United States Helium Market Size, Share, and COVID-19 Impact Analysis, By Phase (Liquid and Gas), By Application (Cryogenics, Leak Detection, Welding, Breathing Mixes, Pressurizing & Puring, Controlled Atmosphere, and Other), and United States Helium Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Helium Market Size Insights Forecasts to 2035

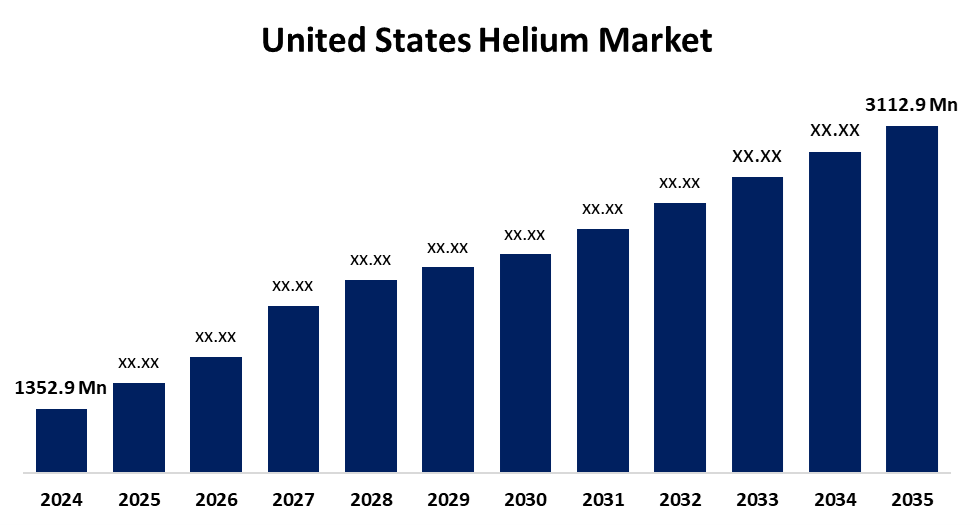

- The US Helium Market Size Was Estimated at USD 1352.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.87% from 2025 to 2035

- The US Helium Market Size is Expected to Reach USD 3112.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Helium Market Size is anticipated to reach USD 3112.9 million by 2035, growing at a CAGR of 7.87% from 2025 to 2035. The expansion of the United States helium market is propelled by expanding product use throughout a wide range of end-use sectors, including the energy, electronics & electrical, medical, aerospace, and defence industries, among others.

Market Overview

Helium is a noble gas that is colourless, odourless, tasteless, and nonflammable. Helium is a necessary element for many scientific tests and studies, especially in the sciences such as physics, chemistry, and materials science. With the advancements in scientific research precisely tied to technologies, the demand for helium products has remained consistent. The competition between domestic and foreign manufacturing enterprises has intensified due to the helium industry. The U.S. Department of the Interior lists helium as the second most available element following hydrogen. Helium is classified as a colourless and odourless inert gas with unique properties. Helium is primarily obtained from natural gas reservoirs, and it is a finite natural resource. Helium is recognised largely as a harmless non-combustible gas for inflating balloons, although it is important for many areas such as national defence, high precision manufacturing, space exploration, laboratory and scientific research, and other emerging health technologies. The key opportunity available in the helium market is the increasing demand for helium across the aviation industry because of its distinct properties and growing advancements in the manufacturing of aircraft design.

Report Coverage

This research report categorizes the market for the United States helium market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States helium market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States helium market.

United States Helium Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1352.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.87% |

| 2035 Value Projection: | USD 3112.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 145 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Phase, By Application and COVID-19 Impact Analysis |

| Companies covered:: | IAC Inc., Linde PLC, Air Products & Chemicals Inc, Messer Group, MESA Specialty Gases & Equipment, Matheson Tri-Gas Inc., Iwatani Corporation, IACX Energy, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States helium market is boosted by the growing semiconductor industry. As unique as its properties are, helium is the most demanding gas and one of the necessities of production in the semiconductor industry. Leading semiconductor companies continue to invest heavily to increase semiconductor production capacity and enable rapid technological advancements. Helium is regarded as a carrier gas and reaction moderator in the semiconductor manufacturing industry due to its unrivaled heat transfer properties. It's an invaluable carrier gas that moves low-volatility compounds and accurately controls temperatures during the wafer fabrication process.

Restraining Factors

The United States helium market faces obstacles due to geopolitical tensions in the US, resulting in volatility of price volatility. As a countermeasure, it is in cooperation with commercial space mining companies in the pursuit of helium-3 from the moon, an energy source of the future and of responsibility for multiple industries.

Market Segmentation

The United States helium market share is classified into phase and application.

- The gas segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States helium market is segmented by phase into liquid and gas. Among these, the gas segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increased use of the product in various application areas, including gas chromatography, welding and cutting, cooling and refrigeration, leak detection, and the nuclear power industry. Helium is used as a carrier gas in many analytical instruments and is a critical component for cryogenic research and low-temperature and close-to-low-temperature studies.

- The cryogenics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States helium market is segmented into cryogenics, leak detection, welding, breathing mixes, pressurizing & purging, controlled atmosphere, and other. Among these, the cryogenics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it has several applications in space exploration, including the cooling of scientific instruments on spacecraft and infrared detectors in telescopes. It serves to maintain temperatures low enough for these instruments to function accurately.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States helium market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IAC Inc.

- Linde PLC

- Air Products & Chemicals Inc

- Messer Group

- MESA Specialty Gases & Equipment

- Matheson Tri-Gas Inc.

- Iwatani Corporation

- IACX Energy

- Others

Recent Development

- In July 2024, US Energy Corporation has acquired acreage in Montana as part of its goal to produce helium across the Kevin Dome structure in Toole County.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States helium market based on the following segments:

United States Helium Market, By Phase

- Liquid

- Gas

United States Helium Market, By Application

- Cryogenics

- Leak Detection

- Welding

- Breathing Mixes

- Pressurizing & Puring

- Controlled Atmosphere

- Other

Need help to buy this report?