United States Geocomposites Market Size, Share, and COVID-19 Impact Analysis, By Function (Separation, Reinforcement, Drainage, Containment, and Other), By Application (Water & Wastewater Management, Road & Highway, Landfill & Mining, and Other), and United States Geocomposites Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Geocomposites Market Insights Forecasts to 2035

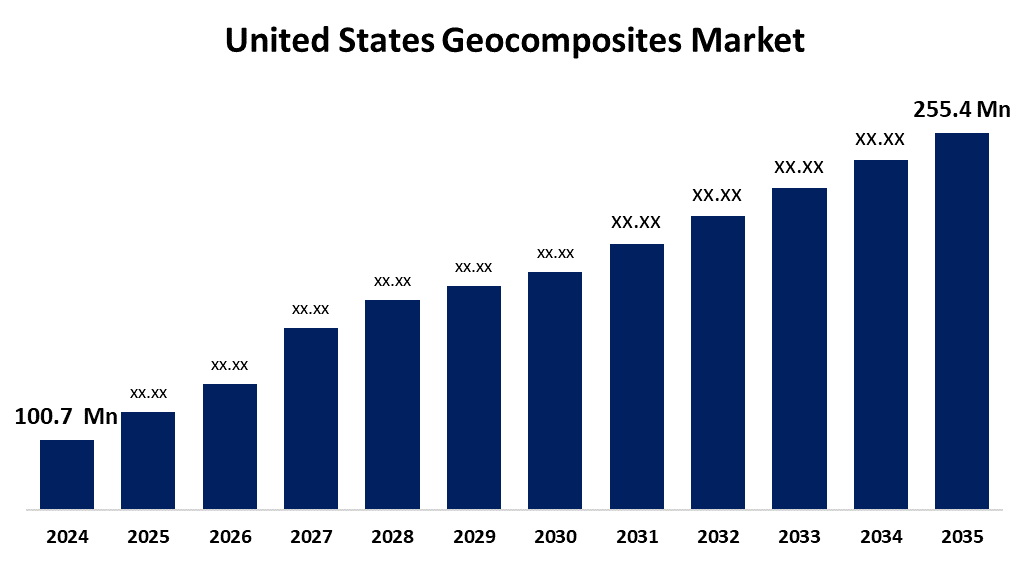

- The US Geocomposites Market Size Was Estimated at USD 100.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.83% from 2025 to 2035

- The US Geocomposites Market Size is Expected to Reach USD 255.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Geocomposites Market Size is Anticipated to Reach USD 255.4 Million by 2035, Growing at a CAGR of 8.83% from 2025 to 2035. The expansion of the United States geocomposites market is propelled by growing infrastructure development and the demand for high-performance, reasonably priced building materials.

Market Overview

A geocomposite is a manufactured material that combines two or more geosynthetics, such as geotextiles, geogrids, geonets, or geomembranes, and is designed to fulfill several geotechnical purposes in a single product. Due to the current peak in demand for sustainable building approaches, this product has been widely used to build green buildings. These products enhance stormwater management, reduce erosion, and improve soil stability without large-scale excavation activities, so they generally meet green construction goals. They represent a more sustainable alternative to conventional methods that facilitate greener solutions and subsequently lower project-level impacts. Contributions can be made to the establishment of green building scopes and certifications, such as LEED certifications, while encouraging ecological sensitivity and resource efficiency, with geocomposites supporting the initiatives. With the increasing use of geocomposites in green buildings, the market is projected to continue growing in the US. The expansion of oil and gas infrastructure projects in the United States will only increase demand by utilizing geocomposites for site construction applications such as building access roads, erosion control, and protecting pipelines.

The U.S. government actively promotes the use of geocomposites through its environmental and infrastructure initiatives. The Infrastructure Investment and Jobs Act allocates billions to waste containment, water systems, and sustainable transportation. Geocomposites are essential for soil stabilisation, drainage, and erosion control, particularly in roads, tunnels, and landfills.

Report Coverage

This research report categorizes the market for the United States geocomposites market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States geocomposites market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States geocomposites market.

United States Geocomposites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 100.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.83% |

| 2035 Value Projection: | USD 255.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Function, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Huesker Holding, GSE Environmental, Leggett & Platt Inc, SKAPS Industries, AGRU America, Inc., Strata Systems, Inc., TYPAR Geosynthetics, Maccaferri Inc. and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States geocomposites market is boosted by the expansion of metropolitan areas in regions of the United States with challenging conditions, such as Florida, Texas, and California have fueled the need for geocomposites in foundation systems. In these areas, high water tables, loose sands, and expansive clay soils can contribute to structural instability and warrant the use of geosynthetic drainage and reinforcement systems. Moreover, geocomposites enhance water drainage efficiency, thus reducing hydrostatic pressure below structures. In the United States, geocomposites are becoming a standard tool for reducing soil-related construction hazards due to government spending on strong infrastructure and rapid urbanisation.

Restraining Factors

The United States geocomposites market faces obstacles, like contractors and developers often still seeing geocomposites as more expensive than traditional materials. Therefore, the high up-front costs are still limiting market acceptance in the United States.

Market Segmentation

The United States geocomposites market share is classified into function and application.

- The drainage segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States geocomposites market is segmented by function into separation, reinforcement, drainage, containment, and other. Among these, the drainage segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the demand for viable water management systems and infrastructure growth. Population and urbanization pressures, increased construction of roads and highways, require sophisticated drainage systems as a fundamental element of civil engineering works. In terms of ensuring adequate water transfer and preventing water accumulation-driven failure, geocomposite drainage systems are regularly applied in roads, railways, landfills, and retaining structures.

- The road & highway segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States geocomposites market is segmented into water & wastewater management, road & highway, landfill & mining, and other. Among these, the road & highway segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the massive rise in infrastructure development schemes. Governments and the private sector are pouring massive money and resources into road repairs and expansions, to enhance mining and landfills networks. Geocomposites are a commonplace material in modern road construction, given their essential role in increasing load-bearing capacity, decreasing maintenance costs, and providing roads with reasonable life expectancy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States geocomposites market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Huesker Holding

- GSE Environmental

- Leggett & Platt Inc

- SKAPS Industries

- AGRU America, Inc.

- Strata Systems, Inc.

- TYPAR Geosynthetics

- Maccaferri Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States geocomposites market based on the following segments:

United States Geocomposites Market, By Function

- Separation

- Reinforcement

- Drainage

- Containment

- Other

United States Geocomposites Market, By Application

- Water & Wastewater Management

- Road & Highway

- Landfill & Mining

- Other

Need help to buy this report?