United States Helicopter Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Light, Medium, and Heavy), By Application (Offshore, Air Ambulance, Business and Corporate Travel, Disaster and Humanitarian Aid, Transport, Leisure Charter, and Other), and By End-User (Civil, Commercial, and Military), United States Helicopter Services Market Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseUnited States Helicopter Services Market Insights Forecasts to 2033

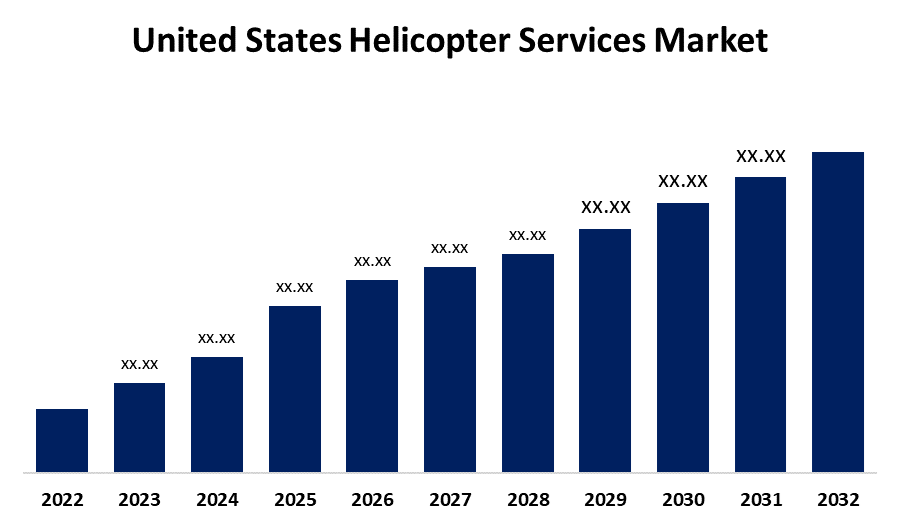

- The United States Helicopter Services Market Size is Expected to Grow at a CAGR of around 6.29% from 2023 to 2033

- The USA Helicopter Services Market Size is Expected to Hold a Significant Share By 2033

Get more details on this report -

The United States Helicopter Services Market Size is Expected to hold a Substantial Share By 2033, With a Compound Annual Growth Rate (CAGR) of 6.29% from 2023 and 2033. The USA helicopter services market is propelled by a mix of drivers such as modernization programs, upgrades, and growing demand for helicopter-based emergency medical services (HEMS), offshore operations, and aerial firefighting. Military uses and requirements for heliborne operations are also growth-inducing factors.

Market Overview

The U.S. helicopter services market means the application of helicopters for all types of aerial transportation and operational procedures, such as executive travel and tourism, to specialized operations such as aerial work, emergency medical services, law enforcement assistance, and military operations. The market is spurred by conditions such as growing demand for light-weight helicopters, growing activities in offshore oil and gas production. Technological advancements, fleets' modernization, and service offerings also account for market growth. There are extreme opportunities presented by the market, mostly in regions such as tourism, air ambulance services, search and rescue services, and offshore support. The market is expected to continue expanding due to growing demand in these regions and technological advancements. Its robust infrastructure, multiple applications, and high presence of key operators are the strengths of this market. The government is transforming towards defense for modernizing the aircraft fleet of the military, and supporting the development of the offshore wind sector by offering financial aid to compete with international companies.

Report Coverage

This research report categorizes the U.S. helicopter services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA helicopter services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. helicopter services market.

United States Helicopter Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.29% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Petroleum Helicopters International Inc., Babcock International Group plc, Robinson Helicopter Company, Global Medical Response Inc., Air Methods Corporation, CHC Helicopter Group, Erickson Incorporated, Bristow Group Inc., West Star Aviation, Acadian Air Med., Metro Aviation and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. helicopter services market is spurred by a mixture of factors such as increasing demand in industries such as emergency medical services (EMS), defense spending, law enforcement, oil and gas, tourism, major investments in urban and other areas, technological progress, strong investments, and safety regulations also have a major influence on propelling the growth of the market. Technological improvements such as the installation of health and usage monitoring systems (HUMS) and the emphasis on fleet renewal are also significant drivers. Businesses are spending on newer, more fuel-efficient helicopter models and reflecting to respond to shifting operational requirements. Helicopters are employed for corporate and VIP transport, especially in regions where road access is restricted.

Restraining Factors

The U.S. helicopter services market is extremely regulated with strict certification and safety standards, which can drive compliance costs up and contribute to complexity for service providers. Issues about maintenance service availability and quality, and safety records, which can affect public image and reduce demand for services. Fuel, maintenance, insurance, and pilot wages make up a high proportion of the cost of operating helicopters, and hence may limit accessibility to some clients.

Market Segmentation

The U.S. helicopter services market share is classified into type, application, and end-user.

- The light segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the United States helicopter services market is divided into light, medium, and heavy. Among these, the light segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. This superiority is largely due to their affordability, versatility, and extensive use in a wide variety of applications such as private aviation, flight training, tourism, law enforcement, and emergency medical services, as opposed to medium and heavy helicopters, making them available to a wider group of users. Light helicopters are made to be small and agile, enabling them to operate in different environments and carry out different tasks.

- The transport segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the USA helicopter services market is divided into offshore, air ambulance, business and corporate travel, disaster and humanitarian aid, transport, leisure charter, and other. Among these, the transport segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This sector involves overall passenger and cargo carrying, such as executive transport, tourism, and industrial support for a range of industries, hence representing a broad and important use. This is also spurred by the high-level oil and gas exploration, advanced EMS facilities, and substantial investment in urban air mobility, all of which need strong helicopter transportation services.

- The civil segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the U.S. helicopter services market is divided into civil, commercial, and military. Among these, the civil segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is propelled by strong demand for services such as emergency medical services (EMS), search and rescue, and law enforcement, and growing usage in commercial markets such as business and corporate aviation. The oil and gas sector is also important, with helicopters employed for crew and cargo transport.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. helicopter services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Petroleum Helicopters International Inc.

- Babcock International Group plc

- Robinson Helicopter Company

- Global Medical Response Inc.

- Air Methods Corporation

- CHC Helicopter Group

- Erickson Incorporated

- Bristow Group Inc.

- West Star Aviation

- Acadian Air Med.

- Metro Aviation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Robinson Helicopter Company launched a redesigned website and helicopter configurator, prioritizing customer experience. The new website offers a modern design, intuitive navigation, a new helicopter configurator, and access to Robinson publications, flight training, and maintenance courses. These tools and more are accessible on both desktop and mobile devices.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the U.S. helicopter services market based on the below-mentioned segments:

U.S. Helicopter Services Market, By Type

- Light

- Medium

- Heavy

U.S. Helicopter Services Market, By Application

- Offshore

- Air Ambulance

- Business and Corporate Travel

- Disaster and Humanitarian Aid

- Transport

- Leisure Charter

- Other

U.S. Helicopter Services Market, By End User

- Civil

- Commercial

- Military

Need help to buy this report?