United States Healthcare Interoperability Solutions Market Size, Share, and COVID-19 Impact Analysis, By Application (Diagnosis, Treatment, and Others), By End-use (Hospitals, Ambulatory Surgical Centers, and Others), and United States Healthcare Interoperability Solutions Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Healthcare Interoperability Solutions Market Insights Forecasts to 2035

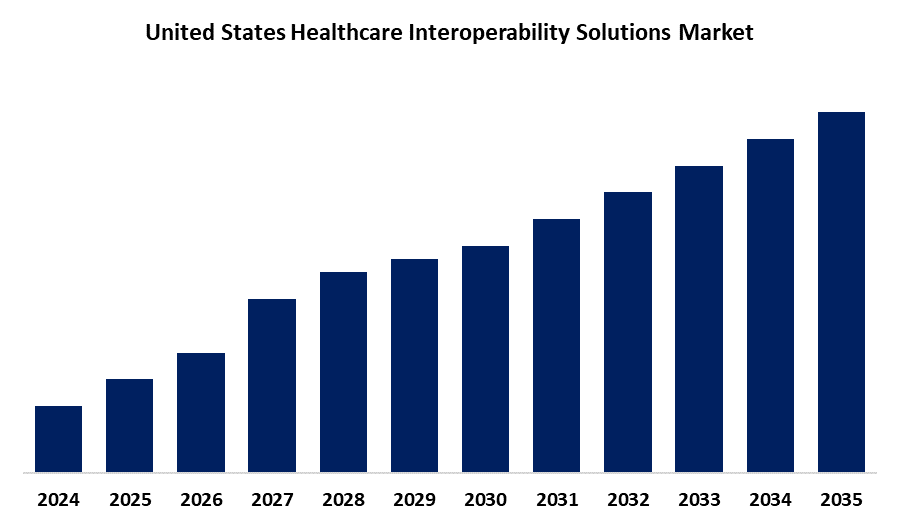

- The USA Healthcare Interoperability Solutions Market Size is Expected to Grow at a CAGR of around 7.9% from 2025 to 2035.

- The United States Healthcare Interoperability Solutions Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the U.S. Healthcare Interoperability Solutions Market is Expected to Hold a Significant Share by 2035, Growing at a CAGR of 7.9% from 2025 to 2035. The market is growing rapidly due to government initiatives like the HITECH Act promoting electronic health record (EHR) adoption, rising demand for patient-centric and coordinated care, advancements in AI and cloud-based technologies that improve data exchange, and efforts to reduce healthcare costs by enhancing system efficiency and communication across providers.

Market Overview

The United States healthcare interoperability solutions market refers to the systems and technologies that enable seamless and secure exchange of healthcare information across various stakeholders, including providers, payers, and patients. This market is driven by the growing need for efficient data sharing to improve care coordination, patient outcomes, and operational efficiency. Key drivers include the rising adoption of electronic health records (EHRs), fueled by government initiatives such as the HITECH Act and the 21st Century Cures Act, which mandate and incentivize interoperability and meaningful use of health IT. Strengths of the market include a high penetration rate of EHRs among healthcare providers and advancements in cloud computing and artificial intelligence that enhance data integration and real-time decision-making. Opportunities exist in expanding personalized and value-based care, leveraging interoperable systems to reduce redundancies and healthcare costs. The strong federal support, increasing demand for patient-centric care, and continued innovation position the U.S. as a leader in advancing healthcare interoperability solutions, further reinforced by government initiatives promoting nationwide health data exchange.

Report Coverage

This research report categorizes the market for the United States healthcare interoperability solutions market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States healthcare interoperability solutions market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States healthcare interoperability solutions market.

United States Healthcare Interoperability Solutions Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End-use, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | InterSystems Corporation, Epic Systems Corporation, Allscripts Healthcare LLC, NextGen Healthcare, Inc., Koninklijke Philips N.V., Orion Health Group, Oracle Health, Veradigm Inc., ViSolve.com, MRO Corp., OSP Labs, Jitterbit, Ellkay, Infor, And Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. healthcare interoperability solutions market is being driven by a growing need for better coordination and more personalized, value-based care. As more healthcare providers adopt electronic health records (EHRs), the demand for systems that can easily and securely share patient data across platforms continues to rise. Advancements in cloud technology, AI, and data analytics are helping doctors make faster, smarter decisions, leading to better outcomes and smoother operations. Patients today also expect more control and transparency in their healthcare, which is pushing the industry toward more connected systems. At the same time, efforts to cut unnecessary costs and reduce duplicate tests are encouraging adoption. The rise of digital health tools and remote monitoring further drives the market, supported strongly by government initiatives promoting seamless data exchange.

Restraining Factors

The data privacy and security concerns, high implementation costs, and the lack of standardized data formats across systems. Resistance to change among healthcare providers and complexities in integrating legacy systems also hinder progress. These challenges slow widespread adoption and limit the effectiveness of interoperability across the healthcare ecosystem.

Market Segmentation

The United States healthcare interoperability solutions market share is classified into application and end-use.

- The diagnosis segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States healthcare interoperability solutions market is segmented by application into diagnosis, treatment, and others. Among these, the diagnosis segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to accurate and timely data exchange is critical for effective diagnosis. Interoperability solutions enable healthcare providers to access comprehensive patient records, test results, and imaging from multiple sources, improving diagnostic accuracy, reducing errors, and accelerating clinical decision-making.

- The hospitals segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States healthcare interoperability solutions market is segmented by end-use into hospitals, ambulatory surgical centers, and others. Among these, the hospitals segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to hospitals managing complex patient data across multiple departments and specialties. Interoperability solutions help integrate this information, enhance care coordination, support regulatory compliance, and improve operational efficiency, making hospitals the primary users of these advanced healthcare technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States healthcare interoperability solutions market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- InterSystems Corporation

- Epic Systems Corporation

- Allscripts Healthcare LLC

- NextGen Healthcare, Inc.

- Koninklijke Philips N.V.

- Orion Health Group

- Oracle Health

- Veradigm Inc.

- ViSolve.com

- MRO Corp.

- OSP Labs

- Jitterbit

- Ellkay

- Infor

- Others

Recent Developments:

- In November 2024, Health Systems Using Epic Have Connected 625 Hospitals to the TEFCA Interoperability Framework in One Year. Epic Systems introduced EpicLink, an EHR integration tool aimed at improving interoperability between Epic and non-Epic EHR systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States healthcare interoperability solutions market based on the below-mentioned segments:

USA Healthcare Interoperability Solutions Market, By Application

- Diagnosis

- Treatment

- Others

USA Healthcare Interoperability Solutions Market, By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

Need help to buy this report?