United States Gelatin Market Size, Share, and COVID-19 Impact Analysis, By Form (Marine-Based and Animal-Based), By End-User (Personal Care and Cosmetics, Supplements, and Food & Beverages), and United States Gelatin Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Gelatin Market Insights Forecasts to 2035

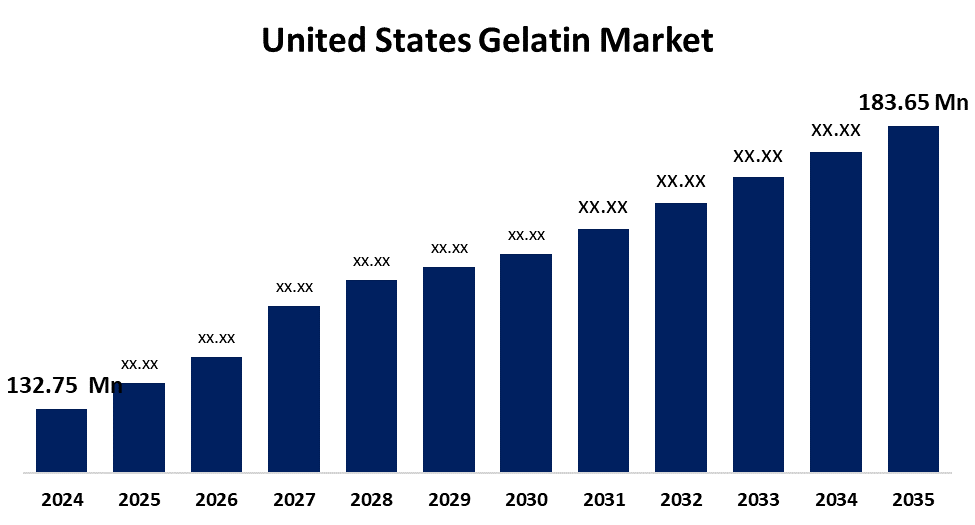

- The US Gelatin Market Size was estimated at USD 132.75 million in 2024

- The Market Size is expected to grow at a CAGR of around 2.99% from 2025 to 2035

- The USA Gelatin Market Size is expected to reach USD 183.65 million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Gelatin Market is anticipated to reach USD 183.65 million by 2035, growing at a CAGR of 2.99% from 2025 to 2035. The growth is attributed to the escalation of the food and beverages, pharmaceuticals, and nutraceutical industries.

Market Overview

The United States gelatin market deals with the production, supply, and utilization of gelatin that is used in various sectors such as nutraceuticals, pharmaceuticals, and cosmetic industries, owing to its gelling and thickening properties. Gelatin is derived from collagen, a connective tissue presents in animal bones and skins, and it is colorless. Its special functional and technological qualities make it a multipurpose ingredient used in food, medicine, cosmetics, and photography. Gelatin is used as a matrix for capsules, ointments, tablet coatings, and emulsions in the pharmaceutical and medical industries, as well as in the food industry to increase the elasticity, consistency, and stability of food. Gelatin hydrolyzes to produce hydrolyzed gelatin, collagen hydrolysate, gelatin hydrolysate, and other substances. Additionally, it serves as a gelling agent in food, medicine, vitamin capsules, cosmetics, paper, and film for photography. Probiotics, including B. adolescentis, can be microencapsulated in gelatin microspheres that have been prepared and coated with alginate.

The growing demand for gelatin from the food and beverage, pharmaceutical, and cosmetics industries is the main factor propelling the market. In the pharmaceutical and medical industries, gelatin is utilized as a gelling agent in capsules and drug coatings, as well as in gummy candy, desserts, and dairy products. The market is expanding as a result of its collagen-boosting qualities in skincare and haircare products. Production process technological developments have produced sustainable and effective ways to extract gelatin from plant and animal sources, enhancing its quality and reducing the production's environmental impact. In addition, new gelatin-based products that satisfy vegetarian and vegan consumer preferences have been introduced as a result of research and development initiatives in the food and pharmaceutical industries.

Report Coverage

This research report categorizes the market for US gelatin market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US gelatin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US gelatin market.

United States Gelatin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 132.75 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.99% |

| 2035 Value Projection: | USD 183.65 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Form, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Italgelatine SpA, Ajinomoto Co., Inc., Gelita AG, Baotou Dongbao Bio Tech Co., Ltd., Nitta Gelatin Inc., Hangzhou Qunli Gelatin Chemical Co., Ltd., Darling Ingredients Inc., Gelatines Weishardt SAS, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Proliferation in the consumption of clean-labelled products:

As consumers' awareness of additives and preservatives grows, they are becoming more engaged in clean-label products. The industry for nutrients is being shaped by this trend, which is forcing producers to adhere to ethical standards. A crucial element of clean-label products is sustainability, and the pandemic has raised worries about the quality and safety of food. Clean label concepts are being driven throughout the supply chain by increased traceability and transparency. Western culture and shifting dietary habits are predicted to maintain gelatin-based products popular.

Increasing usage of gelatin in pharmaceuticals:

In the pharmaceutical industry, gelatin is growing a popularity because of its ability to treat brittle bones, osteoarthritis, rheumatoid arthritis, and chronic disease prevention. People's collagen levels drop with age, causing wrinkles and skin loss. Collagen is essential for healthy skin, and gelatin's protein and amino acids can aid in its formation. In an attempt to satisfy consumer demands, dermatology companies are creating new products. Gelatin is utilized in the production of capsule shells, tablet coating and binding, active ingredient encapsulation, controlled drug release, and safety and biocompatibility. It ensures easy ingestion and shields contents from contamination when used in capsule shells. Additionally, gelatin-based formulations enhance absorption and bioavailability. More research on drug delivery methods and gelatin substitutes is emphasized.

Restraining Factors

The limited availability of the livestock, fluctuations in the prices of the raw materials, a stringent regulatory framework, presence of alternative gelling and thickening agents may impede the market growth.

Market Segmentation

The USA gelatin market share is classified into form and end-user.

- The animal-based segment held the largest market share of 94.87% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The US gelatin market is segmented by form into marine-based and animal-based. Among these, the animal-based segment held the largest market share of 94.87% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the sustainability, rising demand in the pharmaceuticals, and protein-rich nature, and enhances the drug delivery.

- The food and beverages segment accounted for the largest market share of 97.92% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US gelatin market is segmented by end-user into personal care and cosmetics, supplements, and food & beverages. Among these, the food and beverages segment accounted for the largest market share of 97.92% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the growing usage of gelatin in the food industries, such as beverages, bakery products, confectionery, consumer preference, versatility, stability, and growing awareness of healthy lifestyles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US gelatin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Italgelatine SpA

- Ajinomoto Co., Inc.

- Gelita AG

- Baotou Dongbao Bio Tech Co., Ltd.

- Nitta Gelatin Inc.

- Hangzhou Qunli Gelatin Chemical Co., Ltd.

- Darling Ingredients Inc.

- Gelatines Weishardt SAS

- Others

Recent Developments:

- In May 2025, Darling Ingredients has signed a non-binding term sheet with Tessenderlo Group to merge their collagen and gelatin segments into Nextida™, a top-tier collagen-based health, wellness, and nutrition products company. The transaction requires no cash or initial investment, and is subject to negotiation and documentation execution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US gelatin market based on the below-mentioned segments:

US Gelatin Market, By Form

- Marine-Based

- Animal-Based

US Gelatin Market, By End-User

- Personal Care and Cosmetics

- Supplements

- Food & Beverages

Need help to buy this report?