United States Hempcrete Market Size, Share, and COVID-19 Impact Analysis, By Application (Wall, Floor, and Roof), By End-use (Residential and Non-residential), and United States Hempcrete Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Hempcrete Market Insights Forecasts to 2035

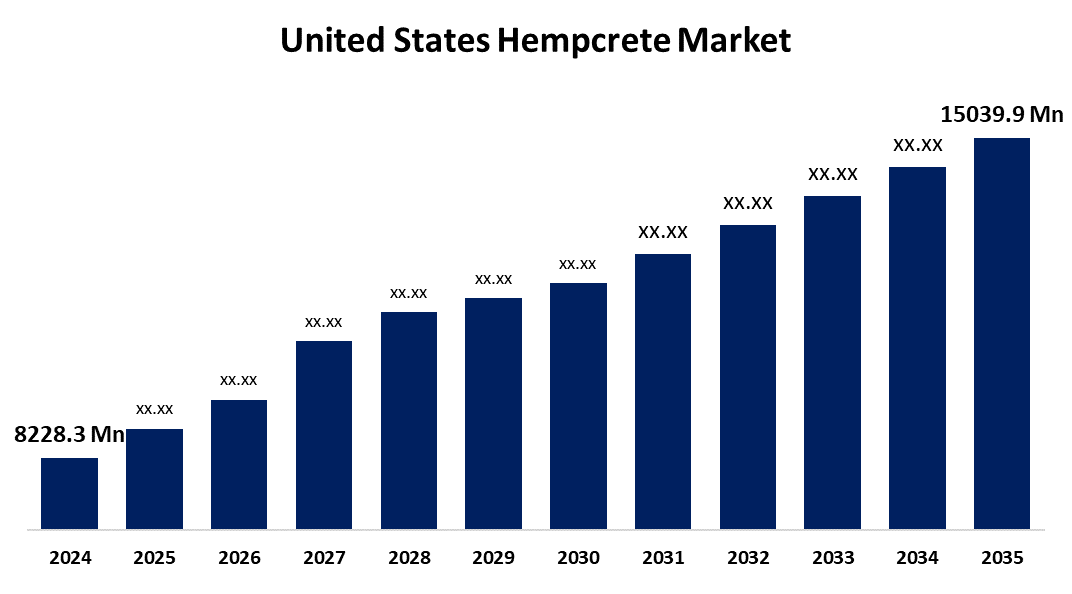

- The US Hempcrete Market Size Was Estimated at USD 8228.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.64% from 2025 to 2035

- The US Hempcrete Market Size is Expected to Reach USD 15039.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Hempcrete Market Size is Anticipated to reach USD 15039.9 Million by 2035, Growing at a CAGR of 5.64% from 2025 to 2035. The expansion of the United States hempcrete market is propelled by the growing focus on environmentally friendly and sustainable building materials.

Market Overview

Hempcrete is a biocomposite building material composed of water, a lime-based binder, and the inner woody core of the hemp plant, also known as hemp hurds or shives. The carbon footprint of the construction industry is reduced considerably relative to traditional building materials, like concrete. Hempcrete is expected to become the primary material used for sustainable building as national governments and environmental agencies put pressure in the form of initiatives such as LEED and BREEAM to use energy efficiency and green building practices. Product and process innovation is also transforming the market for hempcrete by enhancing material performance and increasing the possibility of using hempcrete in conventional buildings. Manufacturers are developing varieties of hempcrete, including pre-cast blocks and sprayable hempcrete, as well as hybridized mixtures that enhance fire-resistance, decrease cure times, and increase thermal performance. These important advances are making hempcrete more versatile for residential and commercial projects. The innovations present considerable evidence of hempcrete's increasing potential to meet stringent building regulations and codes.

The U.S. government has actively supported the development and use of hempcrete, a sustainable, carbon-negative building material, through a variety of initiatives aimed at fostering innovation, standardisation, and market acceptability. In 2024, the U.S. Department of Energy (DOE) awarded Hempitecture an $8.42 million grant to construct a hemp processing facility in Tennessee. This facility produces carbon-reducing products for the building materials sector to revive old coal districts and create jobs.

Report Coverage

This research report categorizes the market for the United States hempcrete market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hempcrete market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hempcrete market.

United States Hempcrete Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8228.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.64% |

| 2035 Value Projection: | USD 15039.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End-use, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Hempitecture, Americhanvre, Hemp Building Company, Homeland Hempcrete, Mr. Hemp House, Fading West Development, DiVita Hemp Block, Americhanvre Cast Hemp and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States hempcrete market is boosted by its positive environmental aspects. This environmentally acceptable, non-toxic, biodegradable, and energy-efficient material attracts attention from the construction industry as a substitute for other carbon-intensive materials. It reduces energy consumption and resulting costs by controlling indoor temperatures, providing superior thermal insulation, and reducing the need for HVAC equipment. The additional factor of hempcrete's dependence on carbon sequestration throughout its lifecycle is noteworthy. Also, it is one of the most carbon-negative building materials available.

Restraining Factors

The United States hempcrete market faces obstacles like the expensive processing, limited industrial hemp, and high production costs. The non-load-bearing nature of hemp necessitates additional steel or timber framing, which raises complexity and costs.

Market Segmentation

The United States hempcrete market share is classified into application and end-use.

- The wall segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hempcrete market is segmented by application into wall, floor, and roof. Among these, the wall segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to its superior moisture-regulating and thermal-insulating properties. Natural insulation with hempcrete walls allows the space to stay cool in the summer and warm in the winter, lowering the energy required for heating and cooling. Hempcrete is perfect to use in high-humidity environments since the breathability of hempcrete minimizes condensation and the risk of mould.

- The residential segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States hempcrete market is segmented into residential and non-residential. Among these, the residential segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by driven by the increased need for environmental and energy-efficient housing options. Its non-toxic feature, fire resistance qualities, and pest resistance make it much more appealing, specifically for families looking to create healthier living spaces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hempcrete market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hempitecture

- Americhanvre

- Hemp Building Company

- Homeland Hempcrete

- Mr. Hemp House

- Fading West Development

- DiVita Hemp Block

- Americhanvre Cast Hemp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hempcrete market based on the following segments:

United States Hempcrete Market, By Application

- Wall

- Floor

- Roof

United States Hempcrete Market, By End-use

- Residential

- Non-residential

Need help to buy this report?