United States Gummy Market Size, Share, and COVID-19 Impact Analysis, By Product (Vitamins, Dietary Fibres, Minerals, Carbohydrates, Omega Fatty Acids, Proteins & Amino Acids, Probiotics & Prebiotics, Melatonin, CBD/CBN, Psylocybin/Psychedelic Mushroom, and Others), By Ingredient (Gelatine and Plant-based Gelatine Substitute), and United States Gummy Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Gummy Market Size Insights Forecasts to 2035

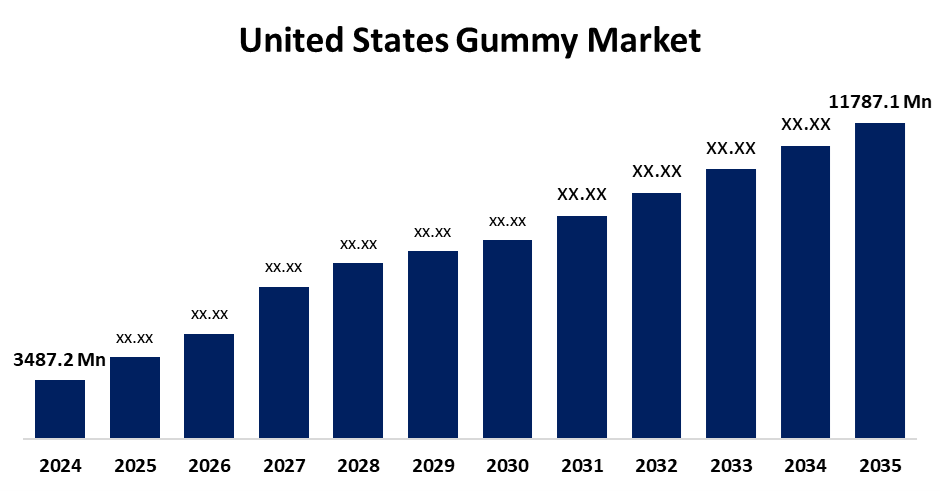

- The US Gummy Market Size Was Estimated at USD 3487.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.71% from 2025 to 2035

- The US Gummy Market Size is Expected to Reach USD 11787.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Gummy Market Size is anticipated to reach USD 11787.1 million by 2035, growing at a CAGR of 11.71% from 2025 to 2035. The expansion of the United States gummy market is propelled by the widespread use of its supplements in the United States, growing consumer awareness of food ingredients, mindful eating and drinking habits, shifting trends that favour nutraceuticals over pharmaceuticals, and the persistent prevalence of health issues like diabetes, hypertension, and cardiovascular diseases, among others.

Market Overview

Gummies are chewy candies with fruit flavours that are mostly made of sugar, gelatin, and flavourings. The leading drivers driving the gummy market in the United States are an increasing number of consumers seeking healthier lifestyles, the preference for dietary supplements that are easily absorbed, the introduction and increased availability of various types of gummies including vegan and plant-based, increased consumer awareness of their ethical and environmental obligations, the innovativeness and the number of products has created in recent years. Young individuals changing lifestyles, heavy work demands, and urbanization have brought a place in the marketplace where consumers must consider their health first. The gummy market in the United States is on the rise at a rapid pace and is currently in a very high growth stage. The market is defined by many popular brands, but also, many manufacturers and suppliers that are relatively small or medium-scale. Thus, creating a fragmented and competitive marketplace.

The U.S. government uses a mix of laws, rules, and voluntary industry standards to regulate the gummy business, especially gummy nutritional supplements. Manufacturers must ensure the safety and labelling of their goods before going on sale, without FDA permission, according to the Dietary Supplement Health and Education Act of 1994 (DSHEA). But once supplements are on the market, the FDA can act to stop them from being tampered with or mislabeled.

Report Coverage

This research report categorizes the market for the United States gummy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States gummy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States gummy market.

United States Gummy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3487.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.71% |

| 2035 Value Projection: | USD 11787.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Ingredient and COVID-19 Impact Analysis |

| Companies covered:: | Well Aliments, Superior Supplement Manufacturing, AJES Pharmaceuticals, Better Nutritionals, Boscogen, Santa Cruz Nutritionals, SMP Nutra, Catalent Inc, SCN BestCo, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States gummy market is boosted due to their unique mouthfeel, enjoyable flavours, and a category-defining bear shape. Gummy bears can be enjoyed because of their chewy texture and expansive flavour profiles. Also, gummy bears can appeal to adults and children alike due to their fun, dynamic quality. Gummy bears can be stocked and consumed as a sweet snack or treat, which is facilitated by their small size and portability. With their delicious flavour and whimsical open ear shape, gummy bears will always be a beloved classic driving demand in the gummy space.

Restraining Factors

The United States gummy market faces obstacles because of complicated formulation and high-end ingredients such as plant-based or sugar-free sweeteners stability problems with heat- and moisture-sensitive vitamins that necessitate excessive fortification and sophisticated processing short shelf life that impacts quality control and logistics growing regulatory scrutiny of sugar content, labelling, and health claims and fluctuating raw material prices gelatin, pectin, natural sugars that further put a strain on affordability and accessibility..

Market Segmentation

The United States gummy market share is classified into product and ingredient.

- The vitamins segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States gummy market is segmented by product into vitamins, dietary fibres, minerals, carbohydrates, omega fatty acids, proteins & amino acids, probiotics & prebiotics, melatonin, CBD/CBN, psylocybin/psychedelic mushroom, and others. Among these, the vitamins segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because the individual deficiencies in Vitamin B12 and D can result from busy schedules, lifestyle changes, and diets lacking proper nutrition. For a busy person, vitamin gummies provide one of the easiest methods to maintain vitamin intake. Additionally, the manufacturers are enhancing demand for vitamin gummies by offering options in an array of colours, sizes, shapes, and unique flavours.

- The gelatine segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the ingredient, the United States gummy market is segmented into gelatine and plant-based gelatine substitute. Among these, the gelatine segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the manufacturing companies. The ideal textures, compatibility with ingredients, and cost-efficiency are just some of the factors that help establish a higher demand for vitamin supplements. Consumers enjoy the chewy, firmer texture that comes with gelatin-based gummies, which greatly influences consumers in choosing top pick gelatin gummies instead of alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States gummy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Well Aliments

- Superior Supplement Manufacturing

- AJES Pharmaceuticals

- Better Nutritionals

- Boscogen

- Santa Cruz Nutritionals

- SMP Nutra

- Catalent Inc

- SCN BestCo

- Others

Recent Development

- In October 2022, Better Nutritionals and Doux Matok announced a partnership developed for manufacturing gummies that would have less sugar content but similar tastes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States gummy market based on the following segments:

United States Gummy Market, By Product

- Vitamins

- Dietary Fibres

- Minerals

- Carbohydrates

- Omega Fatty Acids

- Proteins & Amino Acids

- Probiotics & Prebiotics

- Melatonin

- CBD/CBN

- Psylocybin/Psychedelic Mushroom

- Others

United States Gummy Market, By Ingredient

- Gelatine

- Plant-based Gelatine Substitute

Need help to buy this report?