United States Grain Analysis Market Size, Share, and COVID-19 Impact Analysis, By Grain Type (Cereals, Oilseeds, Pulses), By Technology (Traditional, Rapid), By Target Tested (Pathogens, Pesticides, GMO, Mycotoxins, Others), By End Use (Food, Feed), and the United States Grain Analysis Market Insights Forecasts to 2033

Industry: AgricultureUnited States Grain Analysis Market Insights Forecasts to 2033

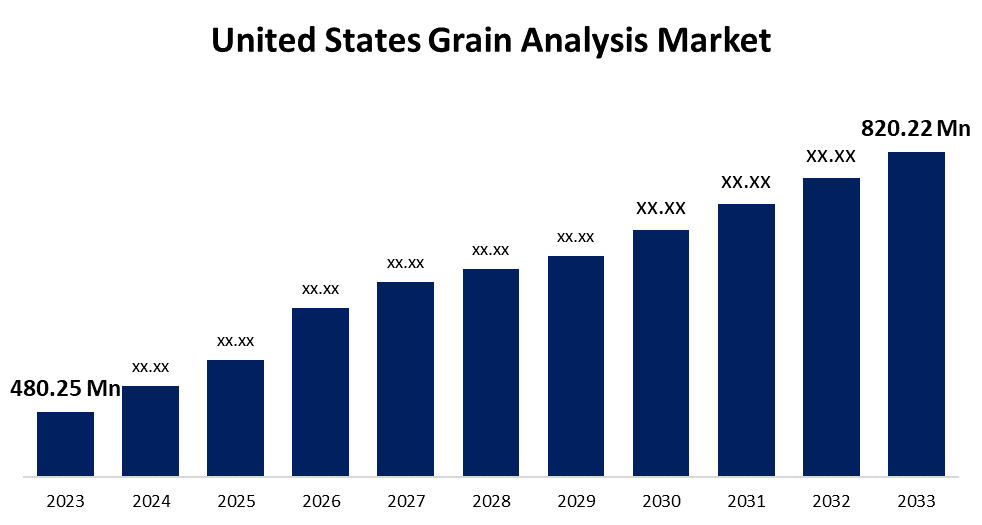

- The United States Grain Analysis Market Size was valued at USD 480.25 Million in 2023.

- The Market Size is Growing at a CAGR of 5.5% from 2023 to 2033.

- The United States Grain Analysis Market Size is Expected to Reach USD 820.22 Million by 2033.

Get more details on this report -

The United States Grain Analysis Market Size is expected to reach USD 820.22 Million by 2033, at a CAGR of 5.5% during the forecast period 2023 to 2033.

Market Overview

Grain analysis monitors grain quality by analyzing samples for mycotoxin contamination, pesticide residue, and physical characteristics like size and weight. The grains are monitored throughout distribution, procurement, and storage. The quality of food grains is assessed by collecting samples and testing them for physical characteristics such as size and weight, pesticide residue, and mycotoxin contamination. Food grains are typically analyzed to monitor their quality, time of storage, procurement, and distribution. The grain analysis market in the United States is rapidly evolving, driven by the agricultural and food industries' need for quality assurance and testing. It provides a variety of services, including, but not limited to, grain size, shape, and distribution analysis. The United States grain analysis market is critical for increasing crop yield, ensuring food safety, and improving product quality. Key players in this market provide a variety of testing methodologies to meet the specific needs of grain producers, processors, and traders.

Report Coverage

This research report categorizes the market for the United States grain analysis market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States grain analysis market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States grain analysis market.

United States Grain Analysis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 480.25 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.5% |

| 2033 Value Projection: | USD 820.22 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grain Type, By Technology, By Target Tested, By End Use and COVID-19 Impact Analysis. |

| Companies covered:: | Bureau Veritas SA, Eurofins USA, ALS Limited, Intertek Group PLC, SGS SA, Thermo Fisher Scientific, Inc., Neogen Corporation, Romer Labs Division Holding GmbH, AB Sciex, Waters Corporation and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid use of grain trade and the rise in foodborne illness outbreaks can be attributed to market growth. Furthermore, stringent food and feed safety and quality regulations, as well as rising government regulations, have a positive impact on the global grain analysis market. Also, rising technological advancements in testing procedures, combined with an increase in food-borne disease outbreaks, are expected to boost market growth over the forecast period. Increased consumption of food grains, which is linked to higher disposable incomes and living standards, is driving the market growth during the forecast period. Moreover, favorable socioeconomic and demographic factors, such as urbanization, rising population, disposable incomes, and rising living standards, are expected to drive the United States grain analysis market, as is an increase in demand for precise future grain production-related information from pesticide manufacturers, seed producers, financial institutions, traders, and other stakeholders.

Restraining Factors

One of the primary factors influencing the United States grain analysis market’s growth is a lack of regulatory harmonization. Different countries have implemented varying food safety control systems and regulatory approaches. The differences in these adopted regulations may result in an international dispute, which hampers market growth during the forecast period.

Market Segment

- In 2023, the cereals segment accounted for the largest revenue share over the forecast period.

Based on the grain type, the United States grain analysis market is segmented into cereals, oilseeds, and pulses. Among these, the cereals segment has the largest revenue share over the forecast period. This can be attributed to the country's large production and consumption of cereal grains such as corn, wheat, and oats. These versatile crops play an important role in a variety of industries, including human food and beverage production, animal feed, and biofuel production, driving up demand for comprehensive grain analysis. With its fertile agricultural landscape and diverse applications, the United States continues to rely on cereal grains for sustenance and economic growth.

- In 2023, the rapid segment accounted for the largest revenue share over the forecast period.

Based on the technology, the United States grain analysis market is segmented into traditional, and rapid. Among these, the rapid segment has the largest revenue share over the forecast period. In comparison to traditional technology, this segment's demand is being driven by factors such as low turnaround time, higher accuracy, sensitivity, and the ability to test a wide range of contaminants.

- In 2023, the pesticides segment accounted for the largest revenue share over the forecast period.

Based on the target tested, the United States grain analysis market is segmented into pathogens, pesticides, GMO, mycotoxins, and others. Among these, the pesticides segment has the largest revenue share over the forecast period. Pesticide use has increased significantly in recent years, driven by the growing need to ensure the safety and quality of grains for consumption and export. As a result, the U.S. grain industry actively uses pesticide testing to ensure compliance, cementing its position as a dominant player in the U.S. grain analysis market.

- In 2023, the food segment accounted for the largest revenue share over the forecast period.

Based on the end use, the United States grain analysis market is segmented into food and feed. Among these, the food segment has the largest revenue share over the forecast period. The factors that contribute to the increase in grain trade, including import and export, their growing use as an ingredient in new food products, government efforts to certify optimum nutrition in food, and complexities in the food supply chain, have resulted in precise grain testing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States grain analysis market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bureau Veritas SA

- Eurofins USA

- ALS Limited

- Intertek Group PLC

- SGS SA

- Thermo Fisher Scientific, Inc.

- Neogen Corporation

- Romer Labs Division Holding GmbH

- AB Sciex

- Waters Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Grain Analysis Market based on the below-mentioned segments:

United States Grain Analysis Market, By Grain Type

- Cereals

- Oilseeds

- Pulses

United States Grain Analysis Market, By Technology

- Traditional

- Rapid

United States Grain Analysis Market, By Target Tested

- Pathogens

- Pesticides

- GMO

- Mycotoxins

- Others

United States Grain Analysis Market, By End Use

- Food

- Feed

Need help to buy this report?