United States Geopipes Market Size, Share, and COVID-19 Impact Analysis, By Product (High Density Polyethylene, Polyvinyl Chloride, Polypropylene, and Other Materials), By Application (Drainage & Sewer Irrigation, Chemicals & Materials, Road & Highway Construction, Mining & Industrial, Oil & Gas Pipelines and Other Applications), and United States Geopipes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Geopipes Market Insights Forecasts to 2035

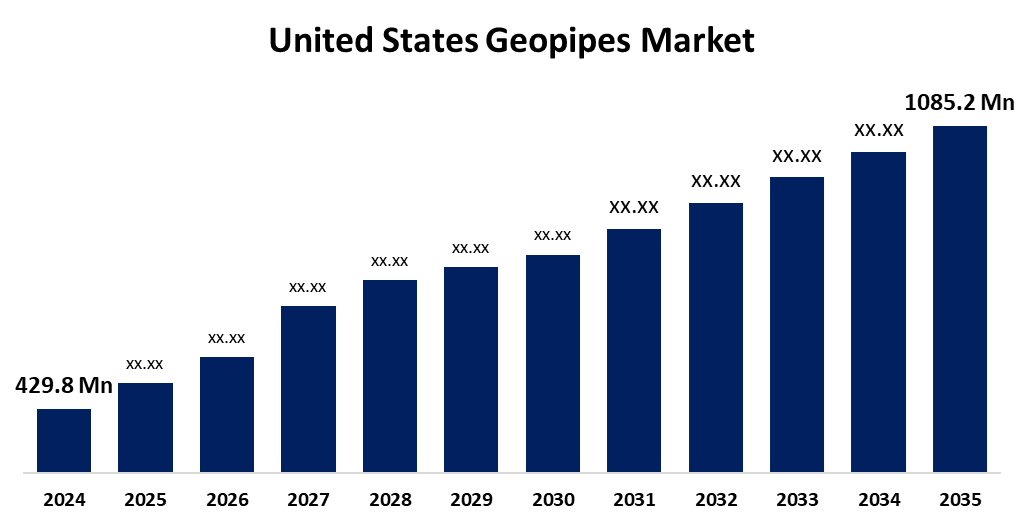

- The US Geopipes Market Size Was Estimated at USD 429.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.78% from 2025 to 2035

- The US Geopipes Market Size is Expected to Reach USD 1085.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Geopipes Market Size is anticipated to Reach USD 1085.2 Million by 2035, Growing at a CAGR of 8.78% from 2025 to 2035. The expansion of the United States geopipes market is propelled by the rising need for environmentally friendly infrastructure options, especially in the fields of civil engineering and construction.

Market Overview

Geopipes, referred to as the sustainable alternative to traditional piping systems, consist of durable, environmentally friendly components. The rising adoption of geopipes occurs because governments, along with organizations across the US, focus on reducing carbon emissions while promoting sustainable construction practices. These pipes demonstrate extended durability through their lower maintenance needs, which results in better corrosion resistance and financial savings throughout their lifespan. The increasing usage of geopipes by industries stems from their effectiveness in reaching both operational targets and environmental standards. The expansion of the geopipes sector happens because of new materials development, together with building technology progress. The installation speed of geopipes has improved because of modern construction methods such as trenchless technology, which reduces labour costs and disturbances while eliminating the need for extensive digging. Geopipes are becoming an increasingly popular choice for both new building projects and infrastructure renovations. In the United States usage of geopipes in energy and energy efficiency systems is growing along with the use of renewable energy.

Moreover, increased use of geopipes in the energy sector will result from their contribution to the sustainability of all renewable energy sources. Applications in renewable energy infrastructure, including geothermal energy systems, where longevity and resistance to corrosion are crucial, are ideally suited for geopipes. Geopipes will add to the sustainability of all the renewable energy sources, which will promote greater use of geopipes within the energy industry. Geopipes are also being adopted on a wider scale by the growth of smart cities in the US. Smart city initiatives have a strong emphasis on incorporating the newest technologies into urban infrastructure to enhance sustainability and efficiency.

Report Coverage

This research report categorizes the market for the United States geopipes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States geopipes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States geopipes market.

United States Geopipes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 429.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.78% |

| 2035 Value Projection: | USD 1085.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Application |

| Companies covered:: | ABG Lab, Thrace-Linq, SKAPS Industries, TenCate Geosynthetics, Huesker Holding, Oceanus, GSE Environmental, LRK GeoVision, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States geopipes market is driven by greater infrastructure demands for sustainable and environmentally friendly alternatives. Geopipes are made from high-performance composite materials and are becoming more durable, corrosion-resistant, and easier to install, making them a better option for applications in wastewater, gas, road, highway construction, and water management.

Restraining Factors

The United States geopipes market faces obstacles like high changes in the price of raw materials, especially HDPE and PVC, which are expected to influence production prices. In the US, ignorance of the advantages of geopipes over conventional drainage systems may also be impeding market expansion.

Market Segmentation

The United States geopipes market share is classified into product and application.

- The high-density polyethylene segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States geopipes market is segmented by product into high-density polyethylene, polyvinyl chloride, polypropylene, and other materials. Among these, the high-density polyethylene segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by outstanding durability, resistance to corrosion, and affordability for a range of applications. HDPE pipes are widely used in the construction, wastewater treatment, and agricultural sectors due to their strength, versatility, and long lifespan. As such, they are perfect for subterranean pipeline systems and infrastructure projects.

- The drainage & sewer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States geopipes market is segmented into drainage & sewer, irrigation, chemicals & materials, road & highway construction, mining & industrial, oil & gas pipelines, and other applications. Among these, the drainage & sewer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing infrastructure development, urbanization, and a need for effective wastewater treatment. As urban areas and populations are growing, there is a need for affordable, long-lasting, corrosion-resistant piping for drainage and sewer systems. Due to their lightweight design and longevity, as well as their excellent chemical resistance, geopipes are becoming preferable to traditional materials like metal and concrete.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States geopipes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABG Lab

- Thrace-Linq

- SKAPS Industries

- TenCate Geosynthetics

- Huesker Holding

- Oceanus

- GSE Environmental

- LRK GeoVision

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States geopipes market based on the following segments:

United States Geopipes Market, By Product

- High Density Polyethylene

- Polyvinyl Chloride

- Polypropylene

- Other Materials

United States Geopipes Market, By Application

- Drainage & Sewer Irrigation

- Chemicals & Materials

- Road & Highway Construction

- Mining & Industrial

- Oil & Gas Pipelines

- Other Applications

Need help to buy this report?