United States Graphite Market Size, Share, and COVID-19 Impact Analysis, By Form (Synthetic and Natural), By End-User (Battery Production, Electrodes, Foundries, Refractories, and Others), and US Graphite Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUSA Graphite Market Insights Forecasts to 2035

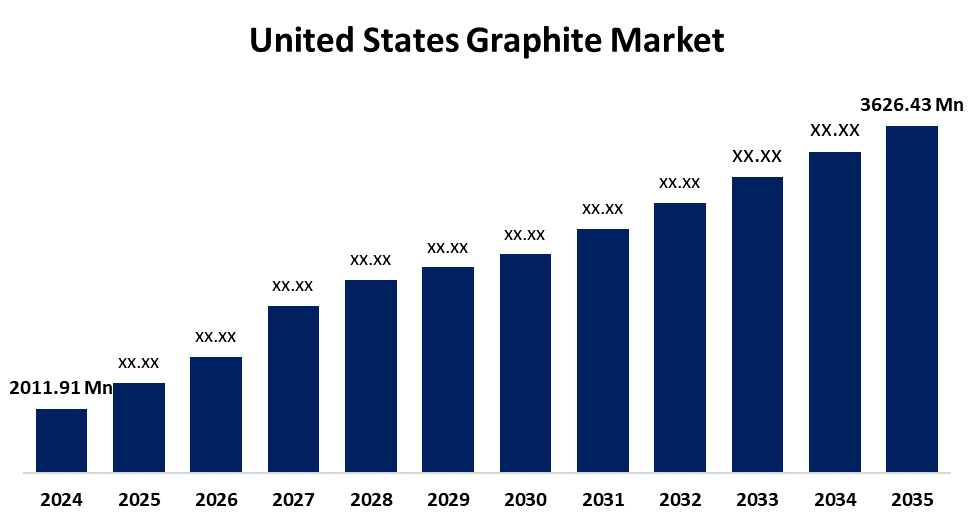

- The US Graphite Market Size was estimated at USD 2011.91 Million in 2024

- The Market Size is expected to grow at a CAGR of around 5.50% from 2025 to 2035

- The USA Graphite Market Size is expected to reach USD 3626.43 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Graphite Market is anticipated to reach USD 3626.43 million by 2035, growing at a CAGR of 5.50% from 2025 to 2035.

Market Overview

The US graphite market is a sector specializing in the production, distribution, and application of natural and synthetic graphite, utilized in various industries. Graphite is used in high-temperature environments such as kilns, incinerators, reactors, and blast furnace linings. It is a lightweight, soft element with both metallic and non-metallic properties that makes it suitable for a variety of industrial applications due to its high thermal and electrical conductivity, as well as its non-metallic properties of inertia, resistance to chemicals, corrosion, and temperature, as well as excellent cleavage and lubricity. High utilization in refractories and rising demand for electric arc furnaces is expected to propel the market growth.

Report Coverage

This research report categorizes the market for the US Graphite market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US Graphite market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US Graphite market.

United States Graphite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2011.91 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.50% |

| 2035 Value Projection: | USD 3626.43 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Form, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Syrah Resources, Northern Graphite, NOVONIX, Tokai Carbon Co. Ltd., Graphite India, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The refractory industry is the largest end-user of graphite due to its extreme resistance to heat or higher temperatures, accounting for almost half of global demand. The steel industry is the primary market for refractories made from natural products, used in high-temperature conditions such as linings for kilns, incinerators, reactors, and furnaces. Graphite is also used in electric arc furnaces, limonite smelting, and crucibles in steel, non-ferrous, and precious metal processing. The steel industry is on the path to becoming a carbon-free industry, with electric arc furnaces playing a crucial role in producing low carbon emissions. Graphite is also used in the automotive industry for lithium-ion batteries and automotive components, with its excellent lubricating properties making it a promising material for growth.

Restraining Factors

The supply chain dependence, tariffs and trade policies, environmental regulations, limited domestic production, and technological challenges may impede the growth of the market.

Market Segmentation

The USA graphite market share is classified into form and end-user.

- The synthetic segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US graphite market is segmented by form into synthetic and natural. Among these, the synthetic segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The commercially produced, higher-purity synthetic graphite is used mainly in lithium-ion batteries, electric arc furnaces for the production of steel, semiconductors, capacitors, resistors, and as a dry lubricant in a variety of industrial applications because of its high conductivity and stability.

- The electrodes segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US graphite market is segmented by end-user into battery production, electrodes, foundries, refractories, and others. Among these, the electrodes segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its speed-up charging and increasing energy storage density. Graphite is an essential component of lithium-ion batteries, electric vehicles, and renewable energy storage. It is also utilized in the steel industry to produce refractories and electrodes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US graphite market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Syrah Resources

- Northern Graphite

- NOVONIX

- Tokai Carbon Co. Ltd.

- Graphite India

- Others

Recent Developments:

- In May 2025, Alfa Chemistry launched advanced flame retardant products, including Expandable Graphite, Halogen Flame Retardant, and Phosphorus Flame Retardant, to meet the growing demand for efficient fire safety solutions in construction, electronics, and transportation sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US graphite market based on the below-mentioned segments:

US Graphite Market, By Form

- Synthetic

- Natural

US Graphite Market, By End-user

- Battery Production

- Electrodes

- Foundries

- Refractories

- Others

Need help to buy this report?