United States Hosiery Market Size, Share, and COVID-19 Impact Analysis, By Type (Non-Sheer and Sheer), By End-use (Women’s and Men’s), and United States Hosiery Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Hosiery Market Insights Forecasts to 2035

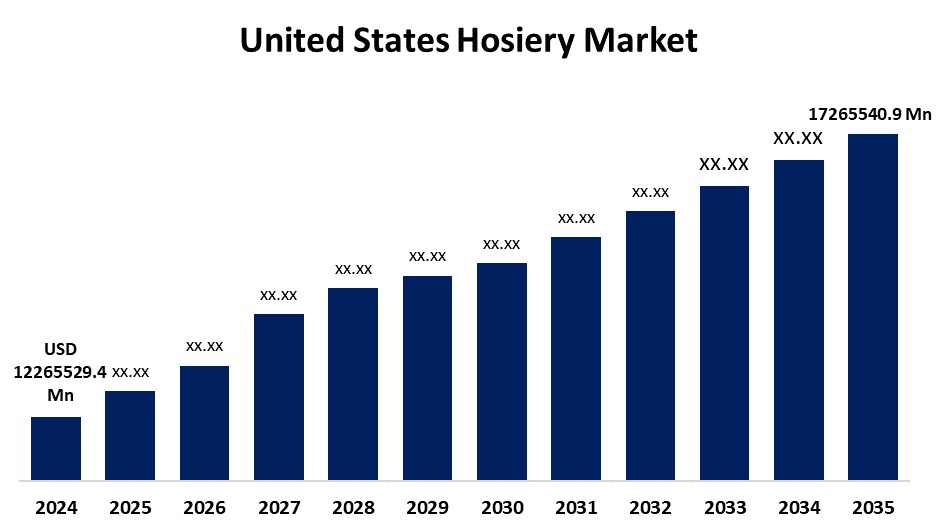

- The US Hosiery Market Size Was Estimated at USD 12265529.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.16% from 2025 to 2035

- The US Hosiery Market Size is Expected to Reach USD 17265540.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Hosiery Market is anticipated to reach USD 17265540.9 million by 2035, growing at a CAGR of 3.16% from 2025 to 2035. The expansion of the United States hosiery market is propelled by the modern metropolitan lifestyle, which prioritises comfort and personal appearance.

Market Overview

The hosiery refers to clothing that is worn directly on the feet and legs, such as tights, stockings, socks, and pantyhose. These items are usually knit or elastic, such as spandex, cotton, nylon, or wool. Homely apparel, especially that which is durable by nature and provides essential support, is beneficial in reducing fatigue in working professionals who are on their feet for long hours. Since consumer demand for an update in design, material library, or aesthetic appeal keeps changing, players in the industry are working on creative approaches to pursue that vision. These collaborative activities have significantly contributed to the expansion of the hosiery industry. The capacity for e-commerce to provide hosiery companies with direct opportunities to engage with customers in an online setting. Digital marketing engagements can often be created that enhance brand access and awareness, or through a combination of virtual try-on capabilities and an actual online purchasing experience. The overall advantages that have resulted from e-commerce for the hosiery industry, the newer developments of e-commerce, such as an increased market reach with direct access to convenience and an experience option with a product library offering product options for customers.

Report Coverage

This research report categorizes the market for the United States hosiery market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hosiery market. Recent market developmen’sts and competitive strategies such as expansion, product launch, developmen’st, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hosiery market.

United States Hosiery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12265529.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.16% |

| 2035 Value Projection: | USD 17265540.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Carolina Hosiery, Jockey International, Spanx, Hanesbrands Inc, Wolford AG, Commando, Gildan Activewear Inc., CSP International Fashion Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hosiery market is boosted by consumer preferences and fashion trends. In terms of legwear fashion, there can be an influence by non-hosiery fashion related to footwear and wardrobe pieces. Consumer demand for fresh legwear options is influenced by new designs, patterns, and colours as they relate to fashion. The latest legwear trends come from a resurgence in vintage and retro fashion. Runway fashion also greatly drives the trends in hosiery. The designs featured in designer runway shows influence legwear trends of the future. Sheer tights distressed with rich patterns or decoration on fashion runways may be used as inspiration for similar retail items created for the consumer, with consumer buying preferences and limited options for consideration.

Restraining Factors

The United States hosiery market faces obstacles like Limited socks may lose demand due to the perception of warm weather, but this may affect sales at certain times too. The hosiery industry may experience seasonal demand that affects inventory tracking.

Market Segmentation

The United States hosiery market share is classified into type and end-use.

- The non-sheer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hosiery market is segmented by type into non-sheer and sheer. Among these, the non-sheer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it often used by many sports participants, medical providers, flight attendants, stewardesses, and other professionals who work. These styles of hosiery are used to serve more pragmatic purposes like protection from the elements, compression of muscles, and skin protection. Such hosiery is durable enough to withstand regular activity.

- The women’s segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States hosiery market is segmented into women’s and men’s. Among these, the women’s segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is common in many professions to be on feet for extended periods of time, increasing the risk for diseases related to poor circulation, like varicose veins and oedema, making hosiery use a preventive measure for some women’s workers. Additionally, another major driver of growth for the female segment of the hosiery market is the increased importance of hosiery to women's athletics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hosiery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developmen’sts of the companies, which includes product developmen’st, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carolina Hosiery

- Jockey International

- Spanx

- Hanesbrands Inc

- Wolford AG

- Commando

- Gildan Activewear Inc.

- CSP International Fashion Group

- Others

Recent Developments

- In June 2023, the LYCRA Company, a U.S.-based hosiery manufacturing company, introduced its innovative sheer sensation technology in its hosiery products. The technology will help eliminate static build-up issues in hosiery. It also helped boost dye color absorption, allowing the company to provide hosiery in different shades of color.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hosiery market based on the following segments:

United States Hosiery Market, By Type

- Non-Sheer

- Sheer

United States Hosiery Market, By End-use

- Women’s

- Men’s

Need help to buy this report?