United States Gas Insulated Switchgear (GCB) Market Size, Share, and COVID-19 Impact Analysis, By Installation Type (Indoor and Outdoor), By Configuration (Hybrid, Isolated Phase, Integrated Three Phase, and Compact GIS), and United States Gas Insulated Switchgear (GCB) Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited States Gas Insulated Switchgear (GCB) Market Insights Forecasts to 2035

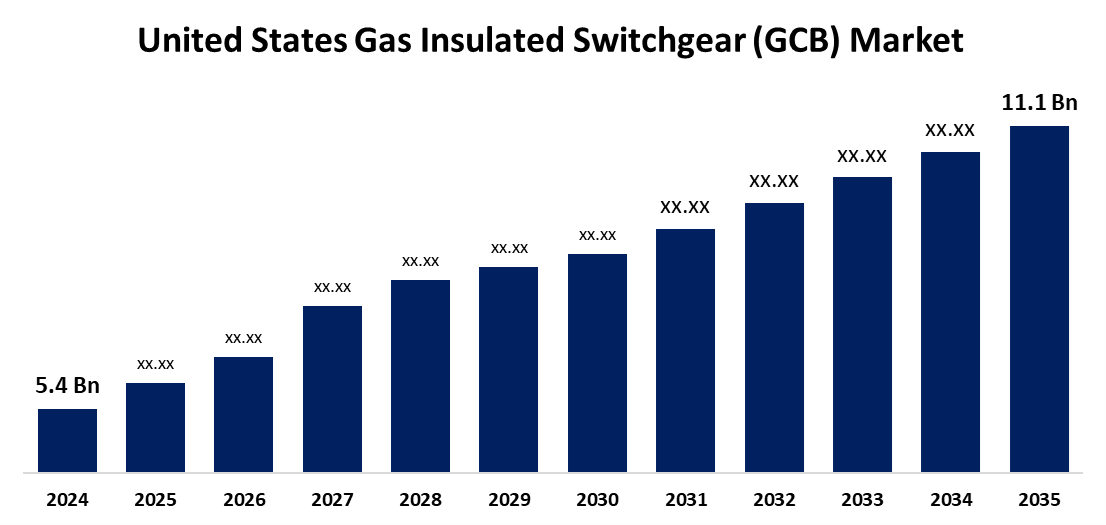

- The United States Gas Insulated Switchgear (GCB) Market Size was estimated at USD 5.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.77% from 2025 to 2035

- The US Gas Insulated Switchgear (GCB) Market Size is Expected to Reach USD 11.1 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Gas Insulated Switchgear (GCB) Market Size is anticipated to Reach USD 11.1 Billion by 2035, Growing at a CAGR of 6.77% from 2025 to 2035. Driven by the growing need for electrification in space-constrained urban and industrial environments. For installation in crowded cities or subterranean infrastructure projects, GIS is small and perfect.

Market Overview

The Market Size for Gas-Insulated Switchgear (GCB) in the USA is the area of the power infrastructure sector devoted to small, high-voltage switchgear systems that are insulated by gas, usually SF6 or an equivalent. Because they require less maintenance, are more dependable, and take up less space than conventional air-insulated switchgear, these systems are frequently utilized in smart grid applications, urban substations, and renewable energy integration. Additionally, AI-based monitoring systems, small modular designs, smart grid integration, and SF6 free technologies are driving innovation in the U.S. GCB market. Businesses are emphasizing digital substations, renewable energy compatibility, and environmentally friendly switchgear. In line with sustainability and modernization objectives, these developments improve grid dependability, lower carbon emissions, and support underground installations and urban infrastructure.

Report Coverage

This research report categorizes the market for the United States gas insulated switchgear (GCB) market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. gas insulated switchgear (GCB) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA gas insulated switchgear (GCB) market.

United States Gas Insulated Switchgear (GCB) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.77% |

| 2035 Value Projection: | USD 11.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Installation Type, By Configuration |

| Companies covered:: | General Electric (GE), Eaton Corporation, Siemens Energy, Hitachi Energy, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the integration of renewable energy sources like wind and solar, urbanization, and the modernization of smart grids. GIS is perfect for critical infrastructure because of its low maintenance requirements and high reliability, and its compact design makes it suitable for spaces that are limited in size. Furthermore, the drive for SF6 free technologies and environmental regulations are speeding up innovation and adoption in the utilities and industrial sectors.

Restraining Factors

The initial costs of gas insulated switchgear (GIS) systems are higher than those of air-insulated alternatives, especially when it comes to installation and upkeep. This hinders their wider market adoption by making them more inaccessible to smaller utilities and budget-constrained industries.

Market Segmentation

The United States gas insulated switchgear (GCB) market share is classified into installation type and configuration.

- The indoor segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gas insulated switchgear (GCB) market is segmented by installation type into indoor and outdoor. Among these, the indoor segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The countrys rapid urbanization will be the cause of this, as it reduces the amount of space available for large electrical T&D equipment. As a result, indoor GIS is commonly installed underground or inside buildings, particularly in crowded urban areas. Additionally, GIS for indoor use is being technologically enhanced to provide cost-effectiveness and adhere to noise and environmental regulations.

- The compact GIS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gas insulated switchgear (GCB) market is segmented by configuration into hybrid, isolated phase, integrated three phase, and compact GIS. Among these, the compact GIS segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for compact GIS is primarily driven by the high level of urbanization because cities have limited space. In order to ensure that the power supply stays steady with minimal maintenance, Compact GIS is also made to be robust and dependable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US gas insulated switchgear (GCB) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric (GE)

- Eaton Corporation

- Siemens Energy

- Hitachi Energy

- Others

Recent Developments:

- In November 2024, Eaton Corporation plc announced a collaboration with Treehouse to enable code-compliant and cost-effective electrification projects for the residential sector. Under the collaboration, Treehouse integrated its AI software into Eatons digitally enabled electrical systems

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Gas Insulated Switchgear (GCB) Market based on the below-mentioned segments:

United States Gas Insulated Switchgear (GCB) Market, By Installation Type

- Indoor

- Outdoor

United States Gas Insulated Switchgear (GCB) Market, By Configuration

- Hybrid

- Isolated Phase

- Integrated Three Phase

- Compact GIS

Need help to buy this report?