United States Hair Care Product Market Size, Share, and COVID-19 Impact Analysis, By Product (Shampoo, Conditioner, Oil, Color, Serum, Styling Product, and Others), By Gender (Men & Women), and US Hair Care Product Market Insights, Industry Trend, Forecasts To 2035

Industry: Consumer GoodsUnited States Hair Care Product Market Insights Forecasts to 2035

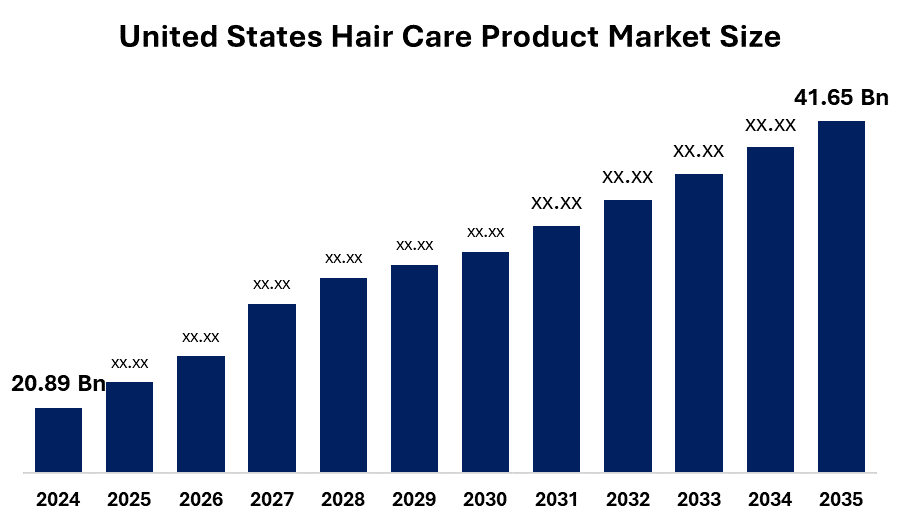

- The United States Hair Care Product Market Size Was Estimated at USD 20.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.47% from 2025 to 2035

- The United States Hair Care Product Market Size is Expected to Reach USD 41.65 Billion by 2035

Get more details on this report -

The US Hair Care product Market Size is anticipated to reach USD 41.65 Billion by 2035, growing at a CAGR of 6.47% from 2025 to 2035.

Market Overview:

Hair care products encompass a wide range of items designed to cleanse, condition, style, and treat hair. Common categories include shampoos, conditioners, hair oils, serums, masks, and styling products like gels and mousses. Specific products can target concerns like dandruff, hair fall, dryness, or damage, and some are formulated to promote hair growth or protect from heat. The use of natural ingredients for hair care, including those for hair strengthening and texture modification, is a growing trend. Hair care e-commerce platforms have disrupted traditional retail channels, offering convenience and competitive pricing. Heat protection and color protection are essential features in many hair care products, catering to consumers' concerns for hair damage. Hair care product manufacturers are focusing on developing and launching new and innovative products to cater to consumers' increasing demands. In the present scenario, consumers are constantly looking for more efficient and novel products that suit their requirements and lifestyles. Hair care marketers are launching technologically advanced products to fulfill the untapped needs of consumers, and these products are priced higher than normal hair care products. These technologically advanced products can offer benefits such as UV ray protection, scalp care, and moisturizing benefits. The focus on product premiumization and product line extension is increasing owing to the willingness of consumers to pay more for innovative products.

Report Coverage:

This research report categorizes the United States hair care product market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hair care product market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the United States hair care product market.

United States Hair Care Product Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.47% |

| 2035 Value Projection: | USD 41.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Gender |

| Companies covered:: | Henkel Corporation, Revlon onsumer products corporation, Kao Corporation, amway Corporation, LOreal USA Inc, Johnson and johnson services Inc, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The rise of the U.S. hair care products industry is primarily driven by the growing demand for natural, vegan, and organic hair care products. Additionally, customers are looking for personalized solutions and are prepared to pay more for high-end and upscale hair care products.

Restraining Factor

The rising number of people with sensitive hair experiencing an allergic reaction from hair cleansing products, such as shampoos, cleansers, serums, and others. The presence of toxic chemicals is a factor hampering the hair care market's growth.

Market Segmentation

The U.S. hair care product market share is classified into product and gender.

- The shampoo segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. hair care product market is segmented by product into shampoo, conditioner, oil, color, serum, styling products, and others. Among these, the shampoo segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Shampoos are designed to replace soap for cleaning the scalp and hair, removing unwanted oil, dandruff, environmental dust, and residues from hair care products, and they also assist in protecting hair color. Shampoos aid in rejuvenating hair by counteracting damage caused by pollution, ultraviolet (UV) rays, and harmful chemicals.

- The women segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period

The U.S. hair care product market is segmented by gender into men and women. Among these, the women segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. A heightened focus on personalized and premium solutions drives this growth. Brands are innovating to meet diverse hair needs, with products tailored for specific concerns like scalp health and hair texture. A broader trend of women seeking high-quality, targeted hair care products that cater to their individual needs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US hair care product market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Market Developments:

- In November 2024, by launching two of its brands, CeraVe and Vichy Dercos, into the American hair care market, L'Oréal increased the scope of its dermatological beauty products in the country. Both Vichy Dercos and CeraVe products are sold online; VichyUSA.com sells Vichy Dercos goods, whereas Walmart.com sells just CeraVe products.

List of Key Companies

- Henkel Corporation

- Revlon onsumer products corporation

- Kao Corporation

- amway Corporation

- LOreal USA Inc

- Johnson and johnson services Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2025 to 2035. Spherical Insights has segmented the United States hair care market based on the below-mentioned segments:

United States Hair Care Product Market, By Product

- Shampoo

- Conditioner

- Oil

- Color

- Serum

- Styling Products

- Others

United States Hair Care Product Market, By Gender

- Male

- Women

Need help to buy this report?