United States Hot-dip Galvanized Steel Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Sheet & Strip, Structure, Pipe & Tube, and Wire & Hardware), By Application (Construction, Home Appliance, Automotive, and General Industrial), and United States Hot-dip Galvanized Steel Products Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Hot-dip Galvanized Steel Products Market Insights Forecasts to 2035

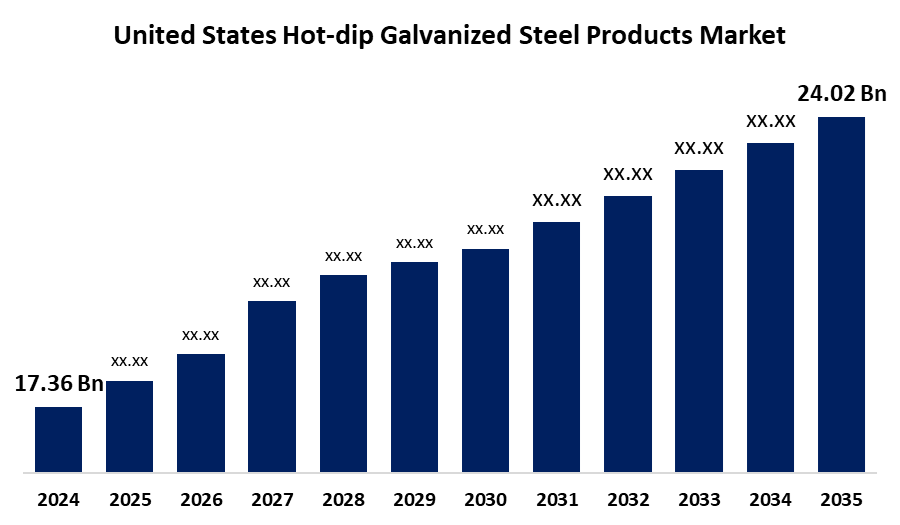

- The United States Hot-dip Galvanized Steel Products Market Size was estimated at USD 17.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.00% from 2025 to 2035

- The United States Hot-dip Galvanized Steel Products Market Size is Expected to Reach USD 24.02 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The U.S. Hot-Dip Galvanized Steel Products Market Size is anticipated to reach USD 24.02 Billion by 2035, Growing at a CAGR of 3.00% from 2025 to 2035. The US hot-dip galvanized (HDG) steel market size is growing due to construction industry demand for durable materials, technological advancements in galvanizing, and increased demand from the automotive sector, particularly for electric vehicles, requiring lightweight, corrosion-resistant parts. Environmental regulations also promote the use of recyclable HDG steel, contributing to the market's expansion.

Market Overview

The United States Hot-Dip Galvanized (HDG) Steel Products Market Size refers to the industry focused on producing and distributing steel coated with a protective layer of zinc through a hot-dip process, which enhances durability and corrosion resistance. This market is expanding due to growing demand in construction, automotive, and infrastructure development. HDG steel’s longevity, recyclability, and low maintenance make it ideal for use in bridges, buildings, and vehicle parts. Strengths of the market lie in its cost-effectiveness, widespread availability, and environmental sustainability, aligning with growing green building practices. Opportunities are emerging in renewable energy projects, smart infrastructure, and increased public and private investment in durable building materials. Technological advancements in galvanizing processes, such as improved coating techniques and energy efficiency, also offer long-term benefits. Government initiatives like the Infrastructure Investment and Jobs Act and stringent environmental regulations further stimulate demand by promoting corrosion-resistant and recyclable materials.

Report Coverage

This research report categorizes the market for the United States hot-dip galvanized steel products market size based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' hot-dip galvanized steel products market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hot-dip galvanized steel products market.

United States Hot-dip Galvanized Steel Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.36 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.00% |

| 2035 Value Projection: | USD 24.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | American Tinning & Galvanizing Co., LA Galvanizing, V&S Galvanizing, Macsteel Service Centers USA, Los Angeles Galvanizing Co., Worthington Industries, Korns Galvanizing Co., Curtis Steel Co., Inc., Duncan Galvanizing, AZZ Inc., Reliance, Inc., O’Neal Industries, Pacific Galvanizing, Metals USA, Infra-Metals Co., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand in the construction sector, particularly for infrastructure, commercial, and residential buildings, fuels the need for corrosion-resistant materials. The automotive industry, especially electric vehicle production, increases demand for lightweight and durable components. Environmental sustainability trends also support HDG steel, as it is fully recyclable and aligns with green construction standards. Technological advancements in galvanizing processes enhance product quality and energy efficiency, boosting competitiveness. Moreover, strict environmental regulations encourage the use of eco-friendly, long-lasting materials. Government investments through legislation like the Infrastructure Investment and Jobs Act further drive market expansion by funding large-scale infrastructure projects that rely on durable, galvanized steel components.

Restraining Factors

The fluctuating raw material prices, especially zinc and steel, which impact production costs and pricing stability. High energy consumption during the galvanizing process increases operational expenses. Environmental regulations, while promoting sustainability, also impose costly compliance requirements. Additionally, competition from alternative corrosion-resistant materials like stainless steel and coatings limits market growth. Supply chain disruptions and skilled labor shortages further challenge timely production and delivery.

Market Segmentation

The United States hot-dip galvanized steel products market share is classified into product type and application.

- The sheet & strip segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States hot-dip galvanized steel products market is segmented by product type into sheet & strip, structure, pipe & tube, and wire & hardware. Among these, the sheet & strip segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its extensive use in the automotive, construction, and appliance industries. Its superior corrosion resistance, formability, and cost-effectiveness make it ideal for mass production and structural applications.

- The construction segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States hot-dip galvanized steel products market is segmented by application into construction, home appliance, automotive, and general industrial. Among these, the construction segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its high demand for corrosion-resistant materials in infrastructure, residential, and commercial projects. Galvanized steel’s durability, strength, and low maintenance make it ideal for building frames, roofing, and structural components, driving consistent demand across the construction industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hot-dip galvanized steel products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Tinning & Galvanizing Co.

- LA Galvanizing, V&S Galvanizing

- Macsteel Service Centers USA

- Los Angeles Galvanizing Co.

- Worthington Industries

- Korns Galvanizing Co.

- Curtis Steel Co., Inc.

- Duncan Galvanizing

- AZZ Inc.

- Reliance, Inc.

- O'Neal Industries

- Pacific Galvanizing

- Metals USA

- Infra-Metals Co.

- Others

Recent Developments:

- In March 2023, V&S Galvanizing, a leading hot-dip galvanizing service provider, announced the acquisition of Korns Galvanizing Company, Inc. The addition of Korns allows V&S to expand both capacity and capabilities in the region. Korns complements current facilities and allows V&S to grow to meet the current market conditions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hot-dip galvanized steel products market based on the below-mentioned segments:

U.S. Hot-dip Galvanized Steel Products Market, By Product Type

- Sheet & Strip

- Structure

- Pipe & Tube

- Wire & Hardware

U.S. Hot-dip Galvanized Steel Products Market, By Application

- Construction

- Home Appliance

- Automotive

- General Industrial

Need help to buy this report?