United States Herceptin Market Size, Share, and COVID-19 Impact Analysis, By Product (Biosimilar and Biologic), By Application (Breast Cancer and Stomach/Gastric Cancer), and United States Herceptin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Herceptin Market Insights Forecasts to 2035

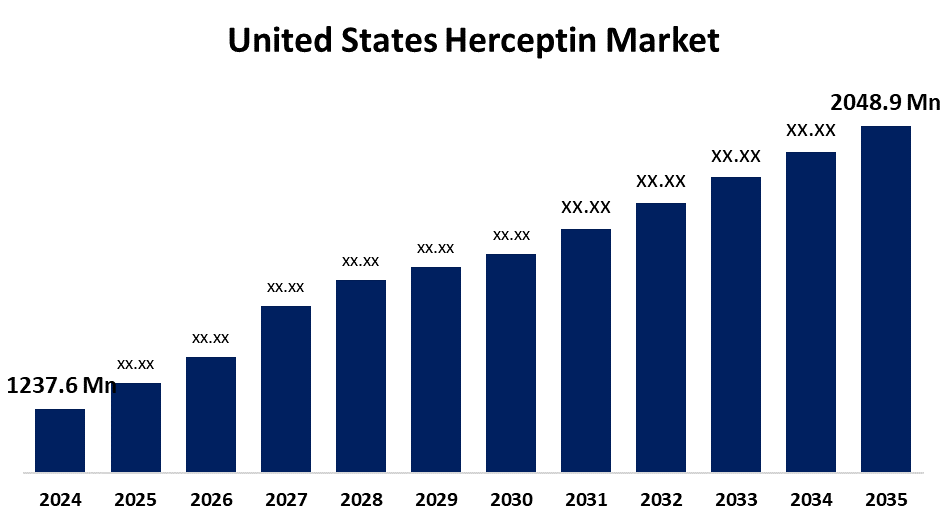

- The US Herceptin Market Size Was Estimated at USD 1237.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.69% from 2025 to 2035

- The US Herceptin Market Size is Expected to Reach USD 2048.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Herceptin Market is anticipated to reach USD 2048.9 million by 2035, growing at a CAGR of 4.69% from 2025 to 2035. The expansion of the United States herceptin market is propelled by the growing prevalence of breast cancer that is HER2-positive and the growing knowledge of targeted cancer treatments.

Market Overview

Herceptin is a humanised IgG1 monoclonal antibody that was developed by Genentech. Changes in delivery methods and therapeutic techniques are shaking up the industry. Subcutaneous versions of Herceptin are becoming increasingly popular due to their shorter infusion times and ease of administration. New clinical guidelines that endorse shorter treatment regimens have boosted efficiency without compromising results. Due to advancements in diagnostics, more patients are being diagnosed earlier and more accurately for HER2 status, leading to a rise in eligible patients. Clinical innovation is also being driven by combination therapies that pair trastuzumab with immunotherapeutics, pertuzumab, or chemotherapy. Patient adherence support programs are enhancing long-term outcomes, while increased awareness and training among healthcare practitioners are ensuring more consistent testing procedures. These evolving circumstances are solidifying Herceptin's role as a cornerstone treatment for HER2-positive cancer. A notable trend in the US Herceptin market is the shift towards combination and sequential therapy to improve outcomes for HER2-positive tumors.

The U.S. government has encouraged access to trastuzumab and its biosimilars through a comprehensive regulatory and policy framework designed to increase affordability and competitiveness. The FDA used a shortened 351(k) pathway under the Biologics Price Competition and Innovation Act (BPCIA) to expedite the clearance process for biosimilars, including numerous trastuzumab biosimilars, while maintaining stringent safety and effectiveness standards.

Report Coverage

This research report categorizes the market for the United States herceptin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States herceptin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States herceptin market.

United States Herceptin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1237.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.69% |

| 2035 Value Projection: | USD 2048.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Mylan, Pfizer Inc, Amgen Inc, Celltrion Healthcare Co., Ltd., Biocon Limited, Prestige Biopharma, Dr. Reddys Laboratories, Roche Holding AG, Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States herceptin market is boosted by the increasing number of HER2-positive tumors and advancements in precision oncology. HER2 plays a vital role in aggressive tumors; pinpointing its presence has become essential for planning effective treatments. According to SEER, about 13.6% of all breast cancer cases in women in the United States are HER2-positive subtypes, highlighting a significant demand for targeted therapies like Herceptin. Given that breast cancer is the most commonly diagnosed cancer, the need for HER2-directed treatments is particularly pressing. The ongoing use of herceptin in treatment settings is supported by routine HER2 testing and its integration into first-line and adjuvant therapy strategies.

Restraining Factors

The United States herceptin market faces obstacles like restricting access despite the availability of biosimilars. Strict patient monitoring is required due to clinical concerns about cardiotoxicity and other side effects, which increases complexity and lowers uptake. Furthermore, regulatory obstacles and intense biosimilar competition reduce branded market share and postpone fresh entry possibilities.

Market Segmentation

The United States herceptin market share is classified into product and application.

- The biosimilar segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States herceptin market is segmented by product into biosimilar and biologic. Among these, the biosimilar segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the surge in demand for affordable oncology treatments, along with patent expirations and the increasing acceptance of biosimilars by both payers and doctors. Competitive pricing has made biosimilars an attractive option for healthcare systems, and regulatory approvals.

- The breast cancer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States herceptin market is segmented into breast cancer and stomach/gastric cancer. Among these, the breast cancer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by herceptin's well-earned reputation as the gold standard for treating HER2-positive breast cancer in early-stage, adjuvant, and metastatic settings is which keeps it firmly in the spotlight. Its ongoing dominance is backed by a wealth of clinical data, supportive guidelines, and the extensive experience oncologists have with it.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States herceptin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mylan

- Pfizer Inc

- Amgen Inc

- Celltrion Healthcare Co., Ltd.

- Biocon Limited

- Prestige Biopharma

- Dr. Reddys Laboratories

- Roche Holding AG

- Others

Recent Development

- In September 2024, Accord BioPharma, Inc., the U.S. specialty arm of Intas Pharmaceuticals, announced FDA approval of a 420mg dose of HERCESSI (trastuzumab-strf), a biosimilar to Herceptin, for treating HER2-positive breast and gastric cancers. This follows the earlier approval of a 150mg dose and positions the company to launch its first U.S. biosimilar.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States herceptin market based on the following segments:

United States Herceptin Market, By Product

- Biosimilar

- Biologic

United States Herceptin Market, By Application

- Breast Cancer

- Stomach/Gastric Cancer

Need help to buy this report?