- Lavazza Premium Coffees Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Starbucks launched olive oil-infused coffee in Italy, with plans to expand to the United States in the spring. Schultz hinted at the release during the company's earnings call in February, describing it as "alchemy" and a "game-changer." The coffee giant will launch its "Oleato" line in about two dozen Italian locations on Wednesday, with plans to expand to Southern California later this spring.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Hot Drinks Market based on the below-mentioned segments:

United States Hot Drinks Market, By Product Type

- Coffee

- Tea

- Others (Malt-Based Drinks, Hot Chocolate, and Apple Cider)

United States Hot Drinks Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Coffee Shops

- Departmental Stores

- Online

- Others

Need help to buy this report?