United States Genomics Market Size, Share, and COVID-19 Impact Analysis, By Deliverables (Services and Products), By Application (Epigenomics, Biomarker Discovery, Functional Genomics, Pathway Analysis, and Others), By End-User (Hospital & Clinics, Clinical Research, Academics & Government Initiatives, Pharmaceutical & Biotechnology Companies, and Others), and US Genomics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Genomics Market Insights Forecasts to 2035

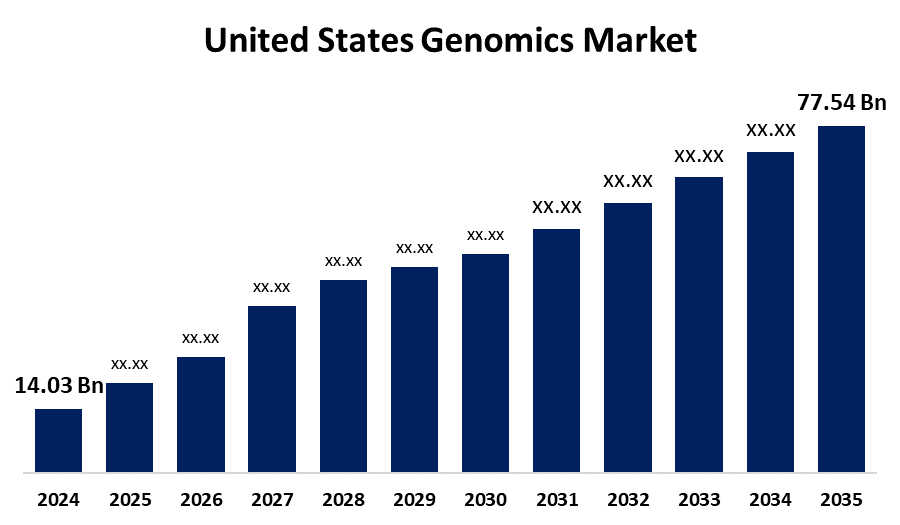

- The US Genomics Market Size was estimated at USD 14.03 Billion in 2024

- The Market Size is expected to grow at a CAGR of around 16.81% from 2025 to 2035

- The USA Genomics Market Size is expected to reach USD 77.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Genomics Market Size is anticipated to reach USD 77.54 Billion by 2035, Growing at a CAGR of 16.81% from 2025 to 2035. Genomics research has increased due to the growing demand for gene therapy and personalized medicine. Drug discovery advances have used genomics to effectively identify potential targets, and cancer genomics is gaining attention because of its genetic foundation, which accelerates the growth of the market.

Market Overview

The study and application of genomics, including the function, mapping, structure, evolution, and genes of an individual's genome, is the focus of the United States genomics market, which includes products, services, sequencing technologies, microarrays, PCR, nucleic acid extraction, and purification. The study of entire organisms' genomes, including genetic components, is known as genomics. It sequences, assembles, and analyzes genomes using bioinformatics, recombinant DNA, and DNA sequencing techniques. The potential of genomics to prevent, manage, and treat disease has been demonstrated. Precision medicine is becoming more prevalent in the healthcare industry, and whole genome sequencing can help diagnose serious illnesses like cancer. Government support for genomics initiatives has increased due to the genomics revolution's impact on biomedical sciences and medicine. Studying the human genome has enabled the concept of personalized medicine, which is transforming rare genetic disorders and clinical oncology. The market growth is attributed to the rising research and development studies, increasing demand for clinical trial services, and rising expenditure from the government for the biopharmaceutical projects.

Report Coverage

This research report categorizes the market for the US genomics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US genomics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US genomics market.

United States Genomics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.03 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.81% |

| 2035 Value Projection: | USD 77.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Deliverables, By Application, By End-User, and COVID-19 Impact Analysis |

| Companies covered:: | Thermo Fisher Scientific Inc., Agilent Technologies, Luminex Corporation, Bio-Rad Laboratories Inc., Caris Life Sciences, Danaher Corp., Eurofins Scientific SE, BGI Genomics Co. Ltd., Illumina Inc., Myriad Genetics Inc., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Advancements in gene sequencing:

Rapid developments in CRISPR-Cas9 genome editing and next-generation sequencing (NGS) technologies are propelling the genomics market. These developments have improved precision, accelerated speed, and decreased costs in hereditary research, revolutionizing the field. As a result, genomic sequencing is now more widely available and appropriate for a variety of industries. The advancement of genomics is accelerated by NGS technologies, which make DNA and RNA sequencing quicker and less expensive than Sanger sequencing. As a result, there has recently been more interest in microbial genomics, agrarian genomics, and personalized medicine.

Upsurge in genomic technologies in clinical applications and rising need for personalized medications drive the market growth:

The use of genomics in clinical applications, including the detection of genetic disorders, cancer screening, and the surveillance of infectious diseases, is driving the market's expansion. To enable personalized medicine, advancements in genomics technologies are fueling the demand for genetic testing and diagnostic tools. This method focuses on tracking the progression of a disease, guiding treatment decisions, and assessing an individual's vulnerability to specific conditions. The increasing prevalence of genetic disorders, the growing understanding of the genetic causes of diseases, and the limitations of traditional treatments are all factors propelling genomics research and investment.

Restraining Factors

Regulatory obstacles, data complexity, ethical and privacy issues, high costs, and low public awareness are some of the challenges facing the US genomics market. Strict government regulations, the high cost of genomic testing and sequencing, along with the requirement for advanced computational resources, may impede market growth.

Market Segmentation

The USA genomics market share is classified into deliverables, application, and end-user.

- The products segment held the largest share of 68.34% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US genomics market is segmented by deliverables into services and products. Among these, the products segment held the largest share of 68.34% in 2024 and is expected to grow at a significant CAGR during the forecast period. Sequencing equipment, consumables, reagents, and software programs, such as next-generation DNA sequencing platforms, are examples of genomic products. Clinical laboratories, research institutes, and biopharmaceutical businesses are the main sources of demand for these products. New applications, the adoption of genomic tools, and technology developments are anticipated to fuel segment expansion.

- The functional genomics segment accounted for the largest share of 30.83% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US genomics market is segmented by application into epigenomics, biomarker discovery, functional genomics, pathway analysis, and others. Among these, the functional genomics segment accounted for the largest share of 30.83% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the early detection of disease and treatment, identifies the genetic alterations, estimates the potential drug targets, and personalizes medications.

- The pharmaceutical and biotechnology companies 21.11% segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US genomics market is segmented by end-user into hospitals & clinics, clinical research, academics & government initiatives, pharmaceutical & biotechnology companies, and others. Among these, the pharmaceutical and biotechnology companies 21.11% segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sector growth is owing to investing in technologies for drug development, personalized medicine, and disease diagnostics, companies are also advancing genomics research. They seek to improve patient outcomes, create precision therapies, and find new drug targets. Growth is fueled by partnerships between research organizations, academic institutions, and industry participants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US genomics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific Inc.

- Agilent Technologies

- Luminex Corporation

- Bio-Rad Laboratories Inc.

- Caris Life Sciences

- Danaher Corp.

- Eurofins Scientific SE

- BGI Genomics Co. Ltd.

- Illumina Inc.

- Myriad Genetics Inc.

- Others

Recent Developments:

- In March 2025, NVIDIA announced partnerships with healthcare leaders IQVIA, Illumina, Mayo Clinic, and Arc Institute to transform the $10 trillion healthcare and life sciences industry. The collaborations aim to accelerate drug discovery, enhance genomic research, and develop advanced healthcare services using agentic and generative AI. The solutions include AI agents for clinical trials, AI models for drug discovery and digital pathology, and physical AI robots for surgery and patient monitoring. These partnerships aim to address $3 trillion in industry growth and create an AI factory opportunity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US genomics market based on the below-mentioned segments:

US Genomics Market, By Deliverables

- Services

- Products

US Genomics Market, By Application

- Epigenomics

- Biomarker Discovery

- Functional Genomics

- Pathway Analysis

- Others

US Genomics Market, By End-User

- Hospital & Clinics

- Clinical Research

- Academics & Government Initiatives

- Pharmaceutical & Biotechnology Companies

- Others

Need help to buy this report?