United States Hemophilia Market Size, Share, and COVID-19 Impact Analysis, By Type (Hemophilia A, Hemophilia B, and Others), By Treatment Type (On-demand, Cure, and Prophylaxis), and United States Hemophilia Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Hemophilia Market Insights Forecasts to 2035

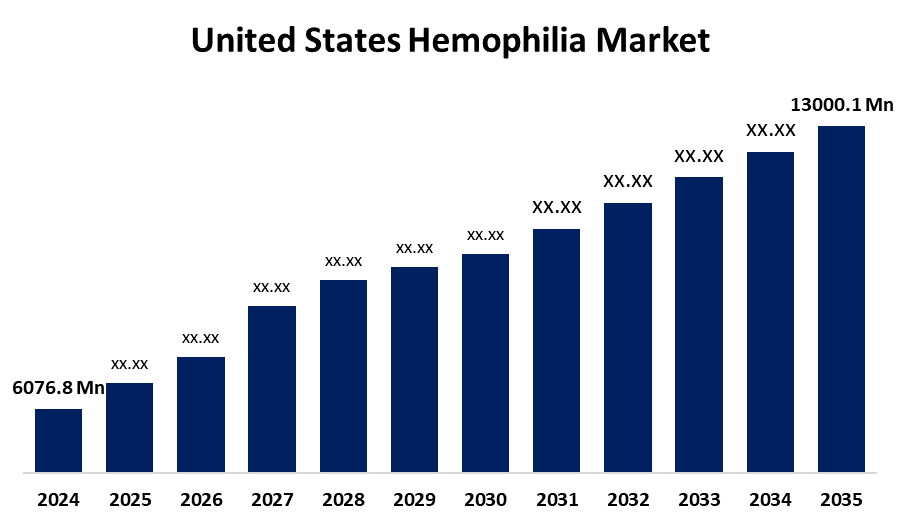

- The US Hemophilia Market Size Was Estimated at USD 6076.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.16% from 2025 to 2035

- The US Hemophilia Market Size is Expected to Reach USD 13000.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Hemophilia Market Size is anticipated to reach USD 13000.1 Million by 2035, growing at a CAGR of 7.16% from 2025 to 2035. The expansion of the United States hemophilia market is propelled by approval for gene therapy, as well as several more candidates in different stages of the pipeline.

Market Overview

Haemophilia is a rare genetic bleeding disease caused by a lack of clotting factors, which are proteins that aid in blood clotting, in the blood. The haemophilia product market in the United States is driving for continued growth due to developments in haemophilia research and developments in diagnostics. Developments in haemophilia research and diagnostics can lead to better patient management and treatment options. Better and newer diagnostics can give conclusive early diagnoses of haemophilia, which is important for conscientious patient management and consideration of treatment paradigms. Advances in genetic testing facilitate family planning for families with a known history of the condition and early preventative actions. Research into the genetic basis for haemophilia has led to better-managed and more individualized treatment plans, particularly if there is a better understanding of the reasons that some patients develop inhibitors to factor replacement therapy. Research must continue in order to create novel therapeutic options, including gene therapy, that eventually provide a cure for haemophilia or significantly lower the disease burden. With research, there will also be development of more potent clotting factors or preparations to have longer half-lives and less immunogenicity.

The U.S. Food and Drug Administration (FDA) approved ALTUVIIIOTM [Antihemophilic Factor (Recombinant), Fc-VWF-XTEN Fusion Protein-ehtl], which was formerly known as efanesoctocog alfa. This first-in-class medicine significantly improves the treatment of haemophilia A by offering a high-sustained replenishment of Factor VIII.

Report Coverage

This research report categorizes the market for the United States hemophilia market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hemophilia market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hemophilia market.

United States Hemophilia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6076.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.16% |

| 2035 Value Projection: | USD 13000.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 174 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type and By Treatment Type |

| Companies covered:: | Biomarin Pharmaceutical Inc., Spark Therapeutics, Pfizer Inc, CSL Behring, Sanofi S.A., Grifols S.A., Novo Nordisk A/S, Octapharma AG, Biogen Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States Hemophilia market is boosted by the increased incidence of hemophilia A and B, which is expected to positively impact the United States hemophilia treatment market. Hemophilia is a rare genetic disease that causes inefficient blood clotting because of a lack of clotting factors VIII (hemophilia A) and IX (hemophilia B). The main treatment for hemophilia is replacement therapy, given with clotting factor concentrates. A greater number of people being diagnosed with hemophilia means a greater demand for hemophilia's essential medicines. Patients are increasingly receiving clotting factors regularly as part of a preventive therapy trend, which aims to prevent instances of bleeding rather than treating them after they happen. This practice drives the total use of clotting factor products.

Restraining Factors

The United States Hemophilia market faces obstacles, like the high cost of treatment, that delay the potential growth of the U.S. hemophilia treatment market. Hemophilia is a chronic condition that requires lifelong management, and the cost of treating hemophilia, both with clotting factor concentrates and newer treatment modalities, can be high.

Market Segmentation

The United States hemophilia market share is classified into type and treatment type.

- The hemophilia A segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States hemophilia market is segmented by type into hemophilia A, hemophilia B, and others. Among these, the hemophilia A segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by a genetic condition that results in a deficiency of blood clotting factor VIII. The variables creating the dominance are the widespread incidence of hemophilia A, the government support towards the launch of products in key markets as the U.S.

- The on-demand segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the treatment type, the United States hemophilia market is segmented into on-demand, cure, and prophylaxis. Among these, the on-demand segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it plays an important role in hemophilia, especially for patients dealing with acute bleeding episodes. On-demand treatment offers flexibility compared to prophylaxis; it is patient-directed, as it correlates with specific clinical interventions as they arise. This particularity of on-demand treatment is often associated with patients with mild to moderate hemophilia.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hemophilia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biomarin Pharmaceutical Inc.

- Spark Therapeutics

- Pfizer Inc

- CSL Behring

- Sanofi S.A.

- Grifols S.A.

- Novo Nordisk A/S

- Octapharma AG

- Biogen Inc.

- Others

Recent Development

- In May 2024, the U.S. Food and Drug Administration (FDA) updated the label for ALTUVIIIO [Antihemophilic Factor (Recombinant), Fc-VWF-XTEN Fusion Protein-ehtl] to include comprehensive results from the Phase 3 XTEND-Kids study. The data demonstrated that once-weekly dosing with ALTUVIIIO provides highly effective bleed protection in children with Hemophilia A.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hemophilia market based on the following segments:

United States Hemophilia Market, By Type

- Hemophilia A

- Hemophilia B

- Others

United States Hemophilia Market, By Treatment Type

- On-demand

- Cure

- Prophylaxis

Need help to buy this report?