United States Gestational Diabetes Market Size, Share, and COVID-19 Impact Analysis, By Diagnosis Type (Oral Glucose Tolerance Test, Fasting Blood Sugar Test, Random Blood Sugar Test, and Haemoglobin A1c Test), By Risk Factor (Obesity, Family History, Age, and Previous Gestational Diabetes), and United States Gestational Diabetes Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Gestational Diabetes Market Insights Forecasts to 2035

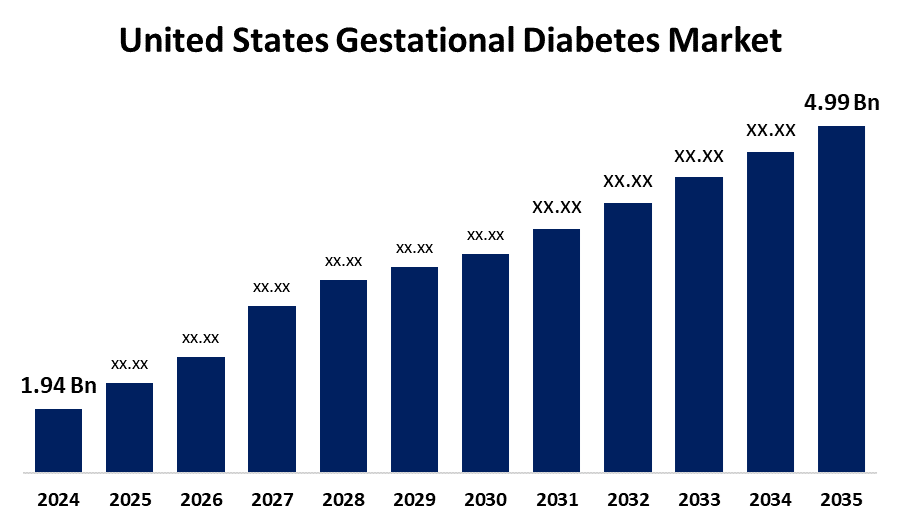

- The United States Gestational Diabetes Market Size Was Estimated at USD 1.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.97% from 2025 to 2035

- The United States Gestational Diabetes Market Size is Expected to Reach USD 4.99 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States gestational diabetes market size is anticipated to reach USD 4.99 Billion by 2035, growing at a CAGR of 8.97% from 2025 to 2035. The United States' gestational diabetes market is experiencing growth due to the increasing prevalence of gestational diabetes mellitus (GDM) is attributed to rising obesity rates and advanced maternal age, both of which are significant risk factors for GDM. Additionally, advancements in medical technology, such as continuous glucose monitoring systems and insulin delivery devices, have enhanced the management of GDM, improving patient outcomes and increasing demand for treatment options.

Market Overview

The United States gestational diabetes market refers to the healthcare segment focused on the diagnosis, treatment, and management of diabetes that develops during pregnancy. This market is growing steadily due to increasing risk factors such as rising obesity rates, delayed pregnancies, sedentary lifestyles, and poor dietary habits among women of reproductive age. Market drivers include heightened awareness of maternal and fetal health, widespread use of early screening tests like the oral glucose tolerance test (OGTT), and improved diagnostic accuracy. Strengths of the market lie in technological advancements such as continuous glucose monitoring systems, user-friendly insulin delivery devices, and a strong prenatal healthcare infrastructure. Opportunities are emerging through expanding telehealth services, increased investment in women’s health, and the development of personalized diabetes care. Moreover, government initiatives like prenatal care programs under Medicaid, awareness campaigns by the CDC, and support for research funding have further strengthened early detection and management efforts.

Report Coverage

This research report categorizes the market for the United States gestational diabetes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' gestational diabetes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States gestational diabetes market.

United States Gestational Diabetes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.94 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.97% |

| 2035 Value Projection: | USD 4.99 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Diagnosis Type, By Risk Factor and COVID-19 Impact Analysis |

| Companies covered:: | Thermo Fisher Scientific, Ascensia Diabetes Care, Johnson and Johnson, Eli Lilly and Company, Abbott Laboratories, AmerisourceBergen, Quidel Corporation, Becton Dickinson, Roche Holding, GlucoWise, Medtronic, Freenome, Dexcom, Abbvie, Sanofi and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of risk factors such as obesity, advanced maternal age, and sedentary lifestyles among pregnant women leads the market. Greater awareness of maternal and fetal health has led to routine screening and early diagnosis, contributing to the rising demand for gestational diabetes care. Technological advancements in glucose monitoring systems and insulin delivery methods have improved disease management and patient outcomes. Additionally, supportive government policies and healthcare initiatives promoting prenatal screening and diabetes education play a key role in driving market growth. A growing number of women seeking prenatal care and a stronger emphasis on preventing complications further fuel the market.

Restraining Factors

The limited awareness in certain populations about the risks and symptoms of gestational diabetes can delay diagnosis and treatment. Additionally, high costs of continuous monitoring and treatment options, along with disparities in access to prenatal care, may hinder timely intervention and market growth in underserved areas.

Market Segmentation

The United States gestational diabetes market share is classified into diagnosis type and risk factor.

- The oral glucose tolerance test segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gestational diabetes market is segmented by diagnosis type into oral glucose tolerance test, fasting blood sugar test, random blood sugar test, and haemoglobin a1c test. Among these, the oral glucose tolerance test segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to its high accuracy and standard use in diagnosing GDM. Recommended by major health organizations, OGTT effectively measures the body's response to glucose intake, making it the preferred and most reliable method for early detection and management of gestational diabetes in pregnant women.

- The obesity segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gestational diabetes market is segmented by risk factor into obesity, family history, age, and previous gestational diabetes. Among these, the obesity segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to excess body weight is a major risk factor for developing insulin resistance during pregnancy. Rising obesity rates among women of childbearing age have led to a higher incidence of gestational diabetes, making obesity a primary contributor to market demand and diagnostic focus.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States gestational diabetes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific

- Ascensia Diabetes Care

- Johnson and Johnson

- Eli Lilly and Company

- Abbott Laboratories

- AmerisourceBergen

- Quidel Corporation

- Becton Dickinson

- Roche Holding

- GlucoWise

- Medtronic

- Freenome

- Dexcom

- Abbvie

- Sanofi

- Others

Recent Developments:

- In December 2024, Dexcom Launched the First Generative AI Platform in Glucose Biosensing. Dexcom launched Stelo, the first over-the-counter continuous glucose monitor (CGM) cleared by the FDA. Designed for adults not on insulin, Stelo offers a 15-day sensor wear and provides personalized insights into glucose levels, activity, and sleep.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. gestational diabetes market based on the below-mentioned segments:

United States Gestational Diabetes Market, By Diagnosis Type

- Oral Glucose Tolerance Test

- Fasting Blood Sugar Test

- Random Blood Sugar Test

- Haemoglobin A1c Test

United States Gestational Diabetes Market, By Risk Factor

- Obesity

- Family History

- Age

- Previous Gestational Diabetes

Need help to buy this report?