United States Guidewires Market Size, Share, and COVID-19 Impact Analysis, By Product (Coronary Guidewire, Peripheral Guidewire, Urology Guidewire, Neurovascular Guidewire, Others), By Coating (Coated, Non-Coated), By Material (Nitinol, Stainless Steel, Others), By End User (Hospitals & Clinics, Diagnostic Centers, Others), and United States Guidewires Market Insights Forecasts to 2033

Industry: HealthcareUnited States Guidewires Market Insights Forecasts to 2033

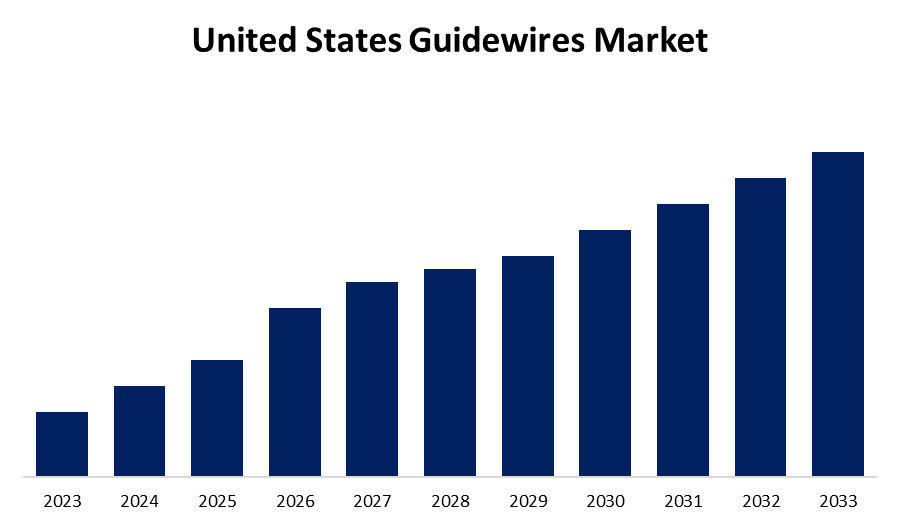

- The Market Size is Growing at a CAGR of 4.6% from 2023 to 2033.

- The United States Guidewires Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Guidewires Market Size is expected to Hold a Significant Share by 2033, at a CAGR of 4.6% during the forecast period 2023 to 2033.

Market Overview

Guidewire technology is widely used to access vascular targets with greater precision and accuracy. These devices improve the quality of surgical and diagnostic procedures. Also, guidewires are widely used in cardiovascular, gastrointestinal, and interventional radiology procedures. Furthermore, certain device characteristics, such as stiffness, advanced tip, coating, and shape, allow surgeons to diagnose and treat lesions in complex anatomical structures. Along with this, advanced technologies in guidewires, such as steerability and superior vision, can improve procedural outcomes. The rapidly increasing prevalence of cardiovascular conditions in United States is expected to increase the number of cardiovascular procedures during the forecast period. Moreover, the increasing number of endoscopic procedures, combined with the increasing demand for advanced guidewires, is expected to fuel the adoption of these devices. In addition, innovation and technological advancements are also influencing the guidewires market. Also, manufacturers are constantly developing guidewires with better materials, coatings, and designs to improve flexibility, steerability, and longevity. These innovations not only improve patient outcomes but also shorten procedure times and lower healthcare costs.

Report Coverage

This research report categorizes the market for the United States guidewires market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States guidewires market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States guidewires market.

United States Guidewires Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.6% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Coating, By Material, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Boston Scientific Corporation, Olympus Corporation, Terumo Medical Corporation, Becton Dickinson & Company, Cook Medical, B. Braun, Stryker Inc., Abbott Laboratories Inc., Medtronic Plc, Teleflex Incorporated and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. guidewires market will grow during the forecast period owing to rising demand for minimally invasive surgeries in United States, which offer benefits such as shorter hospital stays, lower costs, a better patient experience, and faster recovery. This, combined with the benefits of advanced guidewire features such as improved vision, superior lesion access, and low procedural costs, is expected to drive the U.S. guidewires market over the forecast period. Furthermore, technological advancements in diagnostic and surgical equipment are expected to provide lucrative growth opportunities for minimally invasive surgeries, ultimately boosting the guidewire market by 2033. Also, operating players' consolidated focus on strategic collaborations and new product launches with the goal of developing and commercializing new guidewire technology can provide greater incentives for guidewire adoption. Moreover, positive medical reimbursement policies implemented by government authorities are expected to offer significant opportunities for growth in the market during the forecast period.

Restraining Factors

Current commercially available guidewires are made from a variety of materials, including nitinol, stainless steel, Teflon or parylene, and other hybrid polymers. Hybrid polymers are also used to make guidewires because of their numerous advantages, including flexibility, kink resistance, tensile strength, columnar strength, and torque. However, using these materials raises the price of the product significantly when compared to traditional guidewires, this may hamper market growth over the forecast period.

Market Segment

- In 2023, the coronary guidewire segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States guidewire market is segmented into coronary guidewire, peripheral guidewire, urology guidewire, neurovascular guidewire, and others. Among these, the coronary guidewire segment has the largest revenue share over the forecast period. This can be attributed by cardiovascular diseases, such as coronary artery disease, which are still a leading cause of death. These conditions frequently necessitate invasive procedures like angioplasty and stent placement, both of which rely heavily on coronary guidewires. Since cardiovascular diseases are so common, these guidewires are always in demand. Minimally invasive approaches to cardiology have become the standard of care. Coronary guidewires are critical for guiding catheters and devices through the intricate coronary arteries, allowing cardiologists to perform procedures with precision and minimal patient trauma. Patients prefer less invasive interventions because they cause less pain, have shorter recovery times, and require fewer hospital stays, which drives up demand for coronary guidewires.

- In 2023, the coated segment accounted for the largest revenue share over the forecast period.

Based on the coating, the United States guidewires market is segmented into coated and non-coated. Among these, the coated segment has the largest revenue share over the forecast period. Guidewire coatings can be hydrophobic or hydrophilic. These coatings are responsible for the smoother passage of guidewires through complex anatomical structures. Furthermore, coated guidewires reduce the risk of infections and injuries, which is expected to drive growth in the segment by 2033.

- In 2023, the stainless-steel segment accounted for the largest revenue share over the forecast period.

Based on the material, the United States guidewires market is segmented into nitinol, stainless steel, and others. Among these, the stainless-steel segment has the largest revenue share over the forecast period. This is primarily attributed to its qualities, including strong corrosion resistance along with antibacterial, non-magnetic, and non-staining features, stainless steel is a highly favored raw material. Stainless steel provides strong support, force transfer, and torque standards. Moreover, stainless steel properties such as kink resistance and increased rational stability are expected to drive this segment.

In 2023, the hospitals & clinics segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States guidewires market is segmented into hospitals & clinics, diagnostic centers, and others. Among these, the hospitals & clinics segment has the largest revenue share over the forecast period. The rising number of cardiovascular and gastrointestinal surgeries performed in hospitals is expected to drive U.S. guidewires market growth. Joined with this, the gradual shift of patient inclination from inpatient visits to outpatient visits which are expected to offer important growth opportunities for diagnostic centers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States guidewires market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- Olympus Corporation

- Terumo Medical Corporation

- Becton Dickinson & Company

- Cook Medical

- B. Braun

- Stryker Inc.

- Abbott Laboratories Inc.

- Medtronic Plc

- Teleflex Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Artiria received FDA approval for its innovative real-time deflectable guidewire, which is intended to improve the treatment of strokes and related neurovascular and peripheral conditions. Artiria's groundbreaking product gives physicians more control and a better way to navigate the complex network of cerebral arteries, improving treatment efficacy and efficiency.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Guidewires Market based on the below-mentioned segments:

United States Guidewires Market, By Product

- Coronary Guidewire

- Peripheral Guidewire

- Urology Guidewire

- Neurovascular Guidewire

- Others

United States Guidewires Market, By Coating

- Coated

- Non-Coated

United States Guidewires Market, By Material

- Nitinol

- Stainless Steel

- Others

United States Guidewires Market, By End User

- Hospitals & Clinics

- Diagnostic Centers

- Others

Need help to buy this report?